2016 State of the Industry: Juice smoothies, cold-pressed juices trending in category

Juice market seeks to combat concerns about sugar content

Although concerns about the sugar content within products in the juice and juice drink category have challenged the market, juice smoothies and their association as a healthy beverage option have helped the category mitigate contraction. Flavor innovations, including a growth of vegetable juices, also are favorably trending within the category, according to market research analysts.

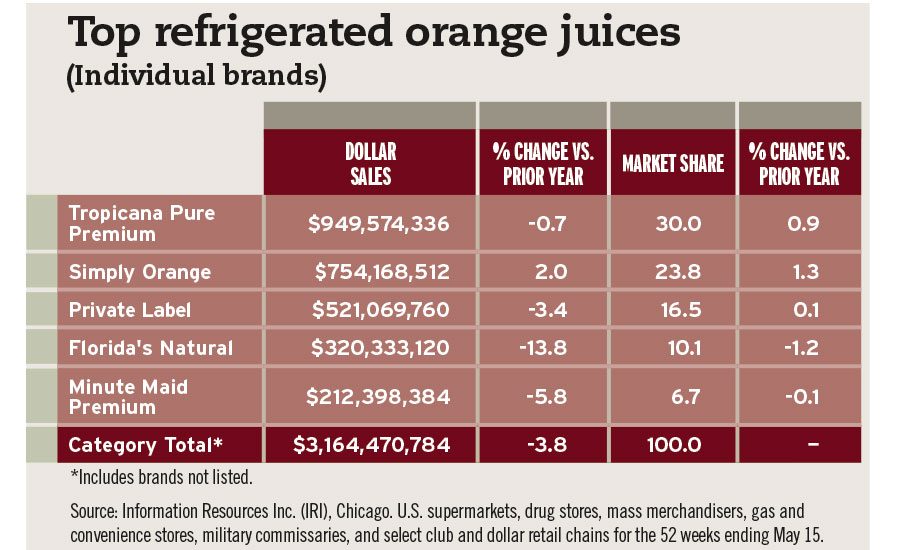

As a whole, the juice and juice drinks category contracted 1.8 per-cent in total volume in 2014, with not-from-concentrate 100 percent juice being the only segment not to experience a volume decline, noted Eric Penicka, research analyst for Chicago-based Euromonitor International, in Beverage Industry’s January issue.

“The core reason the juice industry is in decline is the pervasive consumer aversion to sugars and artificial ingredients,” he said. “… Drinks [that] are not 100 percent juice, as these are more likely to have added sugar, [are] pushing away parents who may have once perceived the products as favorable to carbonates.”

In 2010, fruit juice and fruit drinks were consumed by 61.4 percent of consumers; however, that number has declined to 53.1 percent in 2015, explained Lauren Masotti, client manager of U.S. Beverages for New York-based Kantar Worldpanel US, in Beverage Industry’s January issue.

While the percentage of consumers who drink juice and juice drinks has been declining, juice smoothie consumers have nearly doubled since 2010, Kantar’s Masotti noted. “A consumer is 42 percent more likely to agree with the attitude of ‘to make a healthier choice’ when choosing a juice smoothie as opposed to fruit juice,” she said.

