Juice smoothies, flavor innovations trending in juice category

Category seeks to combat concerns about sugar content

Coconut water appeals to consumers’ desire for natural beverages, Euromonitor’s Eric Penicka says. Zico recently launched its Chilled Strawberry Banana Juice Blend. (Image courtesy of The Coca-Cola Co.)

Beverage-makers are expanding their portfolio of cold-pressed and high-pressure-processed juices. Project Juice released Watermelon Berry, Strawberry Chia and Jala-Greeño 2.0 varieties in 2015. (Images courtesy of Project Juice)

As consumers seek out better-for-you beverage options, categories like juice and juice drinks are seeing a retooling of products to help appeal to these health-focused shoppers. “As health-conscious consumers move away from carbonated drinks, some have also been keeping away from sugary juices, leaving space for new competition to develop,” reports IBISWorld in its April 2015 report “Juice Production in the US.”

The Santa Monica, Calif.-based market research firm adds that niche products, including coconut water and tropical flavors, have proliferated within the market as new brands and manufacturers emerge.

Eric Penicka, research analyst for Chicago-based Euromonitor International, notes that as a whole, the juice and juice drinks industry contracted 1.8 percent in total volume for 2014, with not-from-concentrate 100 percent juice as the only segment not to experience a volume decline.

“The core reason the juice industry is in decline is the pervasive consumer aversion to sugars and artificial ingredients,” he says. “The high-sugar content of many juices has turned health-conscious consumers away from the beverage. This trend is having a particularly damaging effect on juice and juice drinks [that] are not 100 percent juice, as these are more likely to have added sugar in their ingredient lists, pushing away parents who may have once perceived the products as favorable to carbonates.”

Lauren Masotti, client manager of U.S. Beverages for New York-based Kantar Worldpanel, adds that consumer consumption rates in the category also have dipped within the past five years. In 2010, fruit juice and fruit drinks were consumed by 61.4 percent of consumers; however, that number has declined to 53.1 percent in 2015, she notes.

“This can be attributed to consumers becoming more conscious of the beverages they consume and a greater availability of beverages that coincide with the ‘natural beverage’ attitude,” Masotti says. “There are 117 million consumers that agree with the statement ‘I prefer beverages that are all natural,’ up 51 percent from 2010.”

Time for a change

Although the juice and juice drinks market has been challenged, Masotti explains that not all segments of the category are struggling.

“Since 2010, vegetable-blended flavors and fruit-blended flavors have seen growth, especially in the fruit juice occasions,” she says. “In the fruit drink category, vegetable blend has seen the greatest increase, as have berry, fruit punch, apple and cranberry blends. Conversely, lemonade and strawberry-kiwi flavors have seen a steady drop.”

Masotti explains that this shift can be attributed to a healthier stigma that can be associated with vegetable and fruit blends. “Over half of all fruit- and vegetable-flavored occasions are driven by nutritional concern as opposed to a quarter of all fruit juice and fruit drink occasions,” she says. “Vegetable and fruit blends trigger ideas of health among consumers; hence, there has been a greater market share for the two flavors.”

According to IBISWorld’s report, the mixtures in the vegetable juices segment accounts for 6.1 percent of the products and services segmentation of the juice production in the United States and has experienced increases in the past five years.

“Green juices with green vegetables have become increasingly common, using items such as spinach, kale, parsley, romaine, cucumber and celery, often combined with a fruit to sweeten the taste,” the report states.

