Nestlé USA takes multi-pronged approach to new product development

Beverage manufacturers addresses protein, cold-brew coffee trends

During his lifetime, Apple Co-founder Steve Jobs had a bevy of statements that have been used to inspire entrepreneurs across the globe. One that is commonly referenced is when he stated, “I want to put a ding in the universe.” In the beverage industry, innovators are leaving their mark by creating a more convenient universe through new product development.

For Rosslyn, Va.-based Nestlé USA, innovation comes in many forms to serve the needs and wants of today’s consumers.

“At Nestlé, we like to say that we are a 150-year old start-up because we have our fingers on the pulse of the ever-changing trends and consumer preferences and will continue to innovate to meet those preferences,” says Daniel Jhung, president of the Beverage Division for Nestlé USA. “We are taking a multi-pronged approach by strengthening our base brands and driving their relevancy, while also embarking on new ventures that seed future growth. Between our start-up culture and the resources within Nestlé, we are confident that we can continue to be a leader in the food and beverage space.”

Part of that leadership has been to identify the emerging trends that have progressed beyond that stage but now are part of the broader consumer landscape.

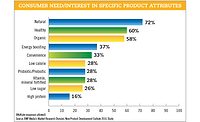

“Over the past few years, we’ve seen the plant-based category skyrocket from food to beverages, and we know this is not just a trend, but a consumer preference that is here to stay,” Jhung details. “Additionally, convenience is a macro trend that’s influencing innovation, which is a large reason why the ready-to-drink (RTD) market is growing and is where we are investing time and resources. Finally, the functional food trend has also started to seep into beverages.”

As Jhung notes, Nestlé USA is addressing these proliferating markets through organic new product development as well as through strategically planned partnerships.

“Winning in today’s competitive market requires a hybrid growth model, which means embarking on new ventures to seed future growth, but also driving value from your base business,” he explains. “My team is working hard to reinvigorate our classic brands to make them more relevant for future generations. For instance, we have introduced plant-based creamers through our natural bliss brand and are introducing fun flavor experiences that tap into ‘90s nostalgia like Funfetti and Cinnamon Toast Crunch via Coffee mate.”

The company also launched its “internal start-ups,” where innovators are able to quickly bring their beverage concept into the new product development process, including designs, prototypes and in-market testing.

“This model allows us to launch new innovations and brands to meet the evolving needs of our consumers in record time — what once took years, now can take just months,” Jhung says.

Nestlé USA also has recognized the entrepreneurs who identified the white spaces in the beverage market early on and were able to capture a dedicated audience. Teaming up with these innovators, as well as established beverage brands, has helped the company in delivering the demanded products of today.

“Through strategic transactions, we are investing to create more value for the business and consumers,” Jhung says. “In 2017, Nestlé made strategic transactions with Blue Bottle Coffee and Chameleon Cold Brew to embrace new, growing opportunities in the super- premium coffee categories. In 2018, Nestlé obtained perpetual rights to market Starbucks Consumer Packaged Goods and Foodservice products globally, outside of the company’s coffee shops.”

Nestlé USA’s dedication to developing these innovative products has paid off, as evidenced by the food and beverage giant’s sales data.

“Nestlé is a leader in the creamer category, driving significant growth for a category that has made positive and stable gains since 2013, and is forecasted to continue growing through 2023, when the cream and creamer market is projected to top $7.8 billion,” Jhung says. “In 2019, our creamer portfolio had a growth rate in the high mid-single digits.”

Helping contribute to that growth was its launch of Starbucks Creamers. Less than a year from inception to shelf, Starbucks Creamers are the fourth product platform developed since the companies formed a global coffee alliance in August 2018, the company says.

“Last August, we launched Starbucks Creamers into the premium segment of the creamer category, which is the fastest growing segment driven by millennials who are increasingly choosing premium coffee solutions,” Jhung says. “We were excited to see that consumers are very excited about these new Starbucks Creamers that offer a new way to enjoy Starbucks flavors they know and love from the comforts of home.”

Available in three flavors — Caramel, White Chocolate and Cinnamon Dolce — the lineup was inspired by customer-favorites Caramel Macchiato, White Chocolate Mocha and Cinnamon Dolce Latte handcrafted beverages that are served at the more than 31,000 Starbucks cafés, the company says.

