2016 Soft Drink Report: Soft drink sales decline, craft soda has potential

Health-and-wellness trends challenge CSD category

In February, Diet Coke launched the It’s Mine program, which made Diet Coke available in millions of unique packaging designs for a limited time. It also was the first time the brand was made available in The Coca-Cola Co.’s signature 12-ounce glass contour bottles. (Image courtesy of The Coca-Cola Co.)

Technavio’s Vijay Sarathi notes that Mountain Dew Kickstart, which contains juice, coconut water and lower amounts of caffeine, has performed well, garnering sales of about $250 million in 2014. The brand launched four new flavors in February. (Image courtesy of PepsiCo)

For the past several years, the beverage industry has faced an evolution in consumer demand. A consumer drive toward maintaining overall health and wellness has impacted several categories, particularly carbonated soft drinks (CSDs). CSDs are working to maintain profitability, innovate new products that appeal to new demands and create engaging content for their already brand-loyal consumers.

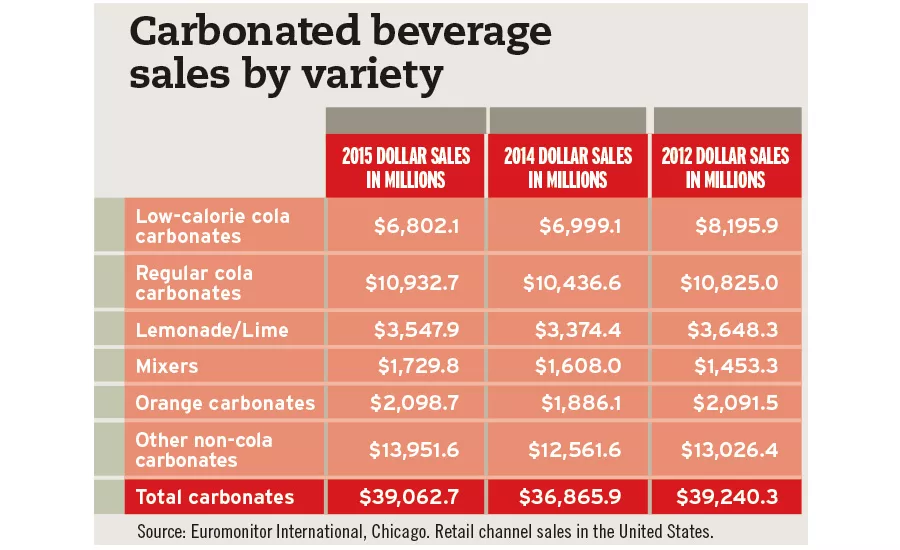

However, market research shows that the U.S. market for CSDs continues to struggle. “CSD was the largest category in the U.S. soft drinks market in 2015 with 36.54 percent market share and a value of $58.35 billion,” says Lead Analyst of food and beverage for London-based Technavio Vijay Sarathi. “However, it has experienced decline in its revenue and volume due to worries among consumers of the calorie and sugar content.”

Technavio’s October 2015 report “Soft Drinks Market in the U.S. 2015-2019” states that the CSD category dominated the U.S. non-alcohol drinks market in 2014, garnering just more than 38 percent market share, but is contracting. “The CSD market in the U.S. was valued at $59.21 billion in 2014 and is anticipated to reach $55.55 billion, declining at a [compound annual growth rate] (CAGR) of -1.27 percent [to 2019],” it states.

Despite consumers’ desires to avoid high-calorie beverages, market research and experts note that declining diet CSD segment sales are further contributing to the category’s overall decline. “The carbonated soft drink (CSD) category has faced several years of sales declines, which is expected to continue as diet CSDs prevent the category from reflecting any positive recovery from the regular segment,” reports Chicago-based Mintel in its June 2015 report titled “Carbonated Soft Drinks: Spotlight on Natural/Craft.”

Technavio’s Sarathi expands on this, illustrating the decline in sales of the diet segment through 2019. “Low-calorie sodas are expected to fall further during the period 2015-2019, from around $7 billion in 2015 to $5 billion by 2019,” Sarathi says.

