Home » consumer trends

Articles Tagged with ''consumer trends''

‘Sober curious’ movement brings opportunity for brands

Read More

Beverage R&D

Natural glam drives color solutions in beverages

Functional beverage trends, international influence driving color concepts

October 25, 2022

Category Focus

Dairy milk, alternatives market impacted by inflation

Changing prices and trends influence consumer choice

October 24, 2022

Ingredient Spotlight

Protein shows its all-inclusive appeal for beverage solutions

Ingredient’s usage increases as consumers take proactive approach to health

October 21, 2022

Beverage Beat

Consumer interest in non-alcohol peaks in January

Celebrities, international brands look to capitalize on growing alcohol-free interests

October 14, 2022

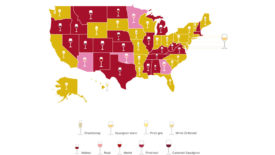

U.S. wine consumption on the rise, according to Wisevoter analyses

White wine bests red wine, rosé wine overall

September 15, 2022

Experts point to AI for the future of new product development

Consumer-centric approach allows brands to create successful, efficient products

August 31, 2022

Beverage Beat

IRI names 2021 New Product Pacesetters

Beverages account for 6 of Top 10 in food, beverage category

June 17, 2022

Up Close With

Athletic Brewing taps into consumers’ desires with alcohol-free brews

Mindful drinking trends, craft beer resurgence propels Athletic Brewing’s growth

May 18, 2022

Channel Strategies

Technology helps beverage brands implement digital merchandising solutions

QR codes help expand direct-to-consumer opportunities

May 2, 2022

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing