Protein drinks benefit from diverse consumer base

Women, seniors growing demographics for sports, protein products

The growing desire among consumers to lead more healthful lifestyles has placed an emphasis on functional beverages that feature a variety of benefits. Among them, sports and protein drinks have experienced steady growth as consumers engage in more active lives and are proactive about their health and wellness.

Although these products feature a variety of benefits and are experiencing some growth, they’re also facing some challenges as well, according to experts.

Sports performance

In 2015, sports drinks experienced volume growth of 5.5 percent to 1.5 billion gallons, with wholesale dollars up 7.8 percent to $6.8 billion, according to an October 2016 report from New York-based Beverage Marketing Corporation (BMC) titled “U.S. Sports Beverages through 2020.”

The report forecasts the market to have a 4.4 percent compound annual growth rate to reach $8.5 billion by 2020, with volume growth at 3 percent to 1.7 billion gallons.

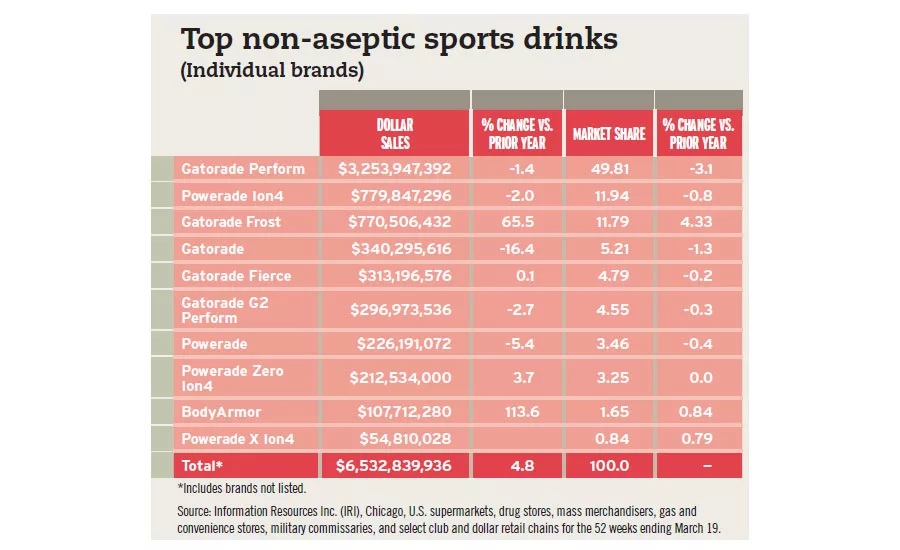

The market remains dominated by Purchase, N.Y.-based PepsiCo’s Gatorade brand and Atlanta-based The Coca-Cola Co.’s Powerade brand, which account for a combined 94 percent share of the sports drinks market, according to Chicago-based Euromonitor International’s February 2017 titled “Sports Drinks in the US.”

The Euromonitor report notes that a few factors are playing into the segment’s current and forecasted performance.

“The product’s innate ability to bridge consumer interest differences is expected to contribute to the category’s relative consistency when compared to other soft drinks, which have been considerably more volatile in recent years,” it states. “And, while a growing subset of consumers have become apprehensive of sports drinks’ sugar content, new products with a higher content of naturally occurring sugar may be able to assuage skeptical consumers.”

BMC’s Senior Editor Roger Dilworth also notes skepticism among some consumers toward sports drinks, but notes that brands are introducing products that answer to the skepticism.

“There might be a suspicion by some consumers that sports drinks are not as healthy as advertised, so PepsiCo has aimed to meet this implicit criticism through organic Gatorade, following an earlier attempt at a G Natural product that has been phased out,” he explains. “The company continues its long-successful tack of celebrity endorsements to underscore the message that Gatorade is a serious beverage for serious athletes.”

The Euromonitor report notes that Gatorade has seen success with its August 2016 launch of G Organic, noting that consumers are more responsive to certified-organic claims than they are to natural claims while they're also looking for premium offerings in the sports drinks space.

“With consumer goods of all types claiming ‘natural’ on their labels, American consumers have become increasingly desensitized to such claims. Organic certification, however, retains consumer confidence,” the report states. “Initial response to the product has been well-received, with distribution rapidly growing beyond its original exclusivity to Kroger and Amazon, and with wages on the rise, consumers are more likely to spend more on a premium Gatorade product than they were six years ago.”

The G Organic lineup is USDA-certified organic and provides the benefits of Gatorade’s Thirst Quencher lineup, the company says.

However, the Top 2 sports drink brands aren’t the only ones appealing to consumers health-and-wellness desires. BodyArmor, a brand of Queens, N.Y.-based BA Sports Nutrition LLC, is one brand that experts highlight as making an impact within the market due to its functional and healthy associations with coconut water.