Los Angeles-based IBISWorld also notes the decreased demand for diet CSDs in its December 2015 report “Soda Production in the US.” “While volume sales of diet CSDs increased in the early 2000s, benefiting from popular diet trends, volume sales have declined in the past five years as consumers have become wary of the health effects of consuming artificial sweeteners,” it states.

Additionally, experts note that government regulation might be a hurdle in the future. “Many state and local governments will seek different ways to further limit the sale of CSDs in the upcoming years,” IBISWorld’s Analyst Chrystalleni Stivaros says. “For instance, more states are expected to implement a soda tax to discourage consumers from drinking soda frequently. A significant increase in the price of regular CSDs can lower the sales of regular soft drinks and cause consumers to turn to substitute beverages.”

According to the IBISWorld report, during the past five years the industry has self-regulated to maintain a positive public image and prevent government regulation. “For example, members of the American Beverage Association have voluntarily eliminated non-diet sodas from public schools nationwide,” the report states. “They have also donated to health-promoting campaigns and proactively placed new calorie labels on the front of every soda bottle.”

The report notes that a tax, of some sort, on CSDs has been enacted in 33 states, and New York and California have debated passing a soda tax during the past several years as well. Although, it is important to note that the taxes that have been enacted generally are not state-wide taxes, but specific to local governments within the states.

Naturally crafted

Despite the challenges, the CSD category continues to strive ahead. Some CSD companies are innovating options in hopes of appealing to consumers. “Health-and-wellness trends have strongly impacted the soda production industry,” IBISWorld’s Stivaros says. “Major companies, such as The Coca-Cola Co. and PepsiCo, have invested in the research and development of new, lower-sugar products to maintain their customer base.”

In August 2015, Purchase, N.Y.-based PepsiCo announced that it reformulated its Diet Pepsi brand to make the product aspartame free. “Diet cola drinkers in the U.S. told us they wanted aspartame-free Diet Pepsi, and we’re delivering,” said Seth Kaufman, senior vice president for Pepsi and Flavors Portfolio at PepsiCo North America Beverages, in a statement at the time of the launch. “We recognize consumer demand is evolving and we’re confident cola-lovers will enjoy the crisp, light taste of this new product.”

According to the company, Diet Pepsi, Caffeine Free Diet Pepsi and Wild Cherry Diet Pepsi now are sweetened with a blend of sucralose instead of aspartame.

“Health and wellness had a major impact on the soft drinks market in the U.S. with the entire new product development in the country focused on the health aspect of soft drinks prompting manufacturers to launch stevia-based drinks,” Technavio’s Sarathi says. “Some notable examples include: Pepsi True, Sprite Green, Sobe Life Water and Zevia soda drinks, among others.”

In fact, in May 2015, Culver City, Calif.-based Zevia LLC announced that it changed its formulas to be color-free and received Non-GMO Project Verified status. “Shoppers want four things from the sodas they drink: flavors, bubbles, sweetness and enjoyment,” Zevia Chief Executive Officer Paddy Spence said in a statement. “But they don’t want artificial sweeteners, artificial preservatives, artificial flavors, GMO ingredients and caramel color.”

The brand, which uses a blend of stevia and monk fruit for sweetness, offers 17 color-free flavors appealing to diet soda drinkers. “Today’s consumers are more sophisticated than ever before, and they want authentic, transparent brands that respond to their concerns,” Spence said.

Noting the evolution of consumers’ sweetener preferences, Technavio’s Sarathi says that natural is an overarching demand from consumers. “Manufacturers are trying hard to bring back the consumers to the soda category; however, consumers’ attitudes toward sweeteners have really changed with a growing mistrust of artificial sweeteners and [this] is not good for the category,” Sarathi says. “Soda today is perceived as an occasional treat, which is contrast to the fact that it was a staple drink a decade ago.”

In its report, Mintel notes that consumers see beverages with natural ingredients as healthier/better-for-you options than those with artificial ingredients. “More than a third of consumers are drinking craft CSDs; top reasons for drinking include natural/real and premium/high-quality ingredients,” the report states. “Food and drink trends focus on ‘real’ and high-quality ingredients, as artificial ingredients are coming under fire, and consumers are demanding cleaner labels.”