The company also has positioned itself to be a leader in the growing RTD coffee segment, particularly the cold-brew coffee sub-segment.

“RTD coffee is another very exciting category, growing close to 10 percent in the last few years, with six times [the] growth within the cold-brew segment, which already accounts for more than 11 percent of the total category,” Jhung explains. “Chameleon was one of the pioneers for this segment within the natural channel, and is looking to continue its leadership by expanding its footprint over the next few years.”

Starting with the consumers

Whether it is from its legacy brands or the newly created ones, Nestlé USA actively is developing products that address all consumer need states — including indulgence.

Last fall, Nestlé USA unveiled SNICKERS Flavored Chocolate Milk and TWIX Flavored Chocolate Milk as its latest flavored milk offerings.

“It always starts with the consumer — we make sure to understand what flavor experiences would improve their coffee moment at home,” says Leo Aizperu, general manager of RTD Beverages at Nestlé USA. “We take inspiration from everywhere — from what they are enjoying at their local coffee shop to what excites them in other food and beverage categories. At the end of the day, we want to provide the best taste and flavor experience to our consumers.”

Available in convenience stores nationwide as well as various retailers including Walmart, Meijer and Hy-Vee, SNICKERS Flavored Chocolate Milk and TWIX Flavored Chocolate Milk already are a hit with consumers. “We are excited to see that consumers are loving these products,” Aizperu says.

As with any product development, Aizperu explains that Nestlé takes a balanced approach to serving the various needs of consumers.

“We are firm believers in giving consumers options and believe our RTD milk portfolio has something for every need state,” he explains. “While [the] SNICKERS and TWIX milks may be chosen for a deserving treat, there’s NESQUIK Protein Plus, which offers 23 grams of protein or our newest GoodNes Chocolate Oat Milk that offers 6 grams of plant-based protein per one cup from a blend of oat plus pea protein and 40 percent less sugar than regular chocolate almond milk.”

Aizperu explains that GoodNes was developed to give consumers health-focused solutions.

“Over the past few years, we’ve seen the plant-based category skyrocket and we know this is not just a trend, but a consumer preference that is here for the long run,” he says. “We recently launched GoodNes by Nesquik Chocolate Oat Milk. When creating GoodNes, the brand was inspired by recent trends of consumers wanting more protein and less sugar in their diets.”

However, GoodNes is not the only protein solution developed by Nestlé USA. When it comes to innovation, the company isn’t just listening to consumers but also to those on the inside.

“Jacked Rabbit is the first product to hit shelves under Nestlé USA’s new employee crowdsourcing platform, Open Channel,” Aizperu says. “On this platform, employees submit ideas, which are voted on by other employees and refined by an expert panel. Winning ideas secure funding and resources to bring the product to shelf.

“The innovator behind Jacked Rabbit is financial analyst Mark Suslik,” he continues. “As an avid weightlifter, Suslik needed something to sustain him through a workout that also delivered on taste. He had tried every protein drink on the market and found most protein drinks to be chalky, flavorless etc.”

Available in more than 1,100 con-venience stores in Florida, Jacked Rabbit is a 38-gram protein shake that contains only 1 gram of sugar.

“Jacked Rabbit is reimagining the protein drink category by offering consumers functional benefits such as protein and less calories, all while delivering strongly on taste,” Aizperu explains.

Yet, when it comes to protein drinks, Nestlé USA also is looking at its tried-and-true products.

“For decades, NESTLÉ Nesquik has offered irresistibly delicious drinks that complement the nutritional power of milk,” Aizperu explains. “In 1948, Nestlé’s ‘Quik’ chocolate powder hit store shelves, giving moms a fast and easy way to create a delicious glass of chocolate milk. From there, the brand continued to innovate and expand its appeal to people of all ages, from the launch of the strawberry flavor in the 1950s to the ready-to-drink bottles and syrups in the 1980s.

“We know that consumers today are looking for versatile and seamless solutions to make their lives more convenient and efficient and this holds true when it comes to food and beverages,” he continues. “Many consumers are looking for added functionality, which is why we developed Nesquik Protein Power, which gives consumers the fuel the need to power through their day.”

