2016 State of the Industry: CSD sales contract, innovation driving future success

Category challenged by health and wellness

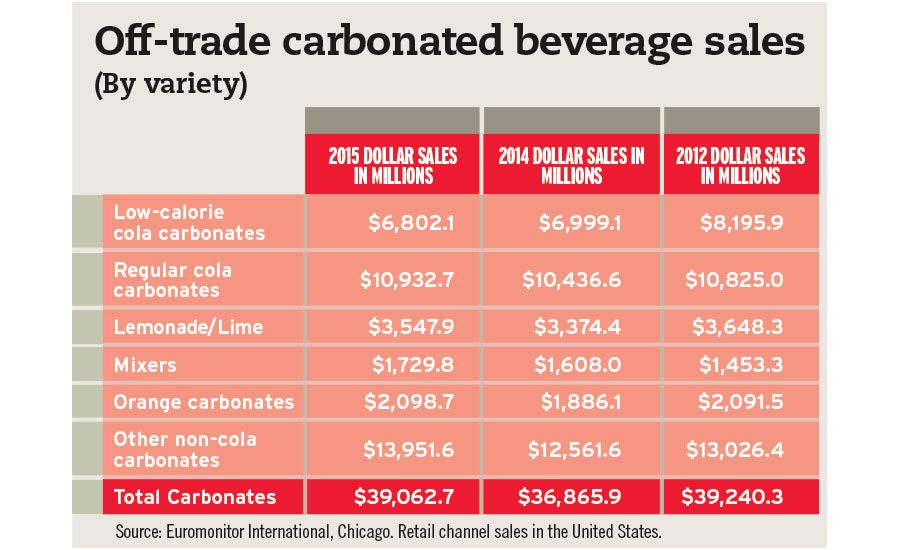

As consumer demand continues to change, market research and analysts indicate that the U.S. market for carbonated soft drinks (CSDs) continues to struggle. “CSD was the largest category in the U.S. soft drinks market in 2015 with 36.54 percent market share and a value of $58.35 billion,” said Vijay Sarathi, lead analyst of food and beverage for London-based Technavio, in Beverage Industry’s April issue. “However, it has experienced decline in its revenue and volume due to worries among consumers of the calorie and sugar content.”

In its October 2015 report titled “Soft Drinks Market in the U.S. 2015-2019,” the market research firm highlights the contraction noting that in 2014, the market was valued at $59.21 billion, but will decline at a -1.27 compound annual growth rate to $55.55 billion by 2019.

Despite consumers’ desires to avoid high-calorie beverages, declining diet CSD sales are further contributing to the category’s overall decline. Sarathi said that the low/no-calorie CSD segment is expected to continue its decline during the 2015-2019 timeframe, decreasing from about $7 billion in 2015 to $5 billion by 2019.

Chicago-based Mintel notes the impact these declines have had on the overall CSD market in its June 2015 report titled “Carbonated Soft Drinks: Spotlight on Natural/Craft.” “The carbonated soft drink (CSD) category has faced several years of sales declines, which is expected to continue as diet CSDs prevent the category from reflecting any positive recovery from the regular segment,” the report states.

Additionally, government regulation also might be a challenge for the category. “Many state and local governments will seek different ways to further limit the sale of CSDs in the upcoming years,” Los Angeles-based IBISWorld’s Analyst Chrystalleni Stivaros said in Beverage Industry’s April issue. “For instance, more states are expected to implement a soda tax to discourage consumers from drinking soda frequently. A significant increase in the price of regular CSDs can lower the sales of regular soft drinks and cause consumers to turn to substitute beverages.”

Despite the challenges, CSD companies are innovating new options that appeal to natural, better-for-you consumer trends. “Health-and-wellness trends have strongly impacted the soda production industry,” IBISWorld’s Stivaros said. “Major companies, such as The Coca-Cola Co. and PepsiCo, have invested in the research and development of new, lower-sugar products to maintain their customer base.”

In August 2015, Purchase, N.Y.-based PepsiCo Inc. announced that it reformulated its Diet Pepsi brand to make the product and its variants aspartame free by instead sweetening the products with a blend of sucralose.

Technavio’s Sarathi added that stevia-based CSDs are growing in popularity as better-for-you and natural trends continue to proliferate.

In its report, Mintel notes that consumers see beverages with natural ingredients as healthier/better-for-you options than those with artificial ingredients, which also might be helping craft CSDs. “More than a third of consumers are drinking craft CSDs; top reasons for drinking include natural/real and premium/high-quality ingredients,” the report states.

Technavio’s Sarathi echoed similar sentiments. “Craft sodas are usually positioned as a better-for-you option fortified with all-natural ingredients, which is gaining consumer attention,” Sarathi said in Beverage Industry's April issue.

Yet, Sarathi added that the craft soda segment is too small to make a major impact on the overall CSD category, currently holding about 1 percent of the market by volume terms. “We believe the fruit-based carbonates could fare [better] than the standard CSD,” Sarathi said.

Although innovation might be the key to the category’s future success, experts noted that CSD manufacturers also are driving their marketing efforts. “Strong marketing campaigns are one way beverage-makers are trying to entice consumers to buy CSDs,” IBISWorld’s Stivaros said.

For example, Atlanta-based The Coca-Cola Co. hit the market this year with its Taste the Feeling and One Brand campaigns, and PepsiCo Inc. launched its #PepsiMoji campaign in May.

In Beverage Industry’s April issue, Technavio’s Sarathi highlighted the emphasis that category leaders, The Coca-Cola Co. and PepsiCo, have placed on their marketing efforts. “Product branding and advertising strategies by leading vendors have been key to sustain in the market with both Coke and Pepsi spending approximately $3.4 billion and $3.9 billion, respectively, in 2014,” Sarathi said. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!