2016 State of the Industry: Wine, spirits markets benefit from specialty releases

Whiskey, red blends gaining market shares

Whether it’s wine or spirits, consumers are turning to specialty products for their alcohol beverages. These alcohol markets also are being impacted by key demographics, such as millennials and women, research notes.

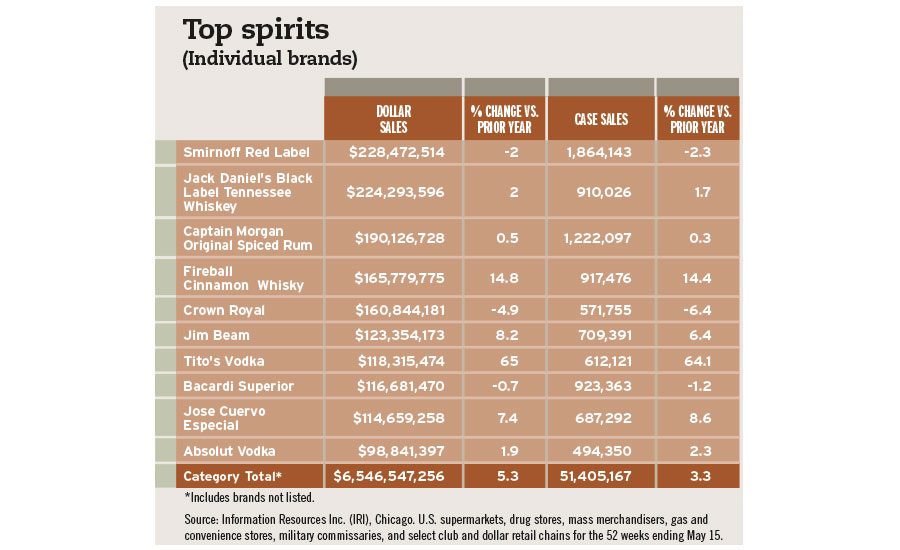

According to the Distilled Spirits Council, Washington, D.C., the category experienced another year of steady growth in 2015, with supplier sales up 4.1 percent, volume up 2.3 percent and estimated retail sales of nearly $72 billion.

Additionally, it reports strong growth for every whiskey segment for the second straight year, with revenues up 8 percent. Tequila experienced sales growth of 9.4 percent, and cognac was up 16.2 percent, it adds.

In Beverage Industry’s April issue, Vijay Sarathi, lead analyst of food and beverage for London-based Technavio, noted various drivers for the U.S. spirits market. “The major drivers in the market include the shift in consumer preferences for spirits, increase in preference for spirits among women, increase in health consciousness and the association of spirits as a lifestyle product,” Sarathi said.

According to the market research firm’s “Alcoholic Beverage Market in the US 2016-2020” report, the spirits segment, which it categorizes as vodka, gin, rum, whiskey, brandy and tequila, is growing faster than the rest of alcohol beverages. “Consumer preference for spirits, especially among women, has been the most significant contributing factor,” the report states. “New product launches, [the] rise in [the] import of distilled spirits and the association of spirits with lifestyle are some of the other reasons for the growth of the spirits segment.”

Premium and value spirits sub-segments also are experiencing strong growth, most notably across vodka, whiskey and tequila, Sarathi said. However, gin, lower-end vodka and other specialty spirits have been relatively flat and might see declines going forward, Sarathi added.

The ready-to-drink (RTD) cocktail segment is faring well in the United States, with a growth rate greater than 9 percent, Sarathi added.

Chicago-based Mintel estimates that the white spirits segment will experience a small growth in volume sales, at just above 1 percent growth through 2020, with vodka remaining the segment leader.

However, as Mintel notes in its December 2015 “Dark Spirits – US” report, white spirits have higher consumption rates than dark spirits.

In the U.S. wine market, market research firms note that wine blends are gaining share. In a Nov. 6, 2015, consumer insights post titled “It’s all in the mix: Red blends are stirring up U.S. wine sales,” New York-based Nielsen reported that red wine blends accounted for more than 13 percent of the category’s table wine market share during the 52 weeks ending Sept. 12, 2015. Divided among the total $13 billion in sales for that time period, the market research firm equated red wine blends to $1.7 billion, up from the $1.15 billion (11 percent market share) in 2011.

The strength of blends in United States also can be found in the segment's new product releases. According to Nielsen, more than 40 percent of releases in 2014 were blends, and more than three-quarters of those were red blends.

Some of the driving factors analysts have listed for spirits also have contributed to growth for the wine category. In its December 2015 report titled “Wineries in the US,” Santa Los Angeles-based IBISWorld highlights the millennial generation, which has shown an affinity for domestic wines.

“Over the past five years, consumer drinking preferences have moved away from standard light beers, and many consumers have switched to wine for its perceived health benefits and diverse flavor profiles,” the report states. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!