Special Report

Wholesale, retail operations embrace benefits of digital solutions

Analytics, online ordering among attributes offered from digital

Former monk and best-selling author Jay Shetty has touted in his books and podcast “On Purpose” the power of meditation. Through his daily content series “The Daily Jay,” Shetty guides listeners through seven minutes of mindfulness sessions, which can heighten the senses and bring participants into the present with a goal of helping people approach their day with more purposeful thoughts, reduce stressors among many other benefits. As Shetty is utilizing technology to enhance the human experience, wholesalers, retailers, restaurants and beverage-makers are seeing how digital solutions can enhance operations to deliver a positive engagement with today’s consumers.

“eCommerce technology has rapidly changed the way consumers find and purchase their favorite alcoholic beverage brands ― and discover new ones,” says Robert Duffy, chief product and technology officer at Boston-based Drizly. “The past few years have been an inflection point for this already growing category, and we anticipate that alcohol eCommerce will only continue to grow in coming years.”

Duffy notes that access to eCommerce data also allow brands and retailers to better understand consumers’ wants and needs, thereby bettering business operations.

“At Drizly, we’ve invested heavily in marketing and advertising products to help suppliers get as close to the end consumer as they legally can ― they can see advertising performance reports, purchase data packages to see what’s trending in local markets and evaluate how brands are performing,” he explains. “Data, and the technology that drives it, gives brands real-time information they can act on based on what they know is resonating in the market.”

Although maturing technology has supported the growth of eCommerce, the capabilities of this digital advancement is enhancing in-store and in-restaurant experiences as well.

“Technology is being used to enhance the experience at bars and restaurants and as a result not only are guests benefiting but so are the brands sold in these bars and restaurants,” says Gary Ross, chief growth officer at Union, Austin, Texas.

Ross explains that Union offers a guest-led ordering experience, where consumers order and pay through their personal devices.

“This experience allows alc/bev brands a new opportunity to understand on-premise consumption in a way that previously didn’t exist as well as the opportunity for brands to engage directly with consumers during time of purchase,” he explains.

Ross notes that this allows brands to have access to granular on-premise sales data. “This gives brands breakthrough insights and moreover enables them to precisely measure the impact of new consumer recruitment and loyalty building efforts,” he says.

Beyond the business-to-consumer (B2C) digital connections, the business-to-business (B2B) opportunities to leverage digital solutions also offer brands potential.

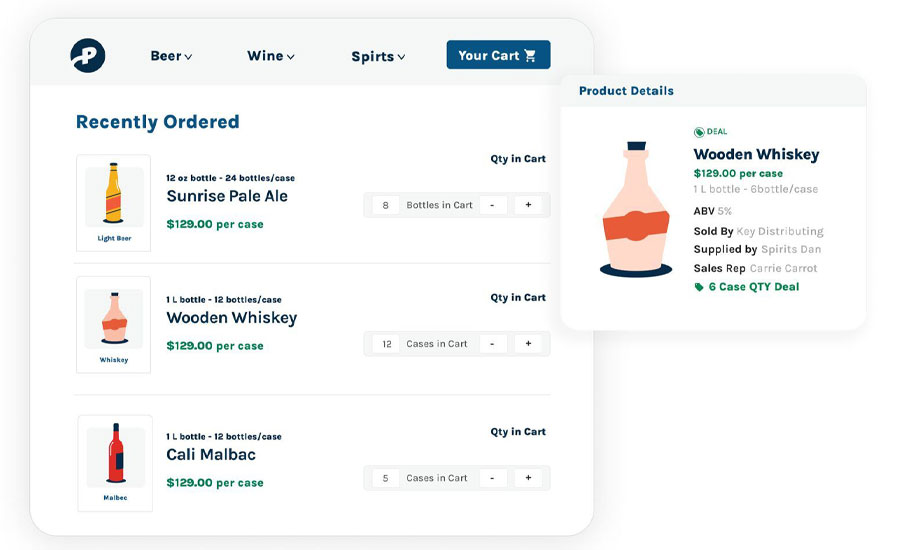

“As Provi is the largest B2B online marketplace in the U.S., we have a unique perspective on how digital technology has impacted the on-and-off premise retail experience with brands,” says Andrew Levy, chief corporate affairs officer at Provi, Chicago. “More often than not, however, bartenders, sommeliers, package store owners, are still consumers’ go-to resource when discovering new products. So, there is certainly a downstream effect on how B2B digital technology impacts the consumer experience.”

This digital transformation also has enabled an opportunity to gain deeper insights about brands.

“Technology has transformed the way retailers learn about and adopt products into their stores or bar programs,” Levy explains. “Instead of retailers only typically accessing pricing and SKU information, they can now obtain an immersive education about a brand or portfolio.

“With digital solutions retailers can learn about the region a product originates from, the story around its development, how to talk about it with their customers, and how to implement it into their beverage programs,” he continues. “This information is ultimately transferred to the end consumer as they ask their local bartender what to drink, or the sommelier on what varietal to try, or as they ask the rep at the liquor store what to bring to a friend’s house warming party.”

Experts also note the growing influence that artificial intelligence (AI) is having on operations.

