Low-calorie, low-sugar attributes boost juice drinks segment

Mintel predicts 100 percent juices could bounce back

In Zone Brands Inc. rebranded its Tummy Tickler and Belly Washers lines as good2grow to highlight the 100 percent juices’ health attributes. (Images courtesy of In Zone Brands Inc.)

Consumers know that consuming fruits and vegetables is important, but nearly half believe they do not consume enough, according to a 2014 infographic from the Produce for Better Health Foundation (PBH), Hockessin, Del. The U.S. Department of Agriculture’s Center for Nutrition Policy and Promotion recommends that Americans consume 1 to 2 cups of fruit and 1 to 3 cups of vegetables each day, depending on age, sex and level of physical activity. Although the PBH’s survey found that primary shoppers believe they consumed more fruits and vegetables in 2014 than in 2012, roughly one in three of these consumers eat less than a cup of fruits and less than a cup of vegetables each day, it says. In addition, one in four shoppers think consuming fruits and vegetables is a chore, it reports.

Beverages tend to be a convenient vehicle for consumption of many types of fortified ingredients, experts note, but 11 percent of shoppers do not believe that 100 percent fruit juices and 100 percent vegetable juices are healthy, according to the PBH’s 2014 report “Primary Shoppers’ Attitudes and Beliefs Related to Fruit & Vegetable Consumption: 2012 vs 2014.” Although 65 percent of primary shoppers agree that 100 percent fruit juices and 100 percent vegetable juices are healthy,

this number is down from 79 percent in 2012, it reports.

U.S. sales of 100 percent juice fell 10 percent to $9.6 million in 2013, according to Chicago-based Mintel’s November 2013 report, “Juice and Juice Drinks – US.” This is likely because of the segment’s perception of being high in calories and sugar, it states.

The PBH study also found that consumers with annual incomes of less than $50,000 were more likely to rate 100 percent fruit juices and 100 percent vegetable juices as healthy, compared with consumers who make more than $50,000 annually. However, the PBH infographic reports that 100 percent juices are both an economical and nutritious form of fruit and/or vegetable consumption.

When it comes to thirst-quenching options, consumers also are choosing beverages in categories that they deem healthier than juice, Los Angeles-based IBISWorld reports in its October 2014 report “Juice Production in the US.” “In line with this trend, marketing campaigns that promote stimulants or natural ingredients have encouraged the surge away from the juice production industry’s sugary juices … toward functional and energy drinks and ready-to-drink teas,” the report states.

Flavored waters also have been a popular alternative, IBISWorld’s report notes. Some health-conscious consumers previously switched their beverage consumption to bottled water, but, during the Great Recession and ensuing economic climate, some consumers preferred not to spend money on bottled water and opted for tap water instead, it states. However, these consumers also would occasionally treat themselves with a similarly priced alternative beverage, namely flavored water, it notes.

Even carbonated soft drinks have been a competitor for the juice and juice drinks category, IBISWorld notes. “Soda is often cheaper than this industry’s beverage offerings, and carbonated soda producers often display a variety of packages for a single product, taking up more shelf space and catching the potential buyer’s eye,” it states.

To re-bolster the juice category within the beverage market and change consumer opinion, education about the nutritional benefits of 100 percent juices will be key, Mintel noted in its report.

Some brands, like Atlanta-based In Zone Brands Inc.’s good2grow brand, already have taken steps in this direction, IBISWorld notes. The company originally offered 100 percent juices for kids packaged in single-serve bottles with licensed character toppers under two different brands: Tummy Tickler and Belly Washers. However, consumer research showed that a well-educated, label-reading sub-segment of the U.S. consumer population deemed “Healthy Hoverers” was not interested in the products because they said the juices “almost looked like candy,” Carl Sweat, In Zone Brands’ chief marketing officer, told Beverage Industry in its March 2014 issue. To combat this perception, In Zone Brands rebranded the juice lines as one good2grow brand that it felt achieved a balance between fun and wellness, Sweat said in the article.

As part of the rebranding, good2grow changed its labels, website and social media channels to reflect some health aspects that were present in the original brands but were not shared as prominently, Sweat explained. “[We want to make] sure that moms understand that we are BPA-free in our bottles and our toppers, [and] we are non-GMO. … We have really taken great pains to make sure that we have addressed a lot of the information that moms really want to know about in this better-for-you space.”

