2015 Craft Beer Report: Beer segment moves from a trend to a cultural movement

Craft beer expected to continue growing, but at a slower pace

Nielsen’s Danelle Kosmal notes that the top reason consumers purchase craft beer is experimenting with styles, flavors and varieties. She says that nearly all flavor profiles, including pumpkin, have experienced growth within the past year. (Image courtesy of Saint Arnold Brewing Co.)

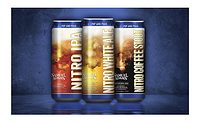

Cans represent 12 percent of craft volume, but contributed 28 percent of growth in the past year, according to Nielsen’s Danelle Kosmal. (Image courtesy of Second Self Beer Co.)

In its report, IBISWorld highlights that MillerCoors and Anheuser-Busch InBev have aggressively promoted their respective Blue Moon and Shock Top, craft-style, wheat beer brands, to compete with craft beer. (Images courtesy of MillerCoors and Anheuser-Busch InBev)

Three cities in Maryland recently named October “Shore Craft Beer and Hard Cider Month.” One of them in Ocean City, also hosted a Shore Craft Beer Festival, which took place Oct. 24 and featured local brewers, according to the Caroline Times Record. This isn’t the only city celebrating craft beer; many cities across the country host festivals to honor the trendy beer segment. Several TV shows feature craft brewers, and craft brands also are making national headlines. Major events like the Boulder, Colo.-based Brewers Association’s (BA) Great American Beer Festival also highlight the segment. This year, the 34th annual event took place Sept. 24-26 in Denver and featured 90,000 square feet dedicated to its tasting hall to accommodate 60,000 attendees with the opportunity to sample more than 3,500 beers from 750 breweries.

It appears that this segment of the beer market, once only a niche market, has grown to become a cultural phenomenon in the United States. For some consumers, craft beer is not just a trend, but part of their daily lives. “Craft is more than a beer segment; it is a cultural movement in American society,” said Jeff Nowicki, chief strategy officer at Bump Williams Consulting (BWC), Stratford, Conn., in Beverage Industry’s March 2015 Beer Report.

Matthew McLaughlin, stakeholder and chair of the craft brewery and craft distillery industry focus team at Jackson, Miss.-based Baker Donelson says: “With craft there is an inherent authenticity. … [T]here’s a connectedness craft beer consumers have with a product.”

Growing affections

During the past decade, this segment of the beer market experienced vast growth. Although the growth spurt has ended, experts say growth will continue. “The past five years have transformed the craft beer production industry into one of the fastest growing and most popular alcoholic beverage segments in the United States,” according to “Craft Beer Production in the U.S.,” an August report from Los Angeles-based IBISWorld.

“The introduction of new products, the ease with which brewers are joining the industry and the growing popularity of craft beer among consumers has demonstrated that the industry is undergoing the growth stage of its life cycle,” the report notes.

Chicago-based Mintel’s Food and Drink Analyst Beth Bloom notes this challenge as well. “The segment is challenged by a relatively small consumer base,” she says. “While craft beer consumption is on the rise, an expanding array of alcoholic beverage options make it difficult for the segment to catch hold in a strong amount.”

However, she notes that as the availability and interest in craft beer continues to grow, the natural result should be a growth in consumption.

Dan Wandel, principal of beverage alcohol client insights at Chicago-based Information Resources Inc. (IRI), says the craft segment will continue to appeal to consumers on multiple fronts because of its variety of offerings. He notes that seasonal products, varying styles and flavors, high and low alcohol-by-volume (ABV) content, can and bottle packaging options, and strong selling of local and high-quality products have contributed to consumer interest in craft beer.

According to IBISWorld’s report, the segment experienced

18.8 percent annual growth from 2010 to 2015; however, the company predicts that the segment will experience a much lower annual growth rate of 5.5 percent from 2015 to 2020, reaching $6.5 billion by the end of 2020.

Danelle Kosmal, vice president of Nielsen Beverage Alcohol Practice at New York-based Nielsen, notes the change. “Craft beer continues to do well, but growth is beginning to slow,” she says.

IRI’s Wandel highlights the segment’s market share as evidence of continuing growth. “Craft continues to gain the highest share in total U.S. supermarkets compared to a year ago,” he says. “It has gained 1.1 share of total beer dollar sales in supermarkets this year according to data ending July 5, 2015. Craft is now up to a 16.5 share of total beer dollar sales in supermarkets. This compares to a 9.4 share craft had back in 2010.

“It may start to slow down from the positive 18 percent year-over-year increases it has experienced the past couple of years, but it is poised to continue to gain share within the beer category,” he continues.

In line with this, in July, the BA released mid-year data indicating that craft beer production volume increased 16 percent in the first half of the year.

