2016 Beer Report: Mexican, Belgian beers post strong gains for import segment

Diversity, affordability among trends contributing to growth

In the 1988 film “Coming to America,” Prince Akeem hopes to escape his arranged marriage to a woman he has never met. With his best friend Semmi by his side, Akeem flees to New York City to find an intelligent, independent woman. As Akeem searches for his true love, he and Semmi encounter some comical adventures as they navigate the foreign land, eventually finding Akeem’s future bride. Luckily for consumers, trying beer from outside the United States does not include as many obstacles, but still can result in a happy ending.

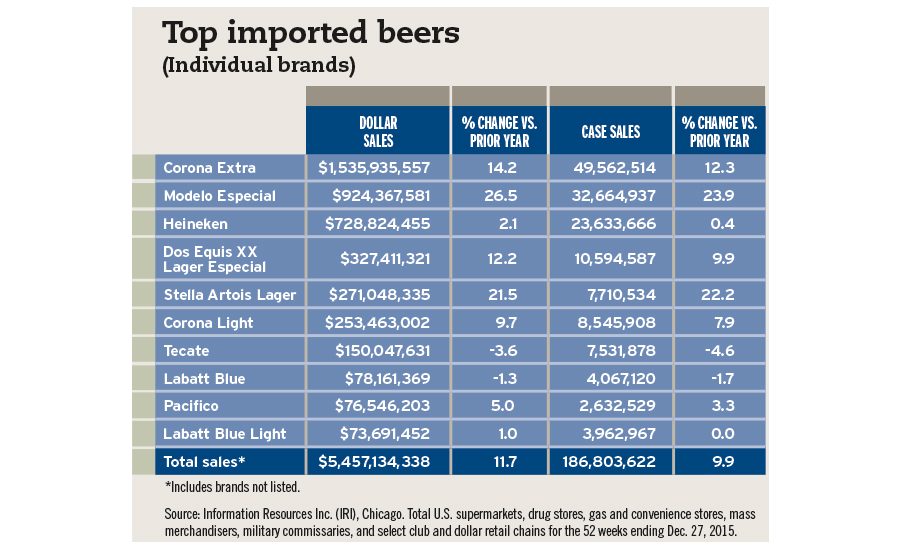

It seems as though U.S. consumers are having their own love affair with import beer. According to Chicago-based Information Resources Inc. (IRI), dollar sales for import beer were $5.4 billion — an 11.7 percent increase — for the 52 weeks ending Dec. 27, 2015, in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains. Case sale gains were just shy of 10 percent during that time period.

Import beer also continues to gain a larger portion of the market. In Chicago-based Mintel’s January 2016 report “Beer – US,” U.S. volume sales of import beers was 15.5 percent in 2015, up from 13 percent in 2010.

Noting that 2015 was another good year for the segment, Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen, says the growth can be attributed to two main drivers: Mexican and Belgian brands.

“Four of the Top 10 growth brands for the [beer] category in 2015 were Mexican and Belgium import brands,” she says. “Even more impressive is that two of the Top 3 growth brands in the total beer category were Mexican import brands.”

Kosmal adds that in 2015, both Mexican and Belgian imports posted double-digit increases from a dollar share perspective. “Mexican imports grew 15 percent in dollar volume, and Belgium imports were up 14 percent,” she says.

The Mexican sub-segment experienced steady growth across the board. “For Mexican imports, it isn’t one brand that is driving growth, but rather nearly every brand within Mexican imports is growing either through distribution expansion, new marketing efforts and shifting consumer interest,” Kosmal explains.

Eric Penicka, research analyst for Chicago-based Euromonitor International echoes similar sentiments. “Mexican imports have done astonishingly well in recent years,” he says. “This is three sided: the brand identity association with beaches, relaxation, vacationing, etc., has really hit a note with consumers; the growing Hispanic demographic in the U.S. assists sales; and relative to other imports and craft beer, they’re quite affordable.”

Based on IRI data, Mexican beers Corona Extra and Modelo Especial, both owned by Victor, N.Y.-based Constellation Brands, are No. 1 and No. 2, respectively, in the import segment for the 52 weeks ending Dec. 27, 2015.

Outside of the Top 10, Tecate Light, a brand of White Plains, N.Y.-based Heineken USA, also posted strong gains. The Mexican beer saw sales increase more than 48 percent, while case sales were up just shy of 45 percent during that timeframe.

On March 1, the brand announced its new campaign: Champions Night. The fully integrated, 360-degree campaign is designed to inspire excitement and passion for Tecate’s deep-rooted partnership with boxing through national TV advertising, digital partnerships, on- and off-premise activation, and a sweepstakes.

The Champions Night campaign will utilize video advertising on various platforms, including Hulu, ESPN, TubeMogul and Roku, in conjunction with national, English and Spanish TV advertisements, reaching 50 percent more Hispanic, millennial men versus 2015, it explains. To keep fans engaged throughout the season, Tecate created an interactive content hub that enables fans to obtain exclusive content and engaging boxing footage on their desktops, tablets or mobile devices.

Diversity among U.S. consumers and the growth of import beer also was highlighted by Mintel Food and Drink Analyst Beth Bloom. “The impact of an increasingly diverse consumer base on the growth of imported beer can be seen,” she says. “Sales of imported beer grew by 7 percent in the 52 weeks ending Oct. 4, 2015, while a larger percentage of consumers report drinking imported beer than domestic beer in 2015. Domestic beer producers may choose to expand ranges to feature international styles in order to engage the widest range of drinkers.”

According to Mintel’s “Beer – US” report, among a base of 878 Internet users aged 22 and older, 44 percent indicated that they had consumed import beer in the past three months compared with 40 percent listing domestic beer.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!