Secondary packaging offers brand visibility, convenience

Flexible packaging formats grow in importance

There’s an old adage that says not to judge a book by its cover. Yet, when it comes to beverage brands looking to stand out on store shelves, beverage-makers want consumers to do just that. Brand owners are using secondary packaging to enhance brand visibility while reducing environmental impact, experts say.

Sean Riley, senior director of media and industry communications at The Association for Packaging and Processing Technologies (PMMI), Reston, Va., notes that the recent burst of innovation in secondary packaging for the beverage industry is driven by a confluence of factors, including sustainability and brand recognition.

Among the factors, the surge in start-up beverage companies is driving demand for secondary packaging to encourage sales. “Over 2,000 food and beverage start-ups entered the market in 2016, greatly expanding categories like craft beer, kombucha and cold-brew coffee drinks,” he explains. “In recent years, secondary packaging suppliers have developed solutions particularly geared toward craft breweries and other start-up beverage companies that meet entrepreneurial budgets and deliver wow-factor graphics.

“One example is Georgia Pacific, which, in alliance with PAX Corrugated, developed a digital pre-printed corrugated packaging capability that results in high-quality graphics, low minimum-order quantities and variable images,” he continues. “Customers can even log onto its website at customcolorbox.com to design and order their packaging.”

Follow the trends

Among the key trends impacting secondary packaging is a move toward aluminum cans, the growth of variety packs and the use of fully enclosed cartons to support the growth of cans, notes David Hayslette, director of business development for craft beverages at Norcross, Ga.-based Westrock.

“Cans are more affordable than glass,” he says. “Historically, many beverages in cans (such as a six-pack) used plastic rings or clips to hold them together, which made it challenging for consumers to interact with the product. Consumers are looking for specific information and it was difficult for them to maneuver [cans] held together by the rings/clips. Fully enclosed cartons eliminate that frustration while providing a larger space for communicating a product’s attributes.”

Indianapolis-based Sun King Brewing Co.’s Owner and Co-Founder Clay Robinson adds: “The full-carton wrap is really starting to take hold with mid-sized breweries. Initially, we were using clip tops/rings for our cans, but we’ve switched to using the wrap a little over a year ago, and it works great for us and our customers.”

Beer variety packs also are growing in the market. “Consumers like the idea of choice and don’t want to be limited,” Hayslette says. “… In the craft beer space, many breweries provide a 12-pack of beer that includes four different varieties. This provides the consumer with the freedom to move across different styles of beer, while still promoting brand loyalty.”

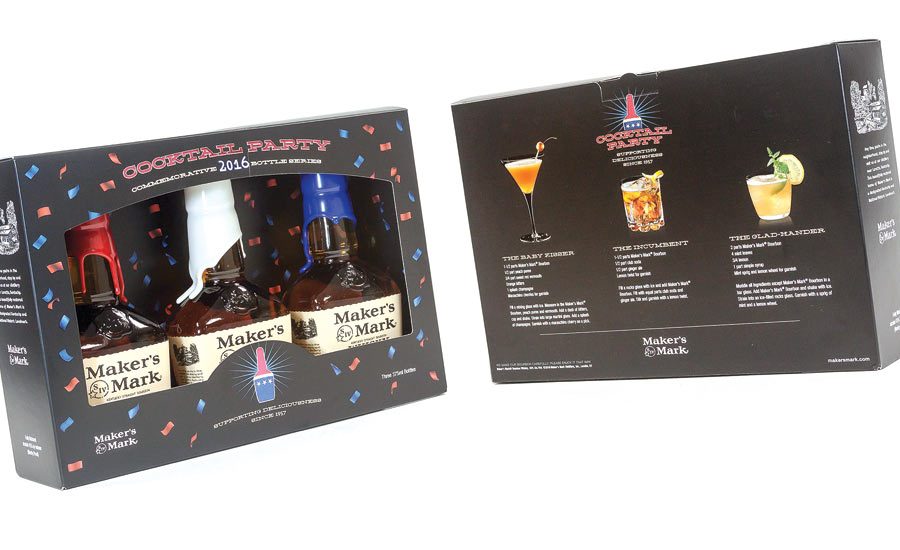

When it comes to highlighting the bottle and any gifts inside of a secondary package, Jessica Warwick, global account director for Supremia International, Plainsboro, N.J., highlights the shift toward removing window film from folding cartons and using custom, die-cut apertures.