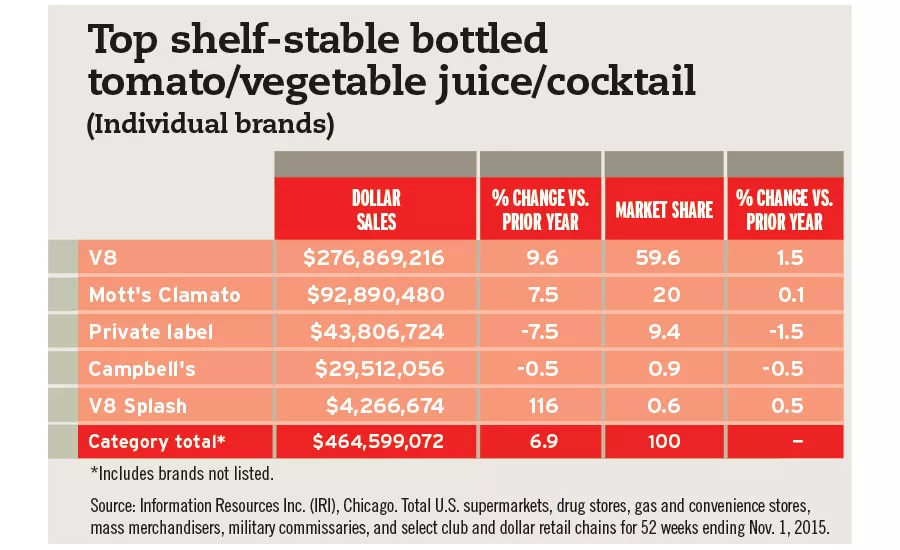

In early 2015, Camden, N.J.-based Campbell Soup Co.’s V8 brand released its Vegetable and Fruit Juice beverages. Featuring blends of vegetables with a touch of fruit, the lineup contains Healthy Greens, which blends the juices of spinach, yellow carrots, apples and pineapples; Purple Power, a combination of juices from purple carrots, beets and apples; Golden Goodness, which mixes the juices of sweet potatoes, yellow carrots, orange carrots and oranges; and Carrot Mango, an amalgamation of juices from carrots and mangos. The varieties do not contain added sugar or artificial ingredients and have 60 calories or fewer.

Euromonitor’s Penicka adds that less traditional juice segments, such as coconut, smoothies, pomegranate, etc., have benefited from consumers expanding their juice horizons. The positioning of these segments seems to have resonated with U.S. shoppers.

“[T]here has been an explosion of natural and healthy positioned juices, which have seen tremendous growth in the past few years,” he says. “Juices like pomegranate juice, coconut water and juice/vegetable smoothies have benefited from consumer demand for natural.”

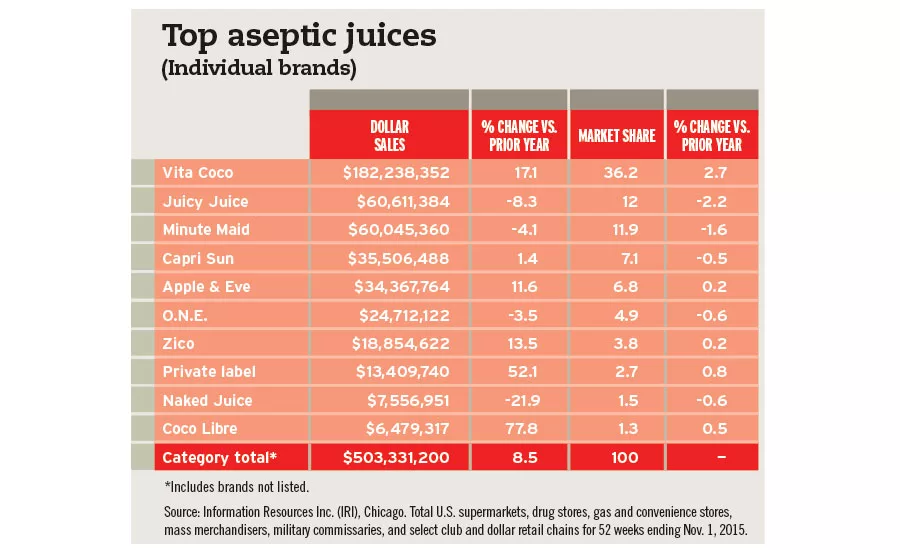

The coconut water segment also has seen a proliferation of varieties. For example, New York-based All Markets Inc., doing business as Vita Coco, will add to its portfolio of coconut waters in 2016 with the spring release of Vita Coco Lemon Tea. The new flavor contains coconut water, tea (water, tea), sugar, lemon puree, lemon and other natural flavors.