It adds that better-for-you CSDs have encouraged consumers to expect more from CSDs. “CSDs need to move past a beverage category that offers consumers basic refreshment and taste with a host of additional health baggage,” the report states.

Craft CSDs also offer potential for the category, the report notes. “The up-and-coming craft segment holds great potential as nearly half of non-drinkers are interested in trying,” it states. “The split between craft interest and disinterest demonstrates the youth of the segment. Although craft and natural CSDs are peaking interest, sales remain too small to see any overall effect.”

Technavio’s Sarathi echoes similar sentiments. “Craft sodas are usually positioned as a better-for-you option fortified with all-natural ingredients, which is gaining consumer attention,” Sarathi says. “They are also perceived to provide new flavor experiences, including blends of fruits, spices and herbs, signifying the naturally sweetened and premium ingredient trends. However, we believe the craft soda segment is too small to make a major impact on the CSD category in the U.S. It currently holds around 1 percent of the overall soda market in the U.S. by volume terms. We believe the fruit-based carbonates could fare [better] than the standard CSD.”

For example, Sarathi highlights PepsiCo’s Mountain Dew Kickstart line, which offers varieties that contain higher juice content, coconut water and lower amounts of caffeine. The brand garnered retail sales around $250 million for the company in 2014, Sarathi adds.

Despite the segments’ low penetration rate thus far, craft soda brands are continually launching new flavors and innovations. For example, in November 2015, Bryan, Texas-based Kristen Distributing Co.’s Boots Beverages craft soda brand launched four new flavors: Caramel Apple, Lemon Meringue, Orange Boots Drömsicle and Strawberries ’n Cream. Then, earlier this year, the brand added Lucky Ginger Brew to its portfolio. Boots Beverages craft sodas boast natural flavors and are sweetened with pure cane sugar.

International companies also are recognizing the potential of craft sodas in the United States. Mima Sodas S.A. de C.V., a Mexican-German beverage start-up, released Búho Sodas in select markets in the United States. Free of artificial flavors and sweeteners, the craft sodas are sweetened with USDA-certified organic blue agave syrup and stevia, and are available in three flavors: Búho Naranjada with a blend of orange, tangerine and lemon juice; Búho Limonada with Persian lime juice and a hint of mint; and Búho Kola with lemon juice and a shot of caffeine.

Making the sale

As CSD manufacturers continue to innovate products to meet health-and-wellness demands, they also are putting a greater emphasis on their marketing efforts, analysts note.

“Strong marketing campaigns are one way beverage-makers are trying to entice consumers to buy CSDs,” IBISWorld’s Stivaros says. “In January, [The Coca-Cola Co.] launched its Taste the Feeling campaign, which unites all of its trademark brands. This campaign emphasizes the vast catalogue of variations of the traditional Coke beverage to remind consumers that there is an option for all tastes and preferences. Coca-Cola has invested most of its marketing programs toward associating drinking one of its CSD beverages with happiness.”

In February, Atlanta-based The Coca-Cola Co.’s Diet Coke brand launched the It’s Mine program, which made Diet Coke available in millions of unique packaging designs for a limited time. The program also marked the first time the brand was made available in the company’s signature 12-ounce glass contour bottles, the company says. “The launch of the It’s Mine program is a continued celebration of our fans’ unique, steadfast love for the delicious taste of Diet Coke,” said Rafael Acevedo, group director of Diet Coke at Coca-Cola North America, in a statement. “Through a robust, integrated national program, we’re inviting fans to choose from millions of unique Diet Coke designs, selecting the one they feel is uniquely their own.”

Technavio’s Sarathi highlights the emphasis that category leaders, The Coca-Cola Co. and PepsiCo, have placed on their marketing efforts. “Product branding and advertising strategies by leading vendors have been key to sustain in the market with both Coke and Pepsi spending approximately $3.4 billion and $3.9 billion, respectively, in 2014,” Sarathi says. “In early 2016, Coca-Cola has come up with a new campaign titled Taste the Feeling, which intends to bring all Coke trademark brands united in one campaign. ... Pepsi, which does not want to lag behind, is relaunching its Pepsi Challenge campaign to increase sales. In early 2016, PepsiCo’s Indra Nooyi said that the company is planning an emoji-clad packaging campaign, hoping that the characters will encourage people to consume [its drinks] as well as promote [them] on social media.”

