Almond milk leads growth in the dairy alternatives segment

Coconut milk shows potential

Blends of almond milk and coconut milk have become more popular, because they offer the familiarity of almond milk with a touch of coconut milk, says Euromonitor’s Virginia Lee. (Image courtesy of WhiteWave Foods)

If major coffee chains are any indication, plant-based dairy alternatives such as almond milk and coconut milk are taking their success mainstream. Although soy milk has been an option available at major coffeehouses for years, only recently did almond and coconut milk begin making an appearance. In September, Dunkin’ Brands Group Inc. added Blue Diamond Growers’ Vanilla Almond Breeze Almondmilk to the menu in select Dunkin’ Donuts stores nationwide. Starbucks Coffee Co. also began testing coconut milk at foodservice locations in recent months.

Mirroring this trend, both almond milk and coconut milk dollar sales increased double digits off-premise last year, according to Euromonitor International, Chicago. Almond milk dollar sales rose 46 percent, and coconut milk dollar sales grew 35 percent, Senior Research Analyst Virginia Lee notes. Likewise, almond milk was featured in nearly half of dairy-alternative drink launches in the United States during the 12 months ending June 30, 2014, according to Natalie Tremellen, market analyst at Innova Market Insights, the Netherlands. Globally, almond milk was used in nearly one-fifth of new dairy alternatives, up from 14 percent in 2013, she says. Worldwide dairy-alternative drink launches featuring coconut milk rose 40 percent during the timeframe, she adds.

Demand for coconut milk is on the rise, partly as a result of consumer awareness of coconut water as a sports drink substitute, according to a December 2013 report titled “Soy & Almond Milk Production in the US” from IBISWorld, Los Angeles. However, coconut milk has not reached the same level as almond milk.

“Repeat purchases are weak in this segment, partly due to the flavor, which is not as universally appealing as almond milk,” states IBISWorld’s report. “Rising costs for coconut milk producers have also been passed on to consumers to some degree, which has also reduced demand.”

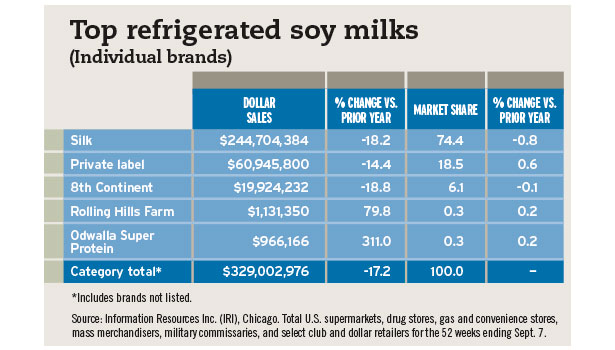

Thus, coconut milk took the fourth-largest part of the dairy alternatives segment in 2013, with 3 percent market share, according to IBISWorld. Almond milk, on the other hand, took the top spot, with a 60.5 percent share of the market last year, the report states. To put this into context, almond milk had captured only 3 percent of the market in 2008, the market research firm reports. This puts soy milk in the No. 2 spot with a 30 percent share of the market, it states. Furthermore, soy milk sales decreased 16 percent last year, Euromonitor’s Lee adds. Soy milk also appeared in fewer new dairy-alternative beverages globally during the 12 months ending June 30, according to Innova. The dairy alternative appeared in nearly three-quarters of new dairy-alternative beverages in 2011 and was featured in nearly two-thirds of new dairy-alternative launches in the most recent timeframe, it reports.

The shift away from soy milk and toward almond milk began in 2010 in response to almond milk’s perceived health benefits as well as marketing efforts from the segment’s biggest manufacturer, Denver-based WhiteWave Foods, IBISWorld notes. The segment experienced particularly explosive growth in 2010, with an increase of 350 percent, the market research firm notes. Almond milk does not contain any saturated fat and generally has fewer calories than soy milk, it adds.

In line with this trend, blends of almond milk and coconut milk have become more popular, because they offer the familiarity of almond milk with a touch of coconut milk, Euromonitor’s Lee says. WhiteWave Foods introduced Silk Almond Coconut Blend earlier this year, and Blue Diamond Growers introduced Blue Diamond Almond Breeze Almondmilk Coconutmilk in 2012.