According to the association, from January through the end of June, approximately 12.2 million barrels of beer were sold by craft brewers, up from 10.6 million barrels in the first half of 2014.

“Industry growth is occurring in all regions and stemming from a mix of sources including various retail settings and a variety of unique brewery business models,” said Bart Watson, chief economist for the BA, in a statement. “The continued growth of small and independent brewers illustrates that additional market opportunities and demand are prevalent, although competition in the sector is certainly growing and the need for brewers to differentiate and produce world-class, high-quality beer is more important than ever.”

Given the rate-of-purchase the craft segment has experienced, IBISWorld’s report notes that it might still be several years before the segment will reach its plateau.

Further supporting the continuing growth, data from IRI shows that the segment experienced a 21.2 percent sales increase year-to-date for $2.7 billion in the 52 weeks ending Sept. 6. Additionally, case sales also show impressive increases with more than 75 million barrels, a 17.2 percent increase year-to-date for the same time period.

Samuel Adams, a brand of Boston-based The Boston Beer Co., leads the segment with $371 million in sales, a 0.9 percent increase in dollar sales year-to-date. However, case sales were down 0.9 percent to just more than 11 million for the same time period, according to IRI data.

Other brand families, however, are seeing significant growth. For example, Petaluma, Calif.-based Lagunitas Brewing Co.’s brand family experienced a dollar sales increase of 54.8 percent year-to-date for the 52 weeks ending Sept. 6, with sales of more than $123 million in U.S. multi-outlets, according to IRI data. Moreover, Lagunitas’ case sales increased 55.2 percent to $3.1 million for the same time period.

Crafting diversity

Craft beers often present unique flavors, ingredients or brewing methods that can entice the ever flavor-curious consumer.

Nielsen’s Kosmal says that the past year saw growth across nearly all flavor profiles in the craft segment. She highlights the commonly known craft flavors like coffee, chocolate, pumpkin and lemon; vanilla, savory and spice (horchata, cinnamon, cloves) flavors; and citrus flavors, which have had several new entrants in the grapefruit space.

She adds that one of the strongest factors driving appeal and growth in the craft segment is its local roots.

“The idea of ‘local’ continues to be an important topic in craft beer,” she says. “From a Nielsen survey conducted in February 2015, we asked consumers how important ‘local’ was in their purchase decisions for beer, wine and spirits. Forty-four percent of respondents said that ‘local’ was important in their purchase decision for beer, and, as expected, that was even higher among craft beer drinkers, with over half — 52 percent — saying ‘local’ was important in their decisions to purchase beer.”

Just like the other segments of the beer market, certain beer styles dominate craft sales. “Styles are still an important part of the craft conversation,” Kosmal notes.

“The craft beer production industry brews virtually all styles of beer and regularly experiments with different ingredients to create variant styles of beer,” the IBISWorld report states. “As a result, the industry’s range of products is diverse.

“…IPA brands are the most popular type of beer among craft beer consumers,” the report continues, “representing 25.2 percent of the industry’s total beer sales.”

In fact, Nielsen tracked more than 400 new IPA craft brands launched in the past year, according to Kosmal.

According to the IBISWorld report, seasonal beers remain a staple for the craft beer segment, representing 23.7 percent of the industry’s revenue.

“Once considered to be revenue-generating promotional tools for craft brewers to expand brand recognition, experimenting with new seasonal beers and advertising the return of limited-edition seasonal brands have become significant revenue-generating activities for craft brewers,” the report states.

Traditional pale ales account for 17.3 percent of craft sales, with slightly contracted sales in the past five years because of expansion of more unconventional styles, according to the report. Amber ales represent 10.9 percent of sales, it adds.

Although pale lagers historically are the most popular style of beer in the world, the lager category accounts for just 8.6 percent of the craft segment’s revenue, the report states.

True to the craft beer segment’s roots of unique ingredients and brewing styles, it also is seeing an influx of once uncommon, regional styles as well as wheat and fruit beers. “As the industry continues to expand, many craft beer producers have attempted to separate their products through beer styles that offer roasted flavor, high-alcohol content, fruit adjuncts and wheat-based malts,” the IBISWorld report states. “Greater popularity of once uncommon regional styles such as saisons, barley wines, lambics, tipels and altbiers will represent a major source of growth for craft brewers over the next five years.”

Nielsen’s Kosmal notes that allowing consumers to easily experiment with the different varieties in a brewer’s portfolio also allows the brand to form a connection. “Craft brands are finding authentic ways to connect with the consumer and continue to offer new options and variety that millennial consumers seek out in the alcoholic beverage space,” she says. “Variety packs are helping meet those needs and are up 13 percent in the past year.”

Canning success

The boom in the craft segment means a greater fight for shelf space in the beer market as a whole. Although unique styles and flavors offer a competitive edge, it takes more than having a good product to generate retail sales.