In its early results, the rebranding was embraced by both new and loyal consumers alike, Sweat added. “We were gratified to find that our core users liked the new branding more than even the new users,” he said. “As we talked to them, [we found out that] it was because all along those people knew what was inside the bottle was 100 percent juice, and they felt good giving it to their kids.”

Nutrition facts

Juice drinks have been ahead of the 100 percent juice segment because of their expansion of reduced-calorie and reduced-sugar offerings, Mintel states in its report. For example, while the 100 percent juice segment’s retail sales fell 4.5 percent from 2011 to 2013, juice drinks sales grew 1.4 percent in the same time period, Mintel reports.

Honest Kids, a brand of Atlanta-based The Coca-Cola Co.’s Honest Tea subsidiary, reformulated its organic kids juice drinks in 2012 to remove the organic cane sugar and sweeten the juice drinks with additional juice content and called out the enhancement on the front of the pouches. Throughout 2013 and 2014, the brand continued to see growth, reaching more than $38.6 million in sales, a nearly 24 percent increase in the 52 weeks ending Nov. 2, 2014, in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries and select club and dollar retail chains, according to Information Resources Inc. (IRI), Chicago.

However, between November 2013 and November 2014, 109 juices with reduced sugar claims were launched in the United States, compared with 99 juice drinks and nectars with the same claim, according to Mintel’s Global New Products Database. In addition, 32 percent of consumers surveyed by Mintel reported buying more 100 percent juice in 2013 than they did in 2012. Based on this, Mintel suggests that a turnaround for the 100 percent juice segment might be in the works.

Analysts also recommend that juice brands amp up their health images by adding nutrient-dense pulp, a fresh-squeezed quality, portion control, or other premium attributes. “Single-serve options, premium juices and super-premium juices remain the bright spots of the category,” explains Howard Telford, beverages analyst at Euromonitor International, Chicago. “While overall volumes remain in decline, the smaller, premium single-serve juices have outperformed. Organic 100 percent juices demonstrated high single-digit value growth for the year.”

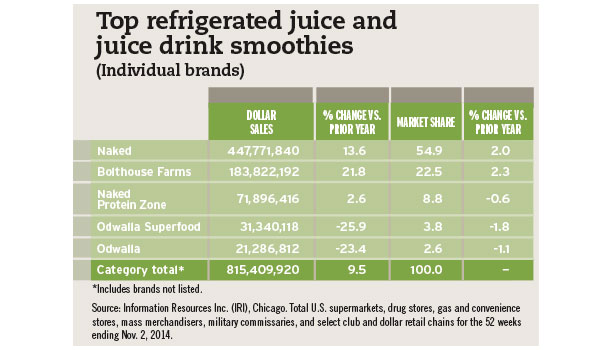

Telford points to Purchase, N.Y.-based PepsiCo Inc.’s Naked brand as an example of a premium juice driving segment growth. The brand was the top performer in the refrigerated juice and juice drink smoothies segment and marked 13.6 percent sales growth to nearly $448 million in the 52 weeks ending Nov. 2, 2014, in IRI-measured channels.

This past fall, the brand also added two new fruit varieties to its Naked juice lineup. Chia Sweet Peach and Chia Cherry Lime chia and juice smoothies feature omega-3s and also include 1-2 grams of protein as well as fiber, the company says.

Overall, smoothies remain popular for home consumption, and the segment continues to see robust sales of premium blenders, Euromonitor’s Telford says. The refrigerated juice and juice drink smoothies segment grew nearly 9.5 percent to more than $815 million in the 52 weeks ending Nov. 2, 2014, in IRI-measured channels.

Cold-pressed juices also have been a key innovation area within the premium juice segment, Telford notes. For example, within the refrigerated apple juice segment, ‘tude cold-pressed juices reported nearly 479 percent growth in the 52 weeks ending Nov. 2, 2014, in IRI-measured channels. This year, the brand of Federal Way, Wash.-based Fresh Matters LLC made its seasonal Honeycrisp apple juice a year-round option, adding to the brand’s five other apple juices and

10 apple-and-fruit-juice blends, the company says.

However, cold-pressed juices remain quite expensive for the average consumer, hindering segment growth, Euromonitor’s Telford points out. In response to this, Monrovia, Calif.-based Trader Joe’s launched a line of private-label cold-pressed juices priced at $4.99 for a 15.2-ounce bottle to help make cold-pressed juices more mainstream and affordable, he explains. By comparison, Seattle-based Vital Juice Co.’s same-named organic, cold-pressed, non-GMO juices are priced between $6.99 and $8.99 for a 16-ounce bottle.