In October 2015, PepsiCo capitalized on its pop-culture reference with the online launch of Pepsi Perfect, the fictional beverage that Marty McFly orders on Oct. 21, 2015, in “Back to the Future Part II.” The 6,500 16.9-ounce collectable bottles, made available and selling for $20.15 each, sold out before the embargoed date. Appealing to Pepsi and “Back to the Future” trilogy fans alike, the company produced another 6,500 bottles in November 2015 to help meet the excess demand, according to a CNN Money article.

“Pepsi fans asked and we heard them loud and clear,” said Lou Arbetter, senior director of marketing for PepsiCo, in a statement before the initial launch. “The ‘Back to the Future’ trilogy was a big moment in pop culture history then as it is now, 30 years later. We are excited to be part of this moment and to bring fans something only Pepsi could deliver — and there’s no need to wait — the future is now.”

Home carbonation systems affected by health-and-wellness trends

A unique segment of the carbonated soft drink (CSD) category, at-home CSD-making machines also are making an effort to boost their health-and-wellness perceptions by offering better-for-you choices and increasing sales. However, similar to the craft soda segment, it appears that at-home CSD-makers are not yet garnering enough attention from consumers to make a strong impact. Additionally, it also faces similar demands for better-for-you options.

In mid-February, SodaStream International Ltd., Airport City, Israel, announced its fourth quarter fiscal 2015 results. According to the company, revenue was $112.9 million for fourth quarter, which ended Dec. 31, 2015, compared with $126.5 million in the fourth quarter 2014.

“The past year was a period of significant change as we sought to set the company on a course for renewed growth moving forward,” said Daniel Birnbaum, chief executive officer of SodaStream, in a statement. “We begin repositioning SodaStream as a healthy water brand and launched our new portfolio of enhanced better-for-you flavors, completed the consolidation of our management structure including new leadership in key markets. ... There is still work ahead of us in order to position the company for consistent profitable growth, but I am confident that our recent actions have us heading in the right direction and will create value for shareholders over the long term.”

The company now offers SodaStream Naturals, a line of flavors that do not include artificial sweeteners and contain only 40 calories in each serving. Additionally, in April 2015, the brand partnered with Skinnygirl to launch Skinnygirl Drink Mixes. Available in two flavors, Cucumber Lime and Mango Berry, the mixes are free from artificial ingredients and designed for making low-calorie, better-for-you sparkling drinks at home, the company says.

Additionally, the company launched Fizz Concierge, a CO2 carbonator-exchange pilot program. The pick-up service launched in select regions in the Northeast and offers a delivery option that makes the sustainable recycling and reusing of carbonator cylinders easier for consumers, the company says.

Most recently, the company announced the launch of a new sparkling water maker, the SodaStream SPIRIT, updates to its SodaStream MIX beverage maker as well as a new variety of sparkling water flavor mixes. Coconut, a tropical addition to the waters line, comes in two variations, Pure Coconut and Coconut Pineapple, which are both made with real coconut water, while Natural Energy offers all-natural energy derived from guarana and green coffee extract and comes in Cranberry and Green Apple flavors.

In September 2015, Waterbury, Vt.-based Keurig Green Mountain Inc. launched the Keurig KOLD, which offers consumers freshly made cold sparkling and still beverages at home with the push of a button, the company says. Keurig KOLD encourages discovery and choice as well as offering exclusive beverage brands from categories, including craft and -fountain-style sodas, zero- and low-calorie flavored seltzers and waters, sports hydration drinks, iced teas and cocktail mixers. Additionally, the machine offers products from Atlanta-based The Coca-Cola Co. and Dr Pepper Snapple Group, Plano, Texas.

“Keurig has redefined the way consumers enjoy coffee and tea in their homes and offices, and today, with the launch of Keurig KOLD, we’re embarking on a new journey that will change the way consumers enjoy cold beverages at home,” said Brian Kelly, president and chief executive officer of Keurig, in a statement at the time of the launch.

In February, the Keurig KOLD drink-maker was named a 2016 Award Finalist by the Edison Awards, which recognizes innovation, creativity and ingenuity in the global economy, the company says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!