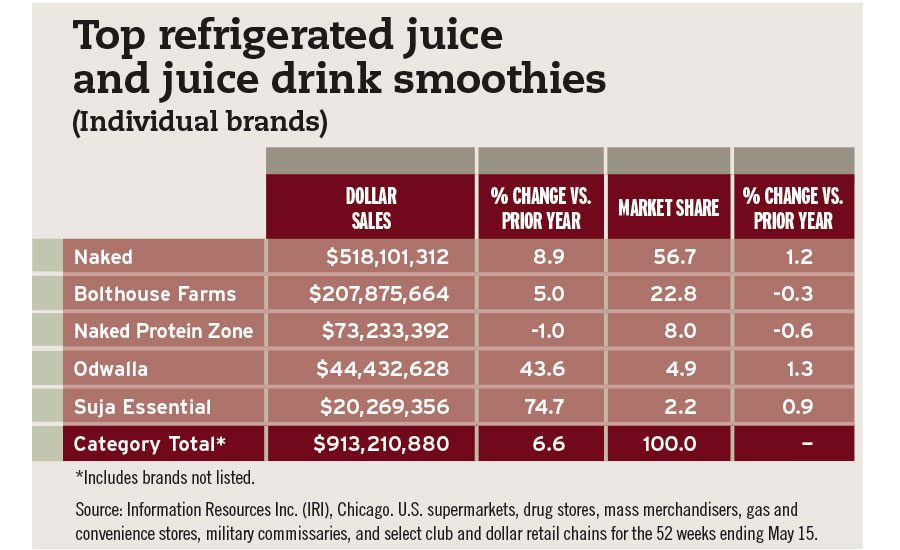

No. 1 in the segment is Purchase, N.Y.-based PepsiCo Inc.’s Naked Juice. The brand recently added Sea Greens to its core portfolio, which blends sea greens with celery, strawberry and orange, the company says.

Another top performer for the juice smoothies segment is Bolthouse Farms, a subsidiary of Camden, N.J.-based Campbell Soup Co., which launched several 2016 spring innovations under the Bolthouse Farms and 1915 Bolthouse Farms brand names, the company says.

Although the juice and juice drinks market has been challenged, Los Angeles-based IBIS World’s April 2015 report titled “Juice Production in the US” notes that the vegetable juice segment accounts for 6.1 percent of juice production in the United States and has experienced increases in the past five years.

“Green juices with green vegetables have become increasingly common, using items such as spinach, kale, parsley, romaine, cucumber and celery, often combined with a fruit to sweeten the taste,” the report states.

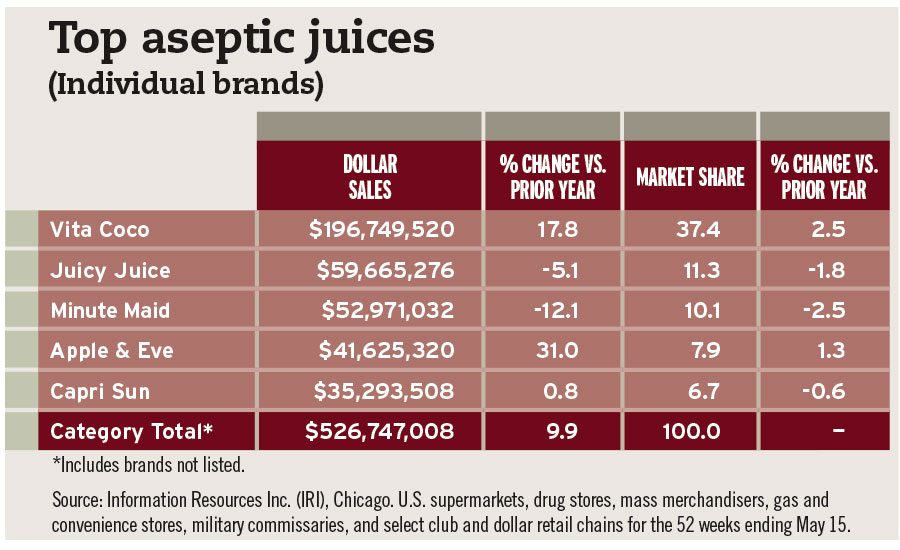

Euromonitor’s Penicka added that less traditional juice segments, such as coconut, smoothies, pomegranate, etc., have benefited from consumers expanding their juice horizons.

“[T]here has been an explosion of natural and healthy positioned juices, which have seen tremendous growth in the past few years,” he said. “Juices like pomegranate juice, coconut water and juice/vegetable smoothies have benefited from consumer demand for natural.”

High-pressure pasteurized and cold-pressure processing also gained traction within the juice and juice drink segment as more products using these forms of processing have emerged in the market, analysts note.

Euromonitor’s Penicka said, “HPP juices are almost exclusively 100 percent not-from-concentrate juices, and therefore are not laden with added sugars or artificial ingredients, providing consumers with a preferred, premium product.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!