“This gives the carton an overall more premium look and feel and allows the consumer to better see what’s inside,” Warwick explains. “We also see a big shift in being very thoughtful in choosing the right combination of substrates, inks and coatings to make a brand’s artwork come to life. This has allowed brands to stand out on shelf and really connect with the consumer.

“Vat-dyed board has started to dominate the market because of the ultra-matte finish, so you will continue to see this look,” she continues. “You will also start to see a bigger shift toward using tactile coatings and scented coatings to enhance the buyer experience by appealing to sight, smell and touch all at the same time.”

Eye appeal, buy appeal

Charles Pavia, director of marketing at Ontario, Calif.-based Proactive Packaging & Display, echoes similar sentiments. “At the shelf, ‘eye appeal equals buy appeal’ and ‘unseen equals unsold,’” he says. “The package design makes it easy to identify the brand and product on the shelf.”

Fueled by design and rising costs in the corrugated market, more and more beverage packaging has moved into Kraft brown board, Pavia says. “Kraft proves a cost savings over No. 3 White, No. 1 White and Kemilite (coated SBS sheet),” he says. “The ability to print it consistently and evenly is more complex due to the porous nature of the material.”

He notes that the company offers several solutions, including eight-color direct-print flexographic on corrugated and a variety of other substrates, and litho label on corrugated.

Shrink-wrap packaging continues to dominate secondary packaging due to its functionality, ease of use and sustainability, says Pamela Wools, director of technical marketing for Chicago-based Coveris.

“Shrink wrap is convenient for consumers in handling the packaging as well as provides minimal packaging to dispose of,” she says. “As well, shrink wrap does not become weak or damp in coolers and provides appropriate support to products in ambient or cold applications.

“The ability for shrink wrap to engage and capture the attention of the consumer is endless. … Printing innovations such as HD Flexo, extended color gamut (ECG) and matte/gloss in tandem, combined with the use of unique ink technologies such as thermochromic, greatly expand the possibility for shelf differentiation,” she continues. “Coveris offers a wide range of plain and printed shrink-wrap packaging. Our Duratite and Duralite films are formulated for a variety of needs, and we use state-of-the-art printing technology to ensure maximum shelf appeal.”

Another benefit of shrink wrap is reduced freight expenses, Wools adds.

When designing secondary packaging for beverages, consumer preferences regarding traits such as sustainability and convenience should be the No. 1 priority, PMMI’s Riley says. “Brands must also consider regulatory requirements, pricing and material sourcing requirements,” he says. “The plastic, paper and paperboard segment accounts for 70 percent of the rigid packaging market by material type. And as the global market begins to adopt flexible packaging formats for beverages, paperboard offers protection for multi-packs of drink pouches.

“Consumers’ increasingly active lifestyles affect their purchasing decisions, illustrated by the 54 percent growth in the number of food and drink beverages with on-the-go claims in the past year,” he continues, citing Chicago-based Mintel’s 2017 key trends report. “Some companies go beyond convenience to implement secondary packaging with other uses. For example, Heineken recently launched the CoolerPack, an 18-pack cardboard configuration that actually allows consumers to pour the ice straight into their beer package.”

How the product will be transported, its size, the message being communicated and the right caliber of materials are important aspects of the packaging for a beverage-maker to consider, Supremia’s Warwick says.

“For example, what types of inserts you should use in the box, how you should pack it, what designs and finishes to use and how to merchandise it in store,” she says. “We also see a combination of materials working well for many brands to gain the ‘best of both worlds’ in terms of design, elegance and strength.

“You see this in cases where you have a paperboard secondary carton and a fluted, printed insert. The paperboard provides the canvas for any printing, finishing and coating treatments needed, whereas the fluted insert provides the strength and rigidity required for heavier bottles and inner contents,” she continues. “An example of this would be the Knob Creek 375-ml co-pack or the Maker’s Mark red, white and blue pack.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!