2016 Beer Report: Craft beer large gains could start to slow

National footprint of larger players linked to decrease of future growth

Based on 2015 sales, Small Town Brewery’s portfolio of hard sodas cracked IRI’s Top 10 list of craft brand families, landing at No. 6. (Image courtesy of Small Town Brewery)

Whether it’s the tortoise and the hare, David versus Goliath or small-market sports teams versus large-market franchises, many Americans have a soft spot for the “little” guy. The same could be said for the U.S. beer market. According to Chicago-based Mintel’s January 2016 report “Beer – US,” craft beer’s market share of U.S. volume sales nearly doubled from 2010 to 2015 — 5.2 percent vs. 10.2 percent, respectively.

When it comes to the driving factors that account for this growth, analysts note that the success of the craft beer market cannot be pinpointed to just one trend.

“A perfect storm of factors can be pinpointed as the cause, including a consumer base interested in trying new products, a savvier group of shoppers invested in where their products come from and how they are made, and a market that responded with a stepped-up version of a familiar product that ticks all the boxes,” says Beth Bloom, food and drink analyst for Mintel. “Craft beer lays claims to being local, small batch and handmade with an identifiable heritage.”

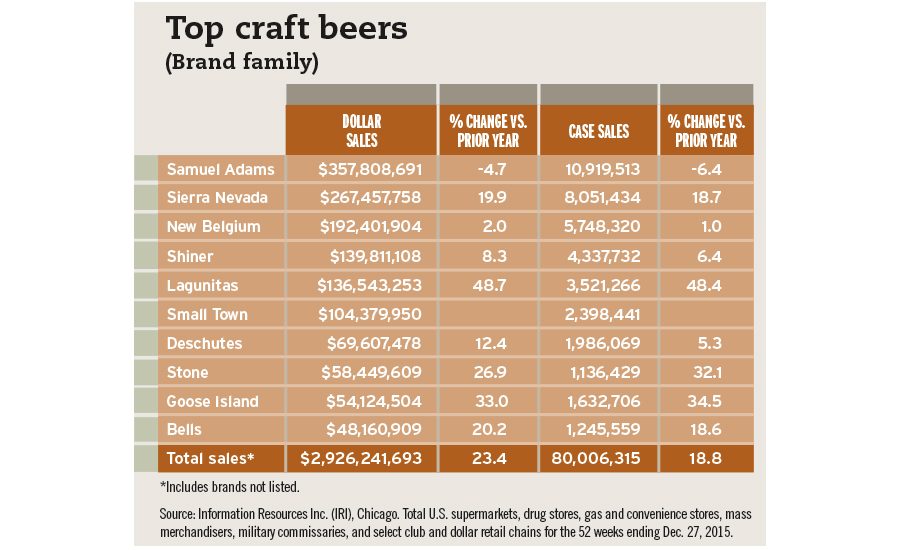

Those trends and their ability to resonate with consumers remain evident in its year-over-year financial performance. According to Chicago-based Information Resources Inc. (IRI), craft beer sales were up 23.4 percent in dollar sales totaling $2.9 billion for the 52 weeks ending Dec. 27, 2015, in U.S. supermarkets, drug stores, mass merchandisers, military commissaries, and select club and dollar retail chains. Case sales also were up double-digits — 18.8 percent — during that time period.

This outperforms 2014 numbers in which dollar sales were up 20.5 percent and case sales were up 17 percent for the 52 weeks ending Dec. 28, 2014, in U.S. multi-outlets, IRI data notes.

Despite craft beer’s strong performance, analysts anticipate that the segment’s growth will begin to slow. “That slowness of growth is driven in large part by large craft brands that have achieved a national footprint,” says Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen. “While the long tail of craft is growing at stronger rates, it still is a small base, presenting just over 10 percent of craft dollar.”

However, the success of craft beer can vary based on your definition of the segment, Kosmal adds. “If you consider the hard root beers launched in 2015 to be considered craft, then they definitely helped to contribute to craft growth,” she says.

According to IRI, Wauconda, Ill.-based Small Town Brewery, which manufactures Not Your Father’s Root Beer and Not Your Father’s Ginger Ale, experienced sales of $104.3 million and was the No. 6 best-selling brand family for the 52 weeks ending Dec. 27, 2015, in U.S. multi-outlets. In comparison, the company did not crack IRI’s Top 20 of craft brand families in 2014.

Part of Small Town’s overnight success could be attributed to its distribution system. In March 2015, Los Angeles-based Pabst Brewing Co. began selling the Not Your Father’s Root Beer portfolio. A few months later, the companies entered into an exclusive distribution agreement.

Betting on craft

Given the success of the U.S. craft beer market, more major brewers are recognizing the positive effect this segment is having on the category. Brewers are developing their own “craft-style” products to compete as well as investing in these operations or even buying them outright.

“In 2015, major brewers also increased their pursuit of craft beer brands, and they now have a much higher stake in this sector,” says Jonny Forsyth, global drinks analyst for Mintel. “[Anheuser-Busch InBev (AB InBev)] has led the way in this strategy ever since its pioneering purchase of Chicago’s Goose Island back in 2011. However, in 2015 [AB InBev] accelerated its pursuit of craft brands, acquiring Los Angeles’ Golden Road Brewing, Arizona’s Four Peaks Brewing, Colorado’s Breckenridge Brewery, Seattle’s Elysian Brewing and Camden Brewery in London, U.K.

“This means that [AB InBev] now owns eight craft breweries as well as having a nearly 32 percent stake in publicly traded Craft Brew Alliance (BREW), the parent company of Widmer Brothers Brewing, Redhook Ale Brewery and Kona Brewing Co.,” he continues.

Another investment that garnered a lot attention in 2015 was Amsterdam, The Netherlands-based Heineken N.V.’s 50 percent stake in Petaluma, Calif.-based Lagunitas Brewing Co., the No. 5 top-performing craft beer brand family, according to IRI data.

“The most noteworthy of 2015 was Heineken’s 50 percent stake in Lagunitas; however, the impact so far is unclear,” says Eric Penicka, research analyst for Chicago-based Euromonitor International. “Big beer’s fairly hands-off approach after acquiring brewers seems to be working quite well, but it remains a delicate line to tread.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!