2013 State of the Industry: Carbonated soft drinks

Flavors, sweeteners add value to soft drinks

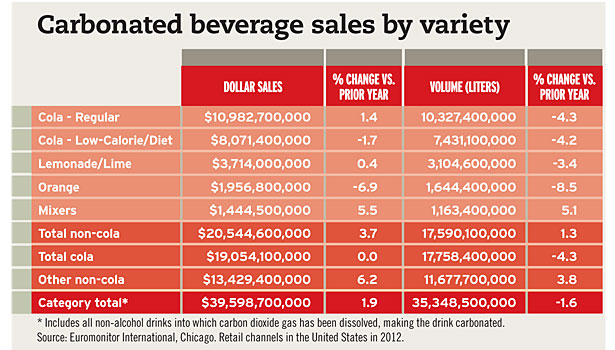

Dollar sales for carbonated beverages in U.S. retail stores increased by 1.9 percent in 2012 compared with the prior year; however, volume decreased by 1.6 percent, according to Euromonitor International, Chicago.

As consumer preferences for healthier beverages continue to rise, the carbonated soft drink (CSD) category remains challenged, according to a January 2013 “Carbonated Soft Drinks” report by Mintel, Chicago. From 2011 to 2016, Mintel projects the overall CSD market to grow 6 percent, reaching $45.5 billion in 2016 in current prices. However, after adjusting for inflation, market sales are projected to decline 3 percent during that time frame, the market research firm adds.

To expand the drinking occasion of CSDs, beverage-makers have launched new products positioned for different times of the day. For instance, earlier this year, Purchase, N.Y.-based PepsiCo launched Kickstart by Mountain Dew, which contains 92 mg of caffeine, 80 calories and

5 percent juice in each 16-ounce can. The beverage is positioned for the morning drinking occasion.

Flavored carbonated beverages are helping to balance out the decline in overall CSDs, according to experts.

As PepsiCo’s second-largest CSD trademark, Mountain Dew volume in North America grew in 2012, proving that there still is potential for growth in CSDs outside of colas, said Indra Nooyi, chairwoman and chief executive officer of PepsiCo, during the company’s fourth-quarter 2012 earnings conference call. Likewise, Atlanta-based The Coca-Cola Co.’s Fanta brand grew 5 percent in volume last year.

Nevertheless, cola remains the most popular flavor in the CSD category, according to a December 2012 report by the Netherlands-based Innova Market Insights titled “Carving New Niches for Carbonates.” Citrus flavors follow as the second most popular flavor option for CSDs, it adds.

Demonstrating cola’s popularity, The Coca-Cola Co. reported that its global share in the sparkling beverage market was up 3 percent last year, led by its flagship brand, Coca-Cola. Additionally, Coke Zero volume grew in the high single digits, it adds.

Naturally sweetened varieties also are gaining traction in the CSD category, experts say.

Earlier this year, Bethesda, Md.-based Honest Tea, a subsidiary of The Coca-Cola Co., released Honest Fizz in select natural food and specialty grocers. As a result of interest from retailers, Honest Fizz expanded availability at a number of natural and specialty retailers around the country. Honest Fizz is sweetened with a blend of stevia leaf extract and erythritol. Similarly, Culver City, Calif.-based Zevia added Strawberry, Cherry Cola and Lime Cola flavors to its line of stevia-sweetened CSDs last spring.

PepsiCo also plans to use natural sweeteners such as stevia to produce reduced-calorie offerings in the near future, Nooyi said during the company’s fourth-quarter 2012 earnings conference call. Last year, PepsiCo launched mid-calorie Pepsi Next nationally. The soft drink features a taste profile closer to regular Pepsi but contains 60 percent less sugar by using a proprietary sweetener blend, the company says. Likewise, The Coca-Cola Co. began testing its own mid-calorie sodas in the United States last year. Sprite Select and Fanta Select contain 50 percent of the calorie content as their full-calorie counterparts, according to Innova’s report.

Following the 2011 launch of Dr Pepper Ten, Plano, Texas-based Dr Pepper Snapple Group (DPS) expanded the 10-calorie platform in select markets to include 7UP Ten, Sunkist Ten, A&W Ten, Canada Dry Ten and RC Ten. Due to its success, the entire line became available nationwide this year, DPS reports.

“With a full year of support behind Dr Pepper Ten, the Dr Pepper trademark grew dollar share by 0.2 in Nielsen channels,” said Larry Young, president and chief executive officer for DPS, during the company’s fourth-quarter 2012 earnings conference call. “Dr Pepper Ten now holds a 0.3 share of the CSD category and, more importantly, has brought new and lapsed consumers back to the category.”

As consumers continue to turn away from sugar and toward natural alternatives, mid-calorie sodas and stevia-sweetened soft drinks are expected to gain in popularity, Innova’s report states.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!