Supermarkets growth to be stunted as competition grows

Channel looks to eCommerce, differentiation to compete

According to IRI’s Susan Viamari, the ready-to-drink tea and coffee category is the fastest growing beverage category within grocery with a dollar sales increase of 11.1 percent bringing it to $1.5 billion year-to-date for the 52 weeks ending Nov. 1, 2015. (Images courtesy of Starbucks Coffee Co. and Honest Tea)

Even though consumers always will have to shop for groceries, the channels in which they visit continually change, and supermarkets now are feeling the pressures of these changes. According to a November 2015 report from Chicago-based Mintel titled “Grocery Retailing – US,” the supermarket channel might appear to be performing well, with 37 percent of consumers reporting this channel as their primary for grocery needs; however, the market research firm also notes that this is an 8 percent decrease from February 2014, when the report was last published.

“In particular, millennials under index on shopping at supermarkets compared to all respondents,” it states. “Second, it’s important to note ‘where else’ people are shopping — Wal-Mart remains a top choice due to its low prices, but other channels such as warehouse clubs, drug stores and dollar stores are all gaining ground as consumers journey through the grocery landscape rather than pointedly go to one place repeatedly for all of their needs.

“Supermarkets are actually losing market share to these other [multi-outlet] (MULO) channels that now comprise the majority of MULO sales,” it continues. “This share gap is only expected to widen through 2020.”

Chicago-based Information Resources Inc.’s (IRI) Vice President of Thought Leadership Susan Viamari also notes the pressure supermarkets are under from their competition. “The supermarket channel is facing significant pressure from competitors inside and outside the [consumer packaged goods] (CPG) marketplace (i.e. including restaurants — particularly quick-service) for share of the stomach,” she says. “Additionally, consumers are still quite frugal and looking to save money by shopping around to find the best deals and by buying needs over wants.”

Additionally, Jon Hauptman, a partner at Willard Bishop, Barrington, Ill., notes differentiation as one factor supermarkets should emphasize as they compete within the grocery landscape. “The primary challenge supermarkets are facing is how to differentiate and drive growth in a retail environment with so many formats (traditional and non-traditional) selling the same or similar products,” Hauptman notes. “Supermarkets are overcoming this challenge by veering away from trying to be ‘all things to all people,’ and instead, focusing on successfully operating either ‘efficiently-driven/low-cost stores’ or ‘marketing-driven’ stores that offer something special that shoppers value, e.g. service, quality, freshness, etc.”

He stresses that supermarkets will need to differentiate to survive. “Supermarkets that can effectively differentiate from competitors will be winners in the future, while those that are not able to differentiate will find themselves in an increasingly steep decline,” Hauptman adds.

According to Viamari, grocery dollar sales increased 2.2 percent year-to-date for the 52 weeks ending Nov. 1, 2015. However, she notes that the non-alcohol beverage category increased 3.4 percent in dollar sales for the same time period, while the alcohol beverage category increased 3.2 percent in dollar sales. She adds that beverages (non-alcohol) account for 11 percent of total grocery dollar sales, while alcohol beverages account for 7 percent.

Sipping on sales

Although this channel has its share of challenges, beverages continue to perform well within it. “Based on performance at leading chains, it appears that shelf-stable beverages have outperformed total supermarket performance by a factor of two,” Willard-Bishop’s Hauptman says. “I.e., beverages are growing at double the rate of the supermarket as a whole.”

According to Hauptman, shelf-stable beverages make up approximately 2 to 3 percent of SKUs in a supermarket. “… [It’s] among the largest segments in the store,” he says. “Other categories with similarly high SKU counts include candy and cosmetics.”

He says that bottled water and functional beverages, like enhanced waters, seem to be driving disproportionate growth within the channel and highlights the better-for-you shift in consumer preference as one aspect contributing to this growth.

IRI’s Viamari adds that the ready-to-drink tea and coffee category is the fastest growing beverage category within grocery with a dollar sales increase of 11.1 percent bringing it to $1.5 billion year-to-date for the 52 weeks ending Nov. 1, 2015. “This category is benefiting from a healthier-for-you appeal and a flurry of innovation activity,” she says.

Also experiencing strong growth within this channel are energy drinks, with a 9.1 percent increase in dollar sales, and sports drinks, with a 6.2 percent increase in dollar sales year-to-date for the 52 weeks ending Nov. 1, 2015, according to Viamari. She notes that these increases also are capitalizing on the benefits around health and wellness and on-the-go energy and satiation.

Despite the increasing sales in health-and-wellness beverages, the carbonated soft drink (CSD) category is the largest within the grocery channel, but experienced flat dollar and unit sales during the past year, Viamari notes. “The category sells more than 70 percent of its volume with merchandising support, but merchandising activity has slipped slightly during each of the past several years,” she says.

Hauptman also notes this strategy as well as the struggles beverage companies have faced securing this space, resulting in the decreased activity. “… [S]upermarket operators are taking greater control of their merchandising space and are reducing the number of endcaps they will ‘contract out’ to beverage companies, and they’re putting stipulations into what can be merchandised and at what prices/savings in those contracts they still permit,” he explains.

Viamari illustrates the impact of merchandising support on non-alcohol beverage sales within grocery and highlights that 38 percent of non-alcohol beverage volume is sold with merchandising support. “Some categories, including carbonated beverages and sports drinks, move even more of their volume with merchandising support,” she says. “Among alcoholic beverages, an average of 30 percent of volume is sold with merchandising support within the grocery channel.”