“Following years of sports drinks and coconut water players stating that they swim in different ponds, one brand manufacturer, BodyArmor, showed that certain sports drinks and coconut water could, in fact, mingle,” the Euromonitor report states. “The brand’s coconut water-based sports drinks, endorsed by household names like Kobe Bryant, Andrew Luck and Rob Gronkowski, have made inroads among health-conscious consumers who have long sought an alternative to the products in the sports drink duopoly.”

BMC’s Dilworth also notes the growth of BodyArmor's sports drinks that feature a coconut water base. “Also, it should be noted that BodyArmor has gained popularity in part due to its implicit promise of being a healthier sports drink — although deep pockets of course have played a role in its relative success.”

BodyArmor has received significant investments from Dr Pepper Snapple Group (DPS), Plano, Texas. DPS has invested in BodyArmor on more than one occasion, most recently in April 2016 when it invested $6 million to the brand, which was in addition to the initial $20 million it invested in August of 2015. With its most recent investment, DPS maintains a 15.5 percent stake in the brand.

Protein power-up

When it comes to protein drinks, the market experienced high single-digit increases in 2016 to more than $600 million wholesale, BMC’s Dilworth says. The protein drink market is benefiting from an increasingly diverse consumer base as well as the influx of protein sources, as more consumers are entering the category for everyday consumption as a way to experience the benefits of protein, he adds.

“Protein drinks should continue to benefit from changing consumer attitudes toward carbohydrates as more people seek out paleo or ketogenic dietary solutions,” Dilworth says.

Benicia, Calif.-based CytoSport Inc.’s Muscle Milk brand continues to lead in the segment, according to Dilworth. “Protein [drink] leader Muscle Milk continues to innovate with new products and has gained a deep pocket with acquisition a couple of years ago by Hormel, which seems committed to growing its protein business, not only in terms of animal-based proteins but also plant-based proteins,” he explains.

In fact, CytoSport Inc. launched a new product at the beginning of the year, Evolve, its first plant-based and vegan ready-to-drink protein line, the company says.

“The Evolve brand provides great tasting, plant-powered protein products that can be enjoyed by everyone,” President and Chief Executive Officer of CytoSport Greg N. Longstreet said in a statement at the time of the launch. “Our goal was to create highly nutritious, delicious and sustainable products that consumers will be proud to support.”

The product contains 20 grams of pea protein along with 10 grams of fiber in each 12-ounce, single-serve bottle.

Although plant-based proteins are gaining share in the market, milk-based proteins are growing with whey protein continuing to be most prevalent, according to BMC’s report.

“As the protein category segments, there are even milk-based protein drinks emerging that can boast of being lactose-free, tapping into an even broader potential base of consumers,” it states.

Although protein is a popular ingredient, Chicago-based Mintel notes in its April 2016 report titled “Nutritional and Performance Drinks – US” that consumers are looking to protein-containing beverages featuring different amounts of the ingredient for a variety of reasons.

“Protein may have a stronger association with weight gain than weight loss,” the report states. “Category participants are more likely than [the] average to look for a small amount of protein for weight loss efforts and are less likely to seek a large amount of protein for this goal. They are also twice as likely to seek a large amount of protein for weight gain efforts.

“Only 18 percent of consumers who are managing their weight are doing so through high-protein diets,” it continues. “The more specific high-satiety claim is on the rise among weight-loss products. This might suggest that, even if protein contributes to satiety, weight-loss consumers may be more open to hearing about the result (no hunger) than the ingredients that get them there.”

In its report, BMC notes that the desire for protein is resulting in a variety of hybrid beverages.

“For example, with energy now a proven functional category and protein drinks hot, a Phoenix-based marketer launched a brand called Whey Up as a ‘protein drink with energy,’” the report states. “The entrepreneur behind the brand, Erik Rothchild, has come up with a sucralose-sweetened beverage that boasts 20 grams of protein via whey protein isolate but only 1 gram of carbohydrates and no sugar.”

Eleanor Dwyer, research analyst at Euromonitor, also notes the growth of crossover products, which are helping to meet the needs of mainstream consumers who occasionally consume these products, she says.

For example, Farmington Hills, Mich.-based Living Essentials LLC, makers of 5-Hour Energy, jumped into the protein space last year with 5-Hour Energy Protein, which boasts 21 grams of whey isolate and vegetable proteins along with a boost of energy in each 6-ounce bottle.

Yet, when it comes to the overall sports nutrition market, including sports and protein drinks, Dwyer notes that eCommerce will play a role in growth going forward.

“The online channel will continue to grow in importance, particularly for young sports nutrition companies as eCommerce allows retailers to stock a wide variety of products [that] appeal to both casual and hard core sports enthusiasts, while still keeping costs relatively low,” she says