New NCSolutions survey shows Americans plan to drink less in 2025

Nearly half of Americans say they will drink less this year as sober curious movement gains momentum

Image courtesy of NCSolutions

NCSolutions (NCS), New York, revealed data from recent consumer surveys in the United States.

One of the findings was that almost half (49%) of Americans say they plan to drink less in 2025. The percentage of those planning to cut back on alcohol consumption has been growing over the last three years. Thirty-four percent of Americans in 2023 noted they planned to drink less. That percentage grew to 41% in 2024.

Thirty-percent of Americans in 2025 said they are taking part in Dry January, a 36% increase from 2024, NCS shares.

These findings are from a 2025 consumer sentiment survey regarding the sober curious movement, a follow-up to 2023 and 2024 surveys, which also focused on consumer interest in non-alcoholic beverages. NCS commissioned these surveys. The findings also include an analysis of NCS proprietary consumer purchase data.

According to the purchase data from NCS, the sober curious movement is impacting consumer shopping behavior. Dry January is the least popular month to buy alcohol. Purchases of spirits dropped 39% in January 2024 compared with the prior month. In the same period, wine purchases fell 36%, while beer/cider/hard seltzer purchases decreased 21%.

Purchases of non-alcohol beverages are on the rise, NCS notes. The company’s purchase data shows a 22% increase in non-alcohol beer purchases from December 2023 to November 2024 in comparison to a year prior.

“As more consumers, especially younger ones, embrace a sober curious lifestyle, we’re seeing a change in purchasing behavior following this cultural shift,” said Alan Miles, CEO of NCS, in a statement. “NCS data shows the demand for new non-alcoholic beverage options grew steadily over the last three years. Beverage brands are meeting and contributing to this demand with new non-alcoholic products on the shelves.”

NCS shares that non-alcohol options go beyond beer, wine and spirits to THC- and CBD-infused beverages. In 2025, 26% of consumers say they are interested in trying these cannabis-infused drinks. Younger generations are more interested in trying such options in 2025, with the newest findings indicating that 38% of Generation Z and 37% of millennials expressing interested — compared with 30% of Gen Z and 32% of millennials in 2024.

NCS shares that, according to the survey, over two-thirds (65%) of Gen Z say they plan to drink less alcohol in 2025, a percentages much higher than other generations. By comparison, only 57% of millennials, 49% of Generation Xers and 30% of boomers intend to cut back.

Thirty-nine percent of Gen Z plan to adopt a dry lifestyle during all of 2025 — not just during Dry January. This marks a significant shift toward the sober curious movement for this generation compared to older generations, NCS says.

However, only 19% of Gen Z said they didn’t drink any alcohol in 2024, a percentage similar to millennials at 18% and Gen X at 19%. Just 19% of millennials and Gen X, along with 10% of boomers, said they planned to adopt a dry lifestyle this year.

NCS shares that, over the past year, 37% of Americans say they’ve noticed more restaurants, bars and stores offering non-alcohol options Younger generations are more likely to have noticed new options, including 54% of Gen Z and 49% of millennials.

Thirty-seven percent of Americans head to the grocery store when shopping for non-alcohol beverages, while 30% purchase them in a superstore and 20% purchase in restaurants. Consumers also shopped for non-alcohol options at convenience stores and wholesale clubs, NCS adds.

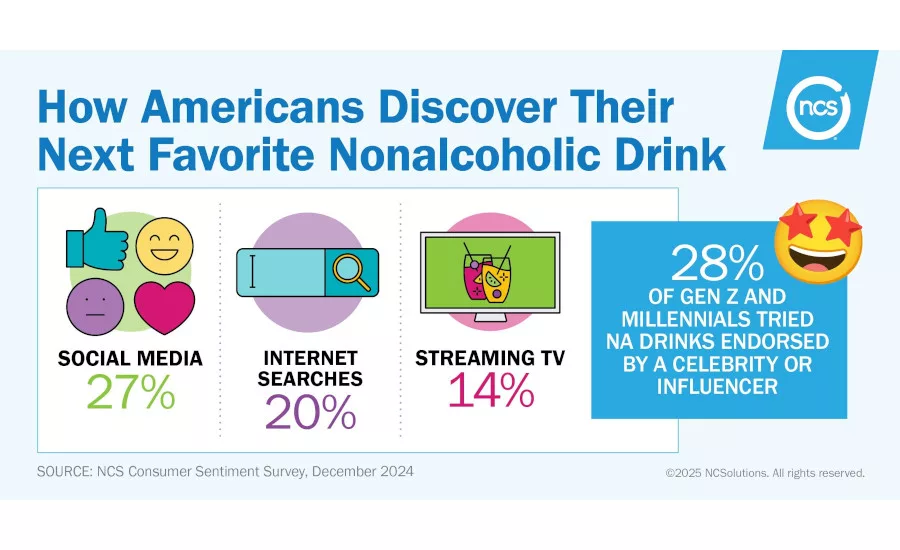

The company shares that social media is a highly effective channel for Americans to learn about new alcohol-free drink options. It’s especially true for younger generations, with 35% of Gen Z and millennials discover new non-alcohol beverages on social media compared with 22% of Gen Xers and 18% of boomers.

Younger generations are influenced by the recommendations of celebrities and influencers. More than one in four (28%) of Gen Zers and millennials have tried an alcohol-free drink endorsed by a celebrity or influencer.

When new beverage products are marketed as aligned with the sober curious lifestyle, NCS says that 43% of Gen Z and 33% of millennials note they are more likely to buy it, compared with just 16% of Gen X and 10% of boomers. Overall, 75% of Americans say they are most likely or as likely to try a new beverage product in 2025 if it is marketed as aligning with the sober curious lifestyle, up from 70% in 2024.

“Over three years of data, the trend couldn’t be more clear — younger consumers are strongly motivated to drink less alcohol than their parents and their grandparents,” Miles said in a statement. “As our analysis shows, Gen Z and millennials are heavy social media consumers and put trust in influencers. Beverage brands can expand their market for non-alcoholic options by targeting the right audiences in the right places with messaging that aligns with the sober curious lifestyle. In addition, they can partner with likeminded influencers.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!