Special Report

Top 100 Beverage Companies of 2023

Beverage Industry identifies top performers of past year

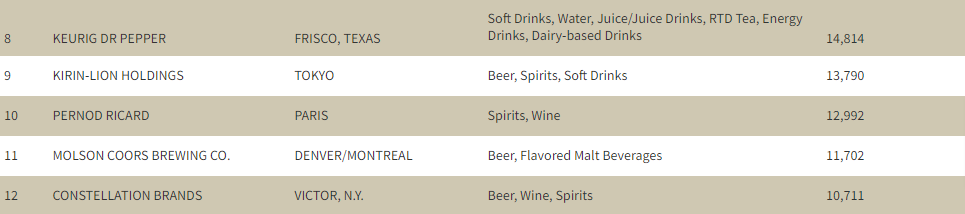

The U.S. beverage market once again saw performance decelerate in 2023, according to data from New York-based Beverage Marketing Corporation (BMC). The market research firm projects that total U.S. beverage market volume declined 1.1% in 2023, however, revenues made up for that decline, mostly due to inflation, with wholesale dollar projected growth up 5.5%.

BMC found that most large mass market refreshment beverage categories struggled in 2023, with the exception of bottled water and energy drinks, which saw volumes up 0.5% and 5%, respectively. Carbonated soft drinks, which has seen a few years in a row of volume growth, saw volume declines with the category down 0.5%. In total, volume for liquid refreshment beverages were down 0.6% in 2023, according to BMC data.

In the beverage alcohol market, distilled spirits was the top performer in terms of volume. The category saw volume up 3%; however, wine and beer volumes were both in decline, down 1.4% and 2%, respectively, according to BMC data. In terms of total volume for beverage alcohol, volume was down 1.5% in 2023.

Taking all of these factors into account, Beverage Industry’s Top 100 Beverage Companies report, based on 2023 fiscal year sales, reflects the ebbs and flows that different factions of alcohol and non-alcohol beverage market experienced this past year.

2023 Top 100 Beverage Companies Preview

Significant Events

Treasury Wine Estates Ltd., Melbourne, Australia, reached an agreement to acquire DAOU Vineyards, the acclaimed luxury wine business founded by brothers and co-proprietors Georges and Daniel Daou for an upfront consideration of $900 million, plus an additional earn-out of up to $100 million. This transformative deal will accelerate TWE’s focus on a portfolio that is increasingly luxury-led with a greater presence in key growth markets such as the United States, it states. Tim Ford, CEO of Treasury Wine Estates, said in a statement: “The U.S. is the world’s largest wine market and we’re beyond thrilled to add DAOU to our portfolio, cementing our position as a global luxury wine leader. This is a transformative acquisition that will accelerate the growth of our luxury portfolio globally and paves the way for new luxury consumer experiences. DAOU is an award-winning luxury wine business with an outstanding track record for growth and we have grand plans for DAOU to become the next brand with the international scale and luxury credentials of Penfolds. With DAOU, we will be well-positioned to connect with a new generation of wine lovers, combining tradition with innovation, culture-led experiences, and global distribution.”

Keurig Dr Pepper Inc., Burlington, MA, and Frisco, Texas, announced the appointment of Tim Cofer as chief operating officer (COO), reporting to Chairman and CEO Bob Gamgort, as a key step in the company's CEO succession plan. Cofer joined KDP on Nov. 6 to work side by side with Gamgort while in a COO capacity, with a planned transition to CEO in the second quarter of 2024. Gamgort will serve as executive chairman of KDP after the transition occurs. KDP’s succession plan provides for a robust transition period, during which Cofer will help drive the company’s strategic growth agenda and oversee operations with Gamgort. Collaborating with KDP’s executive leadership team (ELT), Cofer will play a significant leadership role in each of the company’s business segments. KDP also announced an agreement with Grupo PiSA, Guadalajara, Mexico, in which KDP will sell, distribute and merchandise Electrolit, a premium hydration beverage, across the United States as part of a long-term sales and distribution agreement. The partnership extends KDP’s portfolio into sports hydration, a key white space category for the company, and is designed to expand Electrolit’s distribution and continue the brand’s accelerated growth. Under the partnership, KDP will sell and distribute Electrolit in the vast majority of KDP’s company-owned direct store distribution territories and across all channels of trade. The transition of Electrolit distribution to KDP occurred in early 2024.

Bacardi Limited, Hamilton, Bermuda, announced the completion of a transaction that makes the family-owned company the sole owner of ILEGAL Mezcal, a leading super premium artisanal mezcal. The transaction follows a successful relationship in which Bacardi partnered with ILEGAL since 2015. “We believe that ILEGAL has the credentials to own and lead the super-premium mezcal category at a global level. ILEGAL perfectly complements our portfolio and bringing it into our business sets the brand up for even greater growth as mezcal captivates more and more consumers,” said Barry Kabalkin, vice chairman of Bacardi Limited, in a statement. Mahesh Madhavan, Bacardi Limited CEO, added: “Bacardi and ILEGAL have a shared commitment to communities, quality, and environmental sustainability that we will build upon together as we look to invest for the long term. As a family-owned business for seven generations, we are always building for the future to maintain the legacy that is Bacardi.” Terms of the transaction were not disclosed.