Available at convenience stores nationwide as well as at various retailers like Food Lion, Meijer and Kroger, Nesquik Protein Power contains 23 grams of protein in a 14-ounce bottle.

Yet, protein content is not the only way that Nestlé USA is trying to help consumers meet their health-and-wellness goals. Pulling inspiration from its Outshine snack brand — known for its frozen fruit bars, simply yogurt bars, fruit and cream bars, and half-dipped bars — the company recently developed Outshine Coconut Waters.

“These products were developed based off the insight that consumers are looking for refreshing beverages that taste great and have low sugar,” Aizperu says. “These delicious and refreshing coconut waters are made with real fruit, have zero grams of added sugar, offer natural electrolytes and are a good source of potassium.”

Available in Strawberry Watermelon, Tropical Fruits and Blueberry Lemon, the coconut waters are made with real fruit and contain non-GMO ingredients.

“These beverages stand out from other coconut waters because they are the only coconut water enhanced with real fruit,” Aizperu explains. “The real fruit makes it taste great while still delivering the benefit of natural electrolytes. This light and refreshing taste is unique compared to the rest of the market.”

‘Cold’ reception

New product development for Nestlé USA has not been reserved for heritage brands and markets. Helping to further the company’s commitment to serving the needs of consumers, Chameleon Cold Brew Coffee shows how far this start-up’s innovation has grown.

“In 2017, Nestlé made the strategic transaction of Chameleon Cold Brew to embrace new opportunities in the super-premium category,” Aizperu explains. “Chameleon Cold Brew is USDA organic, expertly crafted and deeply committed to providing an exceptional coffee experience rooted in transparent, sustainable practices. The brand has a variety of offerings in terms of format, taste and price points from multi-serve concentrates and ready-to-enjoy coffees to cold brew coffee pods and ambient latte cans.”

Last year, Chameleon Cold Brew unveiled two new offerings: Chameleon Cold-Brew with Oat Milk and its line of organic Oat Milk Lattes, Whole Milk Lattes and Cold Brew Coffees in 8-ounce cans.

“With its introduction at Whole Foods Market, Chameleon was the first cold brew coffee company to launch an organic oat milk and cold brew product on the national level,” Aizperu says. “Following the release of the Original Oat Milk blend at Whole Foods Market, Chameleon introduced both the Original and a Dark Chocolate blend at Target stores nationwide.

“Oat milk is an ideal plant-based dairy alternative for coffee due to its creamy mouthfeel and blendability, as well as its smaller environmental footprint in relation to nut-based milks — a reflection of Chameleon’s commitment to producing their coffee through sustainable methods,” he continues.

Meanwhile, the Cold Brew Lattes are available in Dark Chocolate Oat Milk Latte, Maple Oat Milk Latte, Black Cold Brew, Churro Cold Brew, Original Whole Milk Latte and Cinnamon Dolce Whole Milk Latte. “Each batch is crafted with ethically sourced coffee beans and organic ingredients, and is meticulously tested by Chief Product Office and Q grader Matt Swenson to ensure a superior cold-brew experience,” Aizperu says.

However, innovation is not the only way that Chameleon Cold Brew is proving to be a leader in the cold-brew coffee market.

“[T]he brand’s commitment to sustainability sets it apart from its competitors,” Aizperu explains. “In 2018, Chameleon Cold Brew debuted its sustainability platform with a mission to cultivate long-term economic, environmental and social sustainability throughout the coffee supply chain. By establishing impactful, relationship-driven projects in Peru, Myanmar, Guatemala and Colombia, Chameleon forges lasting relationships and invests in the coffee communities to empower farmers and producers with the skills to create better, more responsible coffee.”

Sustainability is an important part of the Nestlé USA ethos, Jhung notes. “In collaboration with our partners and stakeholders, we are working toward our ambition to strive for zero net emissions across our value chain by 2050,” he explains. “Additionally, we are investing $2 billion to develop the market for food-grade recycled plastic as part of our ambition to reduce our use of virgin plastic, and to make 100 percent of our packaging reusable or recyclable by 2025.”

With its focus on innovation in terms of formulation and packaging, Nestlé USA continues to bring leadership to the food and beverage markets.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!