Additionally, Zico Beverages LLC, a wholly owned subsidiary of Atlanta-based The Coca-Cola Co., launched Zico Natural Premium Organic Coconut Water, which is certified Fair Trade by the Fair Trade Sustainability Alliance (FairTSA), and most recently Zico Chilled Strawberry Banana Juice Blend. The latest variety combines chilled, natural coconut water with a fusion of strawberry-banana puree and apple juice. Like the rest of the Zico Chilled Juice portfolio, the new variety is free of artificial flavors, fat, cholesterol and preservatives.

“A core belief of the Zico brand is that hydration should be easy, accessible and, of course, enjoyable,” said Tom Larsen, Zico president, in a statement. “We launched Zico Chilled Juices last year to provide people with a ‘best of both worlds’ option, and given the success of the line, we’re proud to offer another great-tasting option with our new Strawberry Banana Juice Blend.”

‘Smoothie’ transition

As consumers opt for healthier beverage options, juice smoothies have emerged as a go-to choice.

“Juice smoothies leverage their natural makeup to appeal to the health-and-wellness concerned consumers,” Euromonitor’s Penicka says.

Kantar’s Masotti also notes the impact that better-for-you beverage trends have had on the market.

“Consumers are still drinking beverages for health reasons, but they are increasingly drinking beverages for a healthier choice — up 32 percent over the last three years — versus for nutritional benefits — down 7 percent over the last 3 years,” she explains. “When consumers do drink for nutrition, they are now turning to smoothies, soy/rice/nut milk, and protein drinks rather than fruit juice. Bottled water and smoothies are winning as a healthier choice.”

Masotti adds that although the percentage of fruit juice and juice drinks consumers has been declining, juice smoothie consumers have nearly doubled since 2010. “This growth can be attributed to the healthy stigma that smoothies carry,” she says. “A consumer is 42 percent more likely to agree with the attitude of ‘to make a healthier choice’ when choosing a juice smoothie as opposed to fruit juice. The overarching movement toward healthier beverages has increased the juice smoothie market share.”

Chicago-based Mintel echoed similar sentiments in its November 2015 report “Juice, Juice Drinks and Smoothies – US.” The market research firm notes that although the segment is small, it has experienced strong growth, which has tempered losses in the larger 100 percent juice segment.

“While juice drinks and 100 percent juice make up larger shares of category sales (in that order), the smoothie segment has chipped away at this dominance and is forecast to continue as such,” the report states.

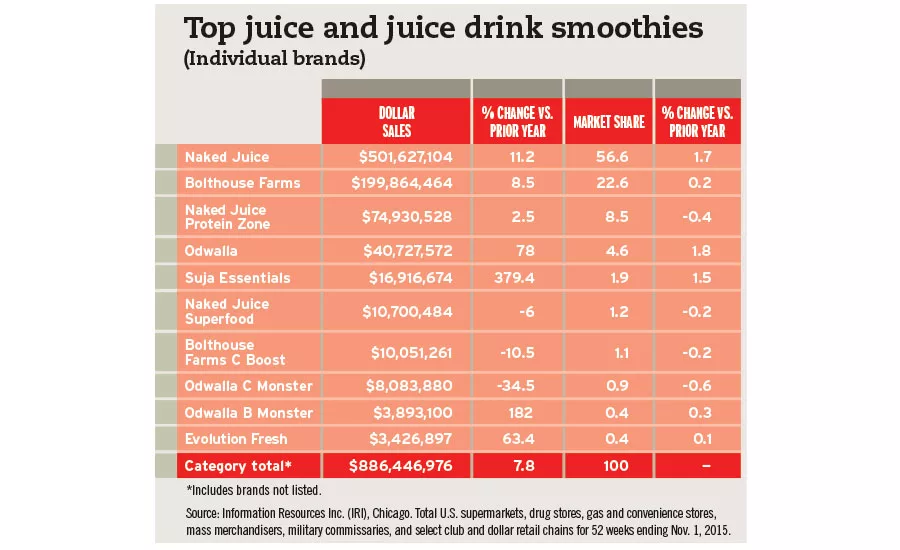

According to data from Chicago-based Information Resources Inc. (IRI), refrigerated juice and juice drink smoothies were up nearly 7.8 percent for approximately $886.4 million in sales for the 52 weeks ending Nov. 1, 2015, in U.S. multi-outlets, supermarkets, mass merchandisers, drug stores, gas and convenience stores, military commissaries, and select dollar and club stores.

