Alternative Drinks

New product joins portfolio of relaxation drinks

Read More

Cocozia expands East Coast distribution

Coconut water brand adds Mom’s Organic Market, Earth Origins Market retailers

June 4, 2014

Consumers seek gluten-free products to promote healthy lifestyles

Devotion Vodka touts gluten-free attributes on package

May 16, 2014

OrganicMe launches 4 functional beverages

EnergizeMe, FocusMe, CalmMe and SleepMe packaged in Rexam’s 12-ounce Sleek cans

April 28, 2014

KonaRed expands partnership with Splash Beverage Group

Sales and marketing agreement to complement distribution relationship

April 28, 2014

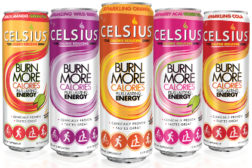

Celsius Holdings reports 65 percent revenue increase in Q1

Revenue reached a record $3.9 million in the quarter

April 25, 2014

Liquid concentrates spread from America to Europe, Asia

Beverage Industry to explore global beverage trends in May 2014 issue

April 16, 2014

KeVita sponsors 2014 Buzz Bus national health and wellness tour

Sparkling probiotic drinks brand helps deliver access to healthy products, wellness education

April 8, 2014

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing