2016 Beer Report: Convenience attribute of FMBs resonates with consumers

Analysts question long-term sustainability of beer segment

In Beverage Industry’s January New Product Development outlook survey, 66 percent of respondents named convenience as a “high-need/interest” product attribute. In fact, only 4 percent listed it as “low need/interest.” Among the numerous beverage categories, the flavored malt beverage (FMB) segment, also known as progressive adult beverages (PABs), is resonating with consumers based on this product attribute.

“Convenience is the big trend driving successful FMBs,” says Eric Penicka, research analyst for Chicago-based Euromonitor International. “The category stands at odds with the premiumization trends we’re seeing in every other alcohol group, but the demand remains for FMBs where full bars/mixologists don’t exist.”

Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen, reports that the above-premium beer segment was up 4.2 percent in dollar volume.

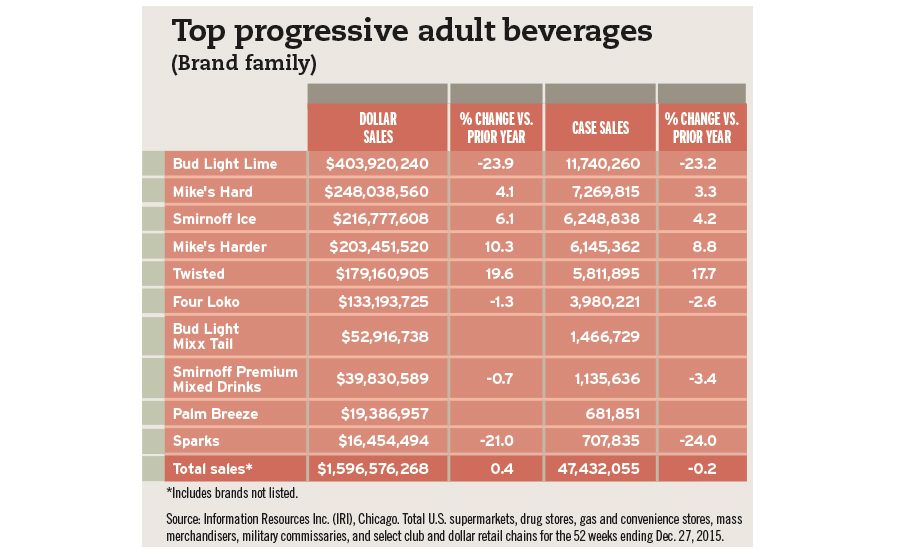

However, Chicago-based Information Resources Inc. (IRI) reports that PAB dollar sales were relatively flat for the 52 weeks ending Dec. 27, 2015, totaling more than $1.5 billion in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and drug retail chains. Case sales also were relatively flat during that time period.

Segment leader Lime-A-Rita’s family, a brand of St. Louis-based Anheuser-Busch, a division of Anheuser-Busch InBev, was among the brands that declined for 2015. Although the FMB brand accounts for a quarter of the market share, its sales were down nearly 24 percent in IRI-measured channels.

Yet, the FMB brand entered 2016 with a bang as it rolled out the most significant marketing and advertising campaign since its 2012 launch, it says. In line with National Margarita Day — Feb. 22 — Lime-A-Rita launched Fiesta Ready, a campaign that focuses on celebrating “Margarita moments” — the special moments when a Margarita can change everyday occasions in unexpected ways, the company says.

The first of five commercials for the campaign debuted during the Grammy’s, but the brand also will unveil billboards, train wraps, elevator TV, heated bus shelters and innovative media partnerships throughout the year.

In addition to Fiesta Ready, the brand launched Lime-A-Rita Splash, a new take on the traditional Margarita, the company says.

“When it launched in 2012, Lime-A-Rita shook up the flavored malt beverage category, and has proven to be one of the most successful innovations within the beer industry to date,” said Mallika Monteiro, senior director of Lime-A-Rita, in a statement. “With the introduction of Splash, Lime-A-Rita continues to reinvent the category as a convenient cocktail solution that helps our consumers extend the weekend and treat themselves to a Margarita whenever they choose.”

Available in six-packs of 12-ounce bottles, Splash is a 4 percent alcohol-by-volume FMB. Lime-A-Rita Splash and Straw-Ber-Rita Splash are the inaugural flavors that launched this month.

However, Lime-A-Rita Splash is not the only addition for the brand. Other flavor launches include Water-Melon-Rita, a new seasonal summer flavor, plus a variety of additional flavors that will be unveiled throughout the year catered to select markets, the company says.

Within the FMB segment, brand owners continue to release products that appeal to younger consumers.

Last summer, Chicago-based Mike’s Hard Lemonade Co. launched Palm Breeze Ruby Red Citrus and Palm Breeze Pineapple Mandarin Orange in the United States. The two light alcohol spritzers were designed to appeal to millennial women needing to turn “girl time” get-togethers into a “vacay every day,” the company says. The 4.5 percent alcohol-by-volume Palm Breeze Spritzes are available in six-packs of 12-ounce cans.

Another trend that could impact the performance of FMBs will be the future of hard sodas.

“Depending on the style and brand, we can expect to see hard root beers and soda interacting heavily with crafts, FMBs and ciders,” Nielsen’s Kosmal says.

Rochester, N.Y.-based North American Breweries’ Seagram’s brand recently blurred this line with the launch of a new line of hard sodas. Available in Cherry Cola, Grape Soda, Lemon n’ Lime and Orange Cream, the new hard soda line seeks to target young adults looking to discover a variety of new flavor experiences, the company says.

Although FMBs are hitting on some of the broader consumer trends, not all analysts think they have the long-term sustainability needed to thrive.

“Manufacturers are pushing them for their ability to offset losses in the domestic lager space, but ultimately they run against all the major consumer trends we’re seeing the U.S.,” Euromonitor’s Penicka says. “I don’t expect them to have a long-term impact on the U.S. alcoholic drinks market.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!