To boost beverage sales, Viamari notes a few actions that grocers can take. “Grocers can enhance visibility and engagement with beverage consumers by continuing to merchandise — but leverage merchandising programs that are tightly tied to the needs and wants of shoppers,” she says. “Unique needs and wants occur all the way down to the market level, so a one-size-fits-all strategy is not appropriate.

“Getting assortment is also critical — again, differences are seen all the way down to the market level,” she continues. “Beverage marketers must have an appropriate mix of immediate-consumption solutions as well as stock-up/larger packages for household replenishment needs. Additionally, assortment needs to reflect key trends within the marketplace (again, trends will vary across different banners and markets).”

Shopping on a site

One opportunity that has poised itself for many retailers within the past several years, eCommerce, has yet to make a significant impact on grocery sales, experts say. However, they also note growing consumer interest in and acceptance of shopping online for groceries.

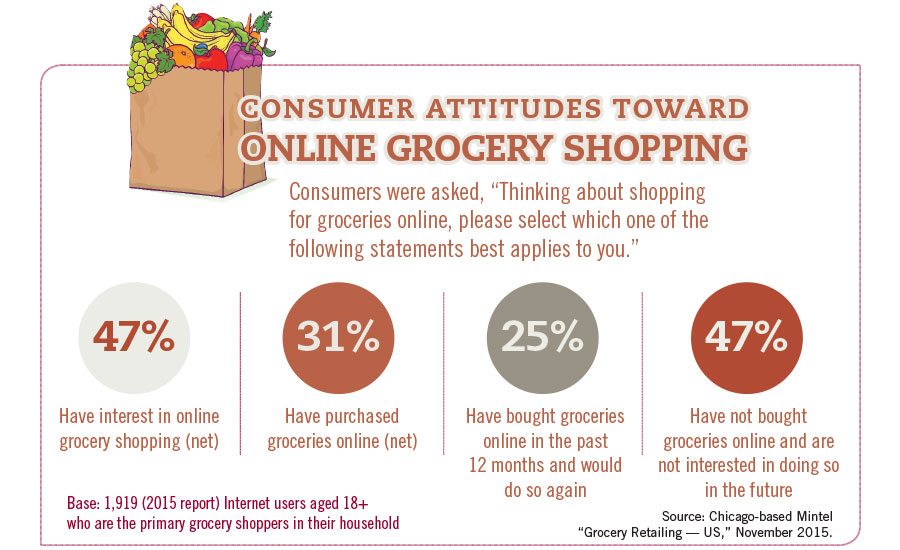

“Grocery eCommerce has been slow to take off and lags behind other retail segments,” Mintel’s report states. “Consumer concerns about freshness and paying delivery fees have impeded trial and adoption rates, and will continue to be challenges. An encouraging sign is the number of shoppers who express interest in experimenting with online shopping and pick-up services; all figures are up substantially since the last issuance of this report.”

Willard Bishop’s Hauptman notes that grocers are not ignoring eCommerce as an opportunity for the future. “While eCommerce represents a small percentage of the retail food industry today, it is top-of-mind among all supermarket operators,” he says. “While some are testing eCommerce offerings, most everyone else is planning their own eCommerce offerings for the near future. Soon eCommerce will be the ‘table-stakes’ in the supermarket industry.

“The key questions retailers are trying to answer are how should I execute an eCommerce offering (store pick, dark store pick, warehouse pick),” he continues. “How should I deliver the product (store pickup, depot pickup, home delivery, etc.); and how should I price my eCommerce offering, e.g. same as in-store prices or with a premium for the service?”

A June 2015 report from Chicago-based Euromonitor International titled “Grocery Retailers in the US,” also highlights the growing interest in grocery eCommerce. “Internet retailing of grocery products continues to expand, but it has yet to significantly impact the grocery market and makes up a small fragment of sales,” the report states. “Interest in the area has continued to grow, however, and a mix of supermarket operators, Internet retailers and tech start-ups are attempting to significantly expand the market.”

The report notes Peapod LLC, Skokie, Ill., as the industry leader reaching $500 million in sales for 2014, and the company’s expectation to reach $1.5 billion in total sales by 2016. “The company plans to accomplish this by growing its online delivery service and its order online, pick-up-in-store components, and expects these to represent U.S. $1 billion and U.S. $500 million in sales, respectively,” it states.

It also notes the influence of Seattle-based Amazon on grocery eCommerce. “… Amazon remains the company many expect to bring online grocery shopping mainstream,” the report states. “The cost of using AmazonFresh remains high and consumers need to shell out U.S. $299 a year for a membership, which allows them to place online orders.”

But eCommerce isn’t the only option for supermarkets to help boost sales and consumer loyalty. Mintel’s report notes that digital tools also are an option. “Mintel Trend Life Hacking discusses how consumers have too much choice and not enough time, and are eager to try tools and take shortcuts that will aid in their decision making,” it states. “Besides offering eCommerce options as well as the ability for consumers to order online and pick up their groceries in store, retailers should be immersing themselves in digital technology and testing. Consumers are already using their mobile devices during the shopping process, and expect to be able to communicate with and/or interact with a brand in digitally enabled ways such as this.”

Mintel’s report also adds that brand value is built through rational and emotional triggers. “Rational drivers such as price, convenience and product selection will lead consumers to a specific store,” it says. “Once in the store, the retailer has an opportunity to leverage the emotional aspect of grocery shopping to ensure that customers have an optimal experience, especially leveraging the sensorial effect that food and beverages can bring about.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!