Blended success

Beyond premium attributes, fruit juice brands also can enhance their health image by adding vegetables to the mix. Euromonitor’s Telford notes that the market research firm is seeing consumer interest in green juices with green vegetable content.

IBISWorld also reports that the fruit-and-vegetable juice segment has been showing growth over the last five years. “Green juices with green vegetables have become increasingly common, using items such as spinach, kale, parsley, romaine, cucumber and celery, often combined with a fruit to sweeten the taste,” it states in its report.

In total, vegetable juices made up 5.1 percent of the juice market in 2014, with citrus juices claiming 57 percent share and non-citrus juices making up the remaining 37.9 percent, IBISWorld reports.

Evolution Fresh, a brand of Seattle-based Starbucks Coffee Co., added three cold-pressed, high-pressure processed (HPP) green juices to its lineup in the middle of last year. Its Organic Sweet Greens and Ginger is a 100 percent organic blend of green vegetables and apple finished with a squeeze of lemon and a spicy ginger kick; Coconut Water and Greens blends coconut water with cucumber, leafy greens and a splash of pineapple; and Smooth Greens green vegetable and fruit juice blends cucumber and leafy greens with pineapple, apple and mint, the company says.

Evolution Fresh HPP fruit-and-vegetable juice blends experienced about 86 percent growth to nearly $3.3 million, and Evolution Fresh Essential Greens cold-pressed fruit-and-vegetable juice blends saw approximately 62 percent growth to about $2.9 million in the 52 weeks ending Nov. 2, 2014, in IRI-measured channels.

Flavor twist

Although healthy, premium attributes are a big part of the consumer purchase decision in the juice and juice drinks category, taste rules, Mintel reports. Seventy-seven percent of surveyed consumers aged 18 and older said they buy juice and juice drinks because they like their tastes, according to Mintel’s report. This means that promoting good-tasting products will be important if brands want to attract the widest array of consumers, it advises.

The use of tropical flavors in fruit juices also can attract consumers by offering flavor variety, IBISWorld suggests. Mango and pineapple flavors have been on the rise as consumers seek creative, healthy products, it reports. In fact, shelf-stable bottled pineapple juice experienced nearly 18 per-cent growth to just more than $34 million during the 52 weeks ending Nov. 2, 2014, in IRI-measured channels.

The Coca-Cola Co.’s subsidiary Zico Beverages LLC played into these flavor trends with the September 2014 launch of its Zico Chilled Juice Blends, which are made with premium coconut water and fruit juice. The lineup includes a Coconut Water & Pineapple Mango Juice Blend that contains naturally occurring electrolytes and up to 50 percent fewer calories than regular fruit drinks, the El Segundo, Calif.-based company says. The line also includes Coconut Water & Orange Juice Blend and Coconut Water varieties.

Beyond these flavors, other exotic flavors like dragon fruit and papaya also can help attract adventurous consumers and meet the taste preferences of the growing U.S. Hispanic population, Mintel reports.

Tried and true

Even with multiple flavor options available on the market, consumers still are sticking to some of the more traditional juices.

Within the 100 percent juice category, orange juice still dominates, according to Euromonitor. The juice flavor controlled more than 60 percent of U.S. off-premise 100 percent juice sales in 2013, it reports. This can partially be attributed to its perceived role as a common cold remedy, which made it more in demand during the intense flu season of 2013, IBISWorld reports. Apple came in a distant second with nearly 12 percent of the sales, Euromonitor reports.

Other flavors in the Top 10 include mixed fruits with 9.3 percent, “other flavors” and tomato each with 4.3 percent, grape with 3.5 percent, cranberry at nearly 3 percent, grapefruit at just more than 2 percent, prune at 1.3 percent, and lemon with 0.3 percent, Euromonitor adds.

Although niche in overall volume, coconut water continues to grow, Euromonitor’s Telford notes. The segment has nearly doubled its sales every year since 2004, IBISWorld reports.

In the future, Mintel expects the overall juice and juice drinks category to turn around as it evolves toward more healthful, calorie- and sugar-conscious options; explores flavor innovations; and meets the needs of key consumer demographics. However, future growth will depend on the category’s ability to present products as convenient and affordable alternatives to competing beverage options, it says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!