“We are seeing modern tooling like generative AI and machine learning play a big part in the eCommerce transformation,” Drizly’s Duffy says. “AI allows us to come much closer to the type of personalized recommendations and experiences that you would get from going into a store. Tools in this space are helping us invent new ways for our customers to navigate increasingly large catalogs.”

Duffy notes that these tools not only benefit the consumers, but also the retailers in the process.

“Beverage alcohol is a unique space with large catalogs and variants on container, size, and quantity for a single product,” he says. “We invest in technology that makes it easy to match what retailers have in store to a product in the marketplace and enrich that so consumers get what they are expecting when they order.”

Additionally, Provi’s Levy touts the adoption and advancements of digital in the B2B space as an achievement, noting how consumers’ embracement of eCommerce nudged those with hesitation.

Image courtesy of Provi

“Today, digital is not only being integrated into the industry to adhere to the consumer shift, but it’s now a necessary growth lever for scaling operations, maintaining relationships, and increasing sales,” he says. “In the last few years, we’ve seen a fundamental shift across each tier on looking to digital to solve for pain points inside and outside of the organization. Provi solves for a unique challenge in the industry around ordering while still maintaining and enhancing the three-tier system.”

With digital solutions that operate within the three-tier system, this can deepen engagement between suppliers, distributors and retailers, thereby making everyone’s jobs easier, Levy notes.

“For suppliers, digital solutions increase brand awareness to the retail tier in a compliant way,” he says. “For distributors, technology helps with mundane and administrative tasks around order processing and paperwork, enabling reps to focus on consultative selling strategies. For retailers, it not only gives them awareness of new products, but it also gives them significant time back in their days.”

Access to data and analytics also is a benefit that all three-tiers can realize.

“Intelligence around everything from brand engagement to sales data to inventory tracking has provided suppliers, distributors, and retailers with tangible insights to help grow and scale their businesses,” Levy says.

Drizly’s Duffy also calls attention to how digital transformation’s ability to reach all major players operating within the consumer packaged goods market.

“eCommerce technology has an opportunity to impact every player within the beverage alcohol industry,” he says. “For distributors, retailers and brands, it has given them an incredible toolset and opportunity to reach their customers in new ways because they are no longer limited to in-person visits and limited shelf space.

“Customers shop across channels and they expect to be able to use digital tools and information for shopping ― whether that is to actually make a purchase or to research and prepare for a trip into a store,” Duffy continues. “We see 40% of Drizly’s customers using our platform for research before their trip so we play a significant role in helping to inform purchases ― both on and offsite.”

Cracking the code

The benefits to operations because of the transformative impact of digital have been well-documented, yet experts note that getting users to embrace technology has its challenges.

“The biggest barrier pre-pandemic was customer awareness that online alcohol delivery is a legal and available option in many states,” Duffy explains. “Now that more consumers are aware of alcohol eCommerce and on-demand delivery as an option, we anticipate retailers continuing to enter the space as consumers come to demand this service as they have from other categories, more local retailers to come online and greater investment across the three tiers that will only deepen.

“Drizly specifically is finding new ways to both fuel and meet the demand in the eCommerce space,” he continues. “We are working hard to improve shopping on Drizly and identify ways to create more personalized and curated experiences.”

Union’s Ross echoes similar sentiments in terms of adoption, but also highlights the benefits that users can capitalize on.

“The biggest challenge is change,” he says. “Partnering with new vendors and integrating new technology is exciting, but also requires rethinking some traditional marketing practices that have been in place for decades. Understanding that Union works with thousands of the largest bars and restaurants across the U.S. they begin to listen.”

Ross adds that the company’s relationship with Southern Glazer’s for on-premise also prompted brands to be more open to change.

“[O]nce they experience the simplicity of execution, staggering results, and granular insights Union delivers, they are quick to adapt,” he says.

Provi’s Levy notes that education plays a big role in getting companies to understand and embrace digital solutions.

“While the growth of digital across the wider beverage alcohol ecosystem has been tremendous, it can often be difficult to navigate through,” Levy explains. “For example, the word ‘eCommerce’ can mean so many different things, depending on who you are talking to and what problem you are working to solve. For Provi, we’ve been heavily focused on educating the industry on viewing digital as a holistic strategy and having the right partners in place to solve for each unique problem a company is facing.”

As digital solutions continue to mature, providers are looking to improve upon the systems already in circulation. For example, Union’s Ross notes that the company is in the process of upgrading the inventory management capabilities for brands, particularly when it comes to seasonal trends.

“With our rich data around seasonality and consumption trends, brands can keep tabs on what beverages and spirits are likely to be running low and it will also help them better stock their customers so they can be ready for consumption spikes,” he says. “Other things we are working on are additional ways we can use our network to support our brand partners with ways to engage with consumers post purchase to drive additional brand education and potential off premise behavior.”

Given the presence that digital has in today’s beverage operations, providers are working to ensure that the experience is one that will enhance experience.

“We are hopeful that digital within B2B continues to evolve and be adopted,” Provi’s Levy says. “Though there have been tremendous strides, the beverage alcohol industry still has a long way to go, especially in comparison to other CPG sectors.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!