2017 State of the Beverage Industry: Premium, RTD teas drive segment growth

Bagged teas remain stagnant

A natural health halo has been benefiting the tea category as consumers look for back-to-nature, better-for-you and functional beverage options. Although the overall tea market has remained relatively stagnant, category growth largely is a result of the performance of the ready-to-drink (RTD) tea segment, managing director of research at New York-based Beverage Marketing Corporation (BMC) Gary Hemphill noted in Beverage Industry’s June issue.

“The overall tea market has been essentially flat, but growth is coming from the RTD category,” he says. “The RTD tea category is experiencing mid-single digit growth driven by the category’s healthy halo, innovation and strong performance in the super-premium segment.”

Chicago-based Mintel also notes this trend in its August 2016 report titled “Tea: Spotlight on Bagged/Looseleaf Tea.”

“Canned/bottled RTD (ready-to-drink) teas and the smaller refrigerated tea segment experienced healthy growth in estimated 2016, which helped to offset losses from bagged/loose-leaf teas,” it states.

In the June issue of Beverage Industry, Chrystalleni Stivaros, industry research analyst at IBISWorld, Los Angeles, noted that the convenience and portability of RTD teas are drivers for the segment. “RTD beverages cater to the on-the-go lifestyles of modern consumers and are often found in locations where most impulse purchases are made (e.g., convenience stores and vending machines),” she said.

Premium teas are driving growth for both RTD and loose-leaf/bagged teas. “Premium teas, packaging and preparation methods have piqued consumers’ interest in the tea space,” Mintel’s report states.

When it comes to premium RTD teas, real-brewed tea is gaining, notes Chicago-based Euromonitor International’s February 2017 “RTD Tea in the US” report. “One of the most-developed premium RTD tea trends is that of real-brewed tea, whereby producers create RTD tea from brewing tea with tea leaves as opposed to the more conventional use of tea extracts or concentrates,” it states.

Loose-leaf teas are growing due to their premium perception, according to Euromonitor’s report. “As the interest in hot tea has flourished in the U.S., and as consumers grow more sophisticated in their consumption, loose-leaf tea has made strong gains,” it states.

Health and wellness has played a significant role in the demand for tea products. According to Mintel’s report, the health-and-wellness benefits of tea play a role in a consumer’s decision-making. “Health-and-wellness benefits are influential to consumers when selecting a tea beverage,” it states. “Nearly all consumers believe in the general health-and-wellness benefits of tea. When it comes to more specific benefits like longevity or therapeutic benefits of those health-and-wellness claims, there is a following by at least a third of brewed-tea consumers.”

Natural and organic traits also bolster the better-for-you perception of teas, according to the Mintel report. “[C]onsumers tend to perceive natural and organic products as healthier and [as] better for you than those laden with artificial ingredients,” it states. “Approximately one in five consumers find natural and organic claims important to their brewed tea selection.”

In line with health-and-wellness trends, functionality and innovation are thought to be key factors in the tea/RTD tea segment going forward. Although the RTD tea segment has experienced a deceleration as of late, the mainstay beverage will continue to entice consumers as innovation continues. “Tea will remain a staple beverage alongside coffee and other functional beverages,” IBISWorld’s Stivaros said in Beverage Industry’s June issue. “The initial skyrocketing gains seen by the RTD segment when it was introduced will slow; however, continuous innovation will push revenue up.” BI

