2014 State of the Industry: Tea and RTD tea

Health properties, premium formats boost tea sales

Consumer interest in healthy beverages has led to an evolving marketplace within the industry, experts note. For instance, the tea category has experienced sales increases due to consumer emphasis placed on healthy living habits, according to a January report from Santa Monica, Calif.-based IBISWorld titled “Tea Production in the US.”

The report also notes that beverage manufacturers are capitalizing on these trends through marketing efforts. “Backed by the scientific community, tea manufacturers are marketing the various health benefits of tea consumption, such as its effect on lowering cholesterol,” the report states. “Additionally, as Americans become more health conscious, they will seek alternatives to sugar-rich, carbonated beverages.”

Dana LaMendola, beverage analyst with Euromonitor International, Chicago, stated in Beverage Industry’s June issue that tea’s positioning as a functional beverage as well as consumer education have helped the U.S. hot tea market and ready-to-drink (RTD) tea market grow in both volume and dollar sales between 2008 and 2013.

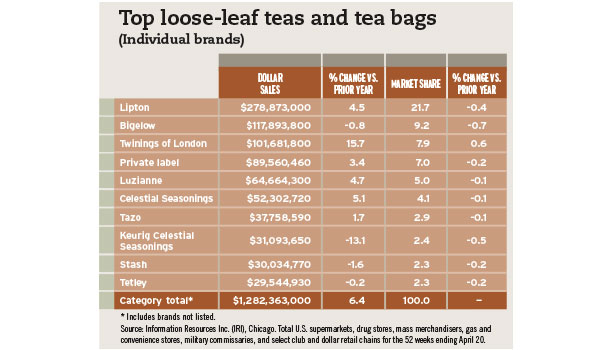

According to Chicago-based Information Resources Inc. (IRI), sales for bagged and loose-leaf teas increased more than 6 percent to

$1.2 billion in sales for the 52 weeks ending April 20 in U.S. multi-outlets. Showing more modest growth, canned and bottled tea sales were up just more than 2 percent to $3 billion in sales.

Within bagged and loose-leaf teas, IBISWorld’s Hester Joen reported that although bagged tea sales make up a majority of the hot tea market, the loose-leaf tea format has cut into its market share.

“The consumption of loose-leaf tea has grown on the back of the growing popularity of specialty tea and coffee shops,” Joen said in Beverage Industry’s June issue.

Adding to this trend, Seattle-based Starbucks Coffee Co. and Oprah Winfrey collaborated to co-create Teavana Oprah Chai Tea. The tea blends cinnamon, ginger, cardamom and cloves with loose-leaf black tea and rooibos.

The category also has seen varietals outside of the black and green tea segments gain in popularity. “Herbal and white teas have also grown in popularity in recent years,” Joen said. “Herbal teas appeal to drinkers who are looking for a refreshing beverage, while white teas appeal to drinkers who want a lightly caffeinated beverage.”

At Natural Products Expo West, Boulder, Colo.-based Celestial Seasonings, an operating unit of The Hain Celestial Group, introduced two new varieties to its Holiday Tea line: Caramel Apple Dream Holiday herbal tea and Cranberry Vanilla Wonderland Holiday herbal tea.

The category also has seen health and wellness trends benefit the RTD category as consumers seek an alternative to carbonated soft drinks, Euromonitor’s LaMendola explained. Brand owners continue to churn out new products that fit this billing, such as Atlanta-based The Coca-Cola Co.’s Honest Tea Unsweet Lemon Tea. The Pepsi Lipton Tea Partnership, a joint venture between PepsiCo Inc. and Unilever, also recently announced the release of Pure Leaf Tea & Lemonade.

However, the segment could be impacted by the proliferation of single-cup tea and liquid concentrates, experts note. “Consequently, liquid concentrates provide convenience to consumers who regularly consume iced tea,” IBISWorld’s Joen said. “While liquid tea concentrates have grown slightly in popularity, their impact on other tea segments has been minimal.”

Large players have entered the segment with AriZona Beverage Co., Cincinnati, and Nestlé Waters North America, Stamford, Conn., releasing lines last year.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!