“Industry operators compete with each other primarily on the basis of quality, taste, branding, marketing and price,” the IBISWorld report notes. “Innovative and offbeat branding, packaging and marketing help operators differentiate their beer from corporate brands. Branding and packaging, including logo design and labeling, are essential to convey the uniqueness of craft beer.”

The type of packaging also might give craft brands a new edge on the shelf. Traditionally, craft beers have been available in glass bottles, but a growing number of craft brewers are moving to aluminum cans as a packaging option. The companies say that the packaging offers a more event friendly and sustainable option for their consumers.

Additionally, Baker Donelson’s McLaughlin notes that aluminum can packaging also helps support a better tasting product. “One of the worst things beer can be exposed to is light,” he says. “Many brewers look to cans to, No. 1, remove light, and No. 2, because consumers can take cans a lot of places they can’t take bottles.”

In April, Atlanta-based Second Self Beer Co. launched two of its craft beers — Thai Wheat and Red Hop Rye — in aluminum cans made from Novelis’ evercan. The company says it added cans to give consumers portability and protection, and notes that launching the craft beer in cans brings the beers into more usage occasions while reducing the brand’s environmental footprint.

Nielsen’s Kosmal adds that 88 percent of case volume in the craft beer segment is comprised of bottles, clearly dominating the segment. However, she says that cans are quickly growing and saw a 39 percent increase in case volume in the past year.

“Cans are contributing more than their fair share of growth to the craft segment,” she says. “Cans represent 12 percent of craft volume, but contributed to 28 percent of growth in the past year.”

Big competition

As the craft beer segment grows, so does the competition within the market. “Although the success of the craft beer category has become widespread…the industry will face considerable challenges from other alcoholic beverage industries,” the IBISWorld report states. “Demand for domestic and foreign wine has increased among U.S. consumers over the past five years, and wineries in the United States represent a continual external threat for industry breweries.”

Craft also faces greater competition from some of the leading beer companies. However, experts note that many notable companies are feeling the effects of the competition more strongly. “Across the United States, on some level, craft was viewed as a fad,” McLaughlin notes. “I don’t think that they took the segment as seriously as they should have, and now they’re playing catch up.”

IRI’s Wandel echoes similar sentiments: “Lead, or flagship, brands are struggling to grow their sales as much as they have in the past due to the increased competition within the craft segment and alone due to the success of local products selling in their markets.”

Yet, many of these brands are fighting back. “Although the industry mostly consists of many small-sized players, there has been increasing consolidation and expansion activity among some of the industry’s largest brewers…In response to the increasing popularity of craft breweries, international beer manufacturing companies, MillerCoors and Anheuser-Busch InBev, have aggressively promoted their respective Blue Moon and Shock Top wheat beer competitor brands in an attempt to capture growing craft beer sales,” the IBISWorld report states.

Additionally, Baker Donelson’s McLaughlin and Mintel’s Bloom note recent acquisitions made by mass brewers to capture sales. Both note that Tenth and Blake, the craft and import division of Chicago-based MillerCoors, acquired a majority interest in San Diego-based Saint Archer Brewing Co. in an agreement that was announced in September.

Baker Donelson’s McLaughlin and Mintel’s Bloom also cite Amsterdam-based Heineken N.V.’s recent interest in Lagunitas Brewing Co. Heineken acquired a 50 percent share in the craft brewer this fall.

Lagunitas will continue to be led by Founder and Executive Chairman Tony Magee with the existing management team, and it will operate as an independent entity. The transaction is expected to be completed fourth quarter this year, the company adds.

However, these acquisitions might result in some additional challenges for craft beer brands. “As craft breweries become larger, sprout additional facilities and streamline their processes, many questions exist over how once-small brewers will continue to be classified as makers of craft beer,” the IBISWorld report notes. “Following a February 2014 meeting among directors belonging to the Brewers Association … the Board of Directors elected to essentially redefine how it classifies its brewers of craft beer, with a stated objective to capture 20 percent of all U.S. beer sales by 2020.”

With craft becoming more popular, more brands are hitting the shelves, which could provide different challenges. “[T]here is some concern that the number of craft breweries in the United States will eventually plateau, as new brewers continue to flock the industry to keep up with the remarkable yearly increases in consumer demand,” the report states. “Over the next five years, the numbers of brewing enterprises are projected to increase at an annualized 7.1 percent rate to 5,338 operators.”

Nielsen’s Kosmal adds that within the past two years, Nielsen identified approximately 3,600 new beer items hitting selves and that the majority of these product launches were from the craft segment. “With so many new styles, packages and local brands being introduced at retail, space will continue to be one of the obvious challenges for craft, and the beer category overall,” she says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!