Consumers also have shown a growing interest in protein and fiber in the dairy-based and dairy-alternative drinks segments, Euromonitor’s Lee says. Earlier this year, WhiteWave Foods launched Silk Vanilla Protein + Fiber Almondmilk that offers 5 grams of protein and 5 grams of fiber in a 240-ml serving size. In contrast, most almond milk contains 1 gram of protein and less than 1 gram of fiber, she says. Last summer, La Farge, Wis.-based Organic Valley introduced Organic Balance milk protein shakes with 16 grams of protein in a 325-ml bottle and Organic Fuel high-protein milk shakes with 26 grams of protein in a 325-ml bottle. Furthermore, Dallas-based Dean Foods extended its TruMoo brand with TruMoo Protein Plus flavored low-fat milks in September. The beverages contain 25 grams of protein in a 14-ounce bottle as well as essential nutrients such as calcium; riboflavin; phosphorus; potassium; and vitamins A, D and B12.

Other dairy alternatives also are showing potential for growth, according to IBISWorld. Rice milk is popular because it is the least allergenic dairy alternative and is a good source of B vitamins, the firm notes. However, its potential might be limited because it is a relatively poor source of calcium and is high in starch, making it unsuitable for diabetics, it adds.

However, quinoa, lupine, peas, peanuts, cashews and sesame seeds carry the possibility of entering the United States on a commercial scale, IBISWorld reports. These sources currently are primarily used to make plant-based milks in countries overseas.

In total, dairy-alternative beverage sales increased 7 percent in the United States last year, according to Euromonitor’s Lee. This performance eclipses the overall drinking milk segment, which grew 1 percent last year, as well as the cow’s milk segment, which declined 2 percent last year, she adds.

“Dairy alternatives are outperforming the larger dairy milk category because they are viewed as healthier than dairy products,” Lee says.

Repositioned for growth

Nevertheless, dairy drinks are working to position themselves in a more healthful way in order to gain consumer interest. For instance, the Milk Processor Education Program (MilkPEP) has been promoting low-fat chocolate milk as a solution for post-workout recovery. More than 20 studies support the benefits of low-fat chocolate milk for post-exercise recovery, and research shows that it has the ideal mix of protein and carbohydrates to help athletes recover quickly, it says.

Additionally, innovation with natural sweeteners and new flavors could support stronger growth potential in the flavored milk segment, suggests Chicago-based Mintel in its April 2014 “Milk, Creamers and Non-Dairy Milk – US” report. More than one-third of respondents to Mintel’s survey said they are interested in naturally sweetened or reduced-sugar flavored milks. Early last year, Dean Foods reformulated its TruMoo flavored milks in order to reduce its sugar content by 40 percent, Euromonitor’s Lee points out.

Plus, nearly two in five respondents to Mintel’s survey said they are interested in more sophisticated milk flavors. Innova’s Tremellen affirms this trend, noting that upscale flavors like Tahitian vanilla, cappuccino ice cream and chocolate fudge brownie are resonating with consumers and breaking away from the traditional flavor mainstays. For instance, Elma, N.Y.-based Steuben Foods partnered with Cold Stone Creamery this past summer to launch a line of Cold Stone Creamery Milk Shakers. The beverages are available in Chocolate Fudge Brownie, Simply Vanilla and Strawberry Swirl flavors. Nestlé USA, Glendale, Calif., also stepped outside the box through a licensing deal with Girl Scouts of the USA. Nestlé Nesquik Girl Scouts flavored milks are available for a limited time in Thin Mints and Caramel Coconut flavors.

Last year, flavored milks increased 7 percent in dollar sales in off-premise channels, Euromonitor's Lee notes.

Finally, kefir has the potential to help boost the dairy-based drinks segment. In terms of new product launches during the 12 months ending June 30, kefir usage decreased double-digits in both the United States and globally, according to Innova’s Tremellen. However, sales for the segment increased 27 percent in 2013, Euromonitor’s Lee reports.

This year, Lifeway Foods Inc., Morton Grove, Ill., introduced three new kefir lines: Lifeway Veggie Kefir, which blends vegetable juices and kefir; Lifeway Kefir with Oats, which contains 11 grams of complete protein per serving; and Lifeway Perfect 12, which contains 12 probiotic cultures and 12 grams of carbohydrates and is sweetened with stevia.

Despite these efforts, Euromonitor expects the U.S. drinking milk market to decline by 2 percent in constant value terms between 2014 and 2019, Lee says. On the other hand, the market research firm projects dairy alternatives to grow by 52 percent in constant value terms during the timeframe.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!