The Naked Juice portfolio, a brand of Purchase, N.Y.-based PepsiCo Inc., leads the segment with more than 66 percent of the market share and sales of approximately $589.8 million. Bolthouse Farms’ portfolio, a brand of Campbell Soup Co., is a distant second with just

less than a quarter of the market share and sales of nearly $210.6 million.

In early 2015, Bolthouse added to its lineup with the release of Blueberry Banana Almondmilk. The dairy-free smoothie contains almond milk, banana puree, blueberry puree, agave, oat bran, chicory root fiber, coconut water concentrate, lemon juice concentrate and natural flavor.

The segment has gained some of its popularity from snacking occasions as Mintel’s report found that 23 percent of consumers opting for the beverage segment as a snack. However, beverage manufacturers can capitalize on other occasions as only 9 percent cited drinking smoothies as part of breakfast, and 11 percent listed consuming them as a breakfast replacement. The market research firm recommended adding mix-ins, such as grains, or expanding into indulgent flavors for occasion positioning.

Citing rolling data on Mintel’s Global New Product Database (GNPD) from October 2010 through September 2015, unspecified chocolate launches of juice smoothies were non-existent in 2011; however, accounted for roughly 8 percent in 2015. Fruit & vegetable launches also saw an uptick, growing from approximately 2 percent in 2011 to 8 percent in 2015. Conversely, banana-and-strawberry launches were down from roughly 10 percent in 2011 to approximately 4 percent in 2015.

As part of its initial launch, Suavva Cacao Smoothies, a brand of Weston, Fla.-based Agro Innova Co., offers its Chocolatey Cheer variety. The high-pressure-processed (HPP) beverage features a combination of cacao fruit juice, cocoa powder and organic agave nectar.

Processing success

HPP and cold-pressure processing also gained recognition within the juice and juice drink smoothie segment as more products using these forms of processing have emerged and even flourished in the market.

“HPP juices are almost exclusively 100 percent not-from-concentrate juices, and therefore are not laden with added sugars or artificial ingredients,” Euromonitor’s Penicka says. “The natural makeup of these products is highly appealing to today’s conscious consumer. Further, the heightened depth-of-flavor clarity has contributed to HPP’s success, providing consumers with a preferred, premium product.”

This sub-segment also is garnering the attention of large beverage manufacturers. In 2015, The Coca-Cola Co. purchased a minority stake in San Diego-based Suja Life LLC. As part of the investment, The Coca-Cola Co. now distributes Suja Essentials juices through its Odwalla chilled direct-store-delivery system.

“Suja's commitment to excellence in its beverages, operations and mission has positioned it as a leader in the rapidly growing organic juice segment,” said Mike Saint John, president of Value Added Dairy and Natural Health Beverages at Coca-Cola North America, in a statement. “This, coupled with the resources of The Coca-Cola Co., including our unmatched distribution system, will expand availability of this delicious beverage. Suja's great-tasting, organic juice will nicely complement our broad portfolio and expand it further to meet people's beverage needs.”

Suja Essentials juice sales have increased nearly 380 percent for the 52 weeks ending Nov. 1 in IRI-measured channels. The organic, non-GMO beverages are processed using cold-pressure.

Upon the announcement of The Coca-Cola Co.’s investment, Jeff Church, co-founder and chief executive officer of Suja released the following statement: “When we started our home-delivery juicing company in San Diego about three years ago, we couldn't have imagined the incredible growth and consumer demand that we face today. As we continued to innovate and find ways to democratize juice, we soon realized that for us to take the business to the next level in providing organic, cold-pressured juice to even more people, we needed to find the correct strategic partners. As these new partnerships begin, nothing will change in Suja's promise to its fans: our juice will always be organic, non-GMO, cold-pressured and free of any additives.”