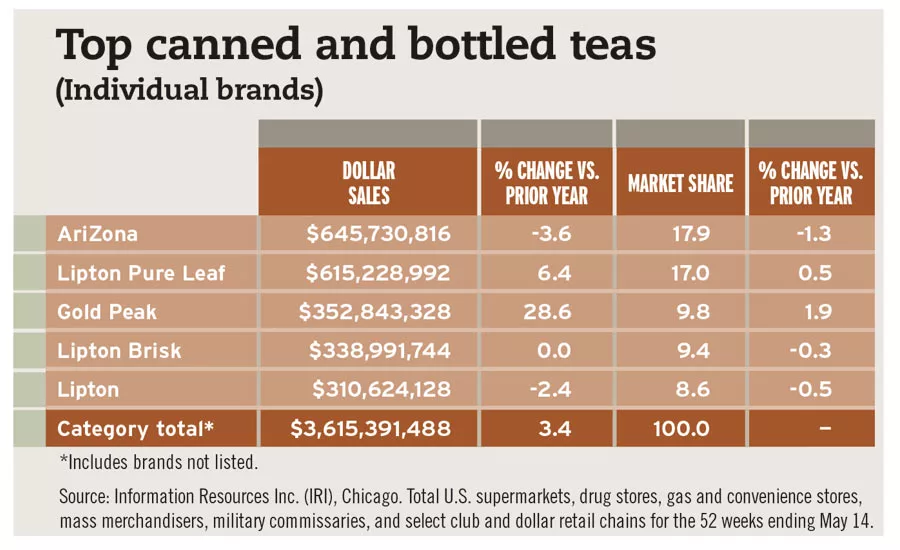

Top canned and bottled teas

(Individual brands)

| AriZona | $645,730,816 | -3.6 | 17.9 | -1.3 |

| Lipton Pure Leaf | $615,228,992 | 6.4 | 17.0 | 0.5 |

| Gold Peak | $352,843,328 | 28.6 | 9.8 | 1.9 |

| Lipton Brisk | $338,991,744 | 0.0 | 9.4 | -0.3 |

| Lipton | $310,624,128 | -2.4 | 8.6 | -0.5 |

| Category Total* | $3,615,391,488 | 3.4 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

Top refrigerated teas

(Individual brands)

| Private label | $249,098,176 | 5.3 | 20.3 | -0.4 |

| Gold Peak | $232,000,576 | 5.5 | 18.9 | -0.3 |

| Red Diamond | $143,073,200 | 2.3 | 11.7 | -0.5 |

| Milos | $110,677,504 | 10.8 | 9.0 | 0.3 |

| Turkey Hill | $95,151,968 | 4.6 | 7.8 | -0.2 |

| Category Total* | $1,225,738,880 | 7.1 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

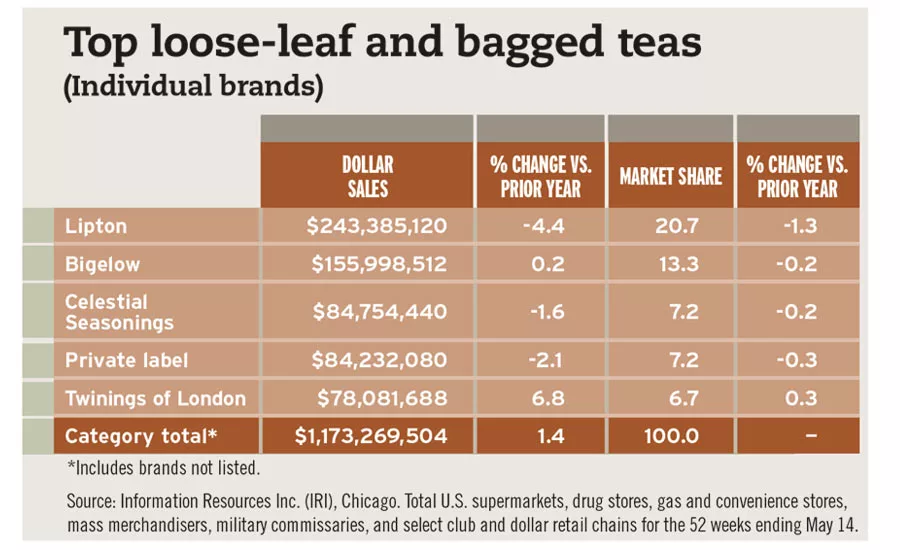

Top loose-leaf and bagged teas

(Individual brands)

| Lipton | $243,385,120 | -4.4 | 20.7 | -1.3 |

| Bigelow | $155,998,512 | 0.2 | 13.3 | -0.2 |

| Celestial Seasonings | $84,754,440 | -1.6 | 7.2 | -0.2 |

| Private label | $84,232,080 | -2.1 | 7.2 | -0.3 |

| Twinings of London | $78,081,688 | 6.8 | 6.7 | 0.3 |

| Category Total* | $1,173,269,504 | 1.4 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!