Molson Coors Beverage Co., Chicago, has reached an agreement to acquire Georgetown, KY-based Blue Run Spirits, an award-winning producer of finely crafted bourbon and rye whiskies. The deal represents another step in Molson Coors’ evolution as a total beverage company while providing Blue Run with resources to continue its growth. As its first spirits acquisition, the addition of Blue Run boosts the Molson Coors’ footprint in spirits as it continues to evolve from its storied history as a beer company and premiumize its portfolio, the company says. In tandem with the acquisition, Molson Coors has established Coors Spirits Co., an expansion of its existing spirits business, which will house Blue Run, Five Trail Blended American Whiskey, Barmen 1873 Bourbon and future innovation, it notes. This acquisition will more than double the size of Molson Coors’ spirits team, further supporting the company’s premiumization strategy, it says. Molson Coors entered the whiskey space with the 2021 launch of Five Trail Blended American Whiskey (which won double gold at the 2022 San Francisco World Spirits Competition) and the 2022 introduction of Barmen 1873 Bourbon.

Brown-Forman Corp., Louisville, KY, reached an agreement to sell its Finlandia vodka brand to Coca-Cola HBC AG for $220 million, subject to the customary closing process. The purchase closed in the second half of the 2023 calendar year. “Finlandia has played an important role in the global growth of Brown-Forman. Since the brand originally joined our portfolio in 2000, many talented individuals have worked hard to bring Finlandia vodka to the world, and I thank them for their dedication,” said Lawson Whiting, president and CEO at Brown-Forman Corp., in a statement. “We believe Coca-Cola HBC is well-suited to support Finlandia’s future growth and look forward to watching the continued evolution of the brand in their capable hands.” Zoran Bogdanovic, CEO at Coca-Cola HBC AG, added: “We are excited and privileged to become the new home for Finlandia vodka. This unique opportunity for us will support our mixability strategy with our core Non-Alcoholic Ready-To-Drink portfolio and sharpen our focus on the strategically important on-premise channel. We are already developing strong plans to take Finlandia to the next level by accelerating and leveraging the brand’s current momentum. Lastly, I would like to welcome the Finlandia team to the Coca-Cola HBC family and look forward to great successes.

Anheuser-Busch, St. Louis, entered into a definitive agreement to sell eight beer and beverage brands to Tilray Brands Inc., New York. Tilray will acquire Shock Top, Breckenridge Brewery, Blue Point Brewing Co., 10 Barrel Brewing Co., Redhook Brewery, Widmer Brothers Brewing, Square Mile Cider Co. and HiBall Energy. The transaction includes current employees, breweries and brewpubs associated with these brands. The purchase price will be paid in all cash and the transaction closed in 2023. Andy Thomas, president of The High End at Anheuser-Busch said: “Tilray Brands reached out to us early this year with interest in purchasing these brands and breweries, and since then, we’ve had many positive conversations that led to today’s announcement. The talented people behind these brands and breweries, along with our significant investments in them over the years, have positioned them for a bright future with Tilray Brands. We are committed to working with Tilray Brands over the coming months to ensure this is a smooth transition for the people who are working every day to get these amazing beers and beverages to consumers across the U.S.” Ty Gilmore, president of U.S. Beer at Tilray Brands, added: “With this transaction, our beer business is expected to triple in size from 4 million cases to 12 million cases annually. Looking ahead, we will further capitalize on the potential of these brands through product innovation, retailer partnerships and expanded distribution into key markets, including the Pacific Northwest and California.”

Milo’s Tea Co., Bessemer, AL, announced it will invest more than $130 million initially to build a new manufacturing and distribution facility in Spartanburg County, SC. In the beginning, this new facility will bring more than 100 jobs to the area. This new investment is a direct response to the growth of the Milo's brand, the company notes. Milo’s broke ground by mid-March 2023 and plans to start production of its famous tea and lemonade in fall 2024. After a multi-year site selection process, Milo’s chose the 48-acre campus at the corner of U.S. Highway 290 and U.S. Highway 221 in Moore, SC. The 110,000-square-foot facility will be the fourth production plant for the company. The company’s other manufacturing facilities are located in the Tulsa, OK area and Bessemer and Homewood, AL. The move to South Carolina supports the company’s goal of expanding its production of all-natural teas and best tasting beverages. Milo’s also plans on adding additional lines of production over the coming years. “South Carolina was the optimal location to efficiently serve our customers up and down the east coast. Like our selection journey for our Oklahoma facility, we immediately felt at home in the Spartanburg area as we received a warm welcome from state and local community partners,” said CEO Tricia Wallwork, in a statement. “South Carolina and Spartanburg County in particular proved to be the right ecosystem to help us advance our People First culture by offering an excellent standard of living for our associates and robust workforce development resources to drive economic prosperity not only for our people but also for the region.”

Danone North America, Broomfield, CO, announced it will invest as much as $65 million during the next two years to create a new bottle production line in Jacksonville, FL. The investment will support Danone North America’s long-term growth strategy and will deliver key benefits across the U.S. business, including advancing operational excellence, enabling flexibility in bottle design, accelerating the company's sustainability goals, and driving cost efficiencies, it notes. “We are delighted to announce this investment in our North American business, which will allow us to capitalize on consumer demand in key beverage categories including coffee creamers, plant-based creamers, and ready-to-drink coffee, while also supporting our long-term growth agenda,” said Shane Grant, group deputy CEO and CEO Americas, in a statement. “This investment will help us keep our products on our customers' shelves and give more American consumers the Danone products they love.” This multi-million-dollar investment will increase production of several of Danone’s coffee and creamer brands in the U.S., including International Delight, Silk and SToK. It also serves to meet consumer demand in these categories while supporting the company’s sustainability goal by reducing overall water consumption, decreasing carbon emissions and accelerating the company's goal of packaging circularity.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!