Emeryville, Calif.-based Jamba Inc. also has been investing in the cold-pressed juice market. The company launched its line of non-GMO, ready-to-drink Organic Cold Pressured Juice Blends. Available in Tropical Greens, Citrus Breeze, Mango Limeade, Cayenne Limeade and Orange Reviver, the new product line is part of the company’s ongoing commitment to provide consumers with better-for-you beverage choices and comes bottled for on-the-go convenience, the company says.

Beverage-makers also continue to churn out new varieties in the HPP/cold-pressured market. San Francisco-based Project Juice released three new products this spring — Strawberry Chia, Watermelon Berry and Jala-Greeño 2.0 — as well as a limited-edition variety — Camu Superstar — this past fall. The seasonal variety features a combination of root vegetables, citrus and camu camu (myrciaria dubia).

Euromonitor’s Penicka adds that fresh-squeezed juice options are emerging in the retail landscape. “Fresh-squeezed and raw juices are making a reappearance in the American retail landscape,” he says. “While a mainstay in less developed markets, fresh-squeezed, raw juice has been quite rare and altogether expensive in developed markets like the U.S. Previously limited almost exclusively to foodservice establishments, some supermarkets have begun selling in-store-squeezed juice to appeal to juice purists.”

Challenges ahead

Although the juice and juice drink smoothies segment has experienced growth in recent years, the 100 percent juice and juice drinks segments have faced contraction.

In its report, Mintel notes that that the 100 percent juice and juice drinks markets recently have struggled because of consumer perceptions of high sugar content. Juice drinks also have been perceived as less fresh, a challenge for this segment, and 100 percent juice struggles to find occasions outside of breakfast for regular consumption. However, the market research firm says that beverage manufacturers can employ new ways to reach consumers.

“A diversification in flavors and packaging formats will likely benefit 100 percent juice drinks, while a focus on clean labels can benefit juice drink brands,” the report says.

The segments within the 100 percent juice and juice drinks category also are not without their challenges.

“Citrus juices have been steadily declining as a share of the juices industry over the last 10 years,” writes IBISWorld. “Orange juice, which accounts for 50.5 percent of all fruit juice production, along with a range of other citrus fruits, are facing an incurable disease known as citrus greening.”

In its Crop Production release, The U.S. Department of Agriculture (USDA) reported that the United States all-orange forecast for the 2015-2016 season is down 5 percent from the previous forecast and down 14 percent from the 2014-2015 final utilization, according to the Nov. 10, 2015, data by the National Agriculture Statistics Service, Agricultural Statistics Board and USDA.

Euromonitor’s Penicka notes that orange juice’s off-premise volume declined 2.2 percent, outpacing the juice and juice drinks industry contraction of 1.8 percent.

With sales totaling more than $3.2 billion, the refrigerated orange juice segment is down just more than 2 percent for the 52 weeks ending Nov. 1, 2015, according to IRI data. Among the Top 5 brands in the segment, Simply Orange, a brand of The Coca-Cola Co., was the only one to post sale gains during that time period.

In comparison, the shelf-stable bottled orange juice segment saw a modest increase of 2.5 percent for approximately $280 million in sales.

In spite of these challenges, analysts anticipate that more changes will be in store for the juice and juice drinks category, and as manufacturers embrace those changes, more opportunities emerge.

“New nutrition fact legislation, which separates added sugar from [naturally occurring] sugar, could benefit the juice category,” Penicka says. “Although most juices are high in sugar, if consumers are more easily able to identify products with added sugar from products with naturally occurring sugar, the juice category may be able to shed some of the perceptions of being an unhealthy beverage.”

Kantar’s Masotti adds that single-serve premium products have the potential to drive short-term growth, while lower-calorie content also could serve a purpose going forward. “I think there is an opportunity for a lower-calorie, high-nutrient HPP juice to fulfill health needs with limited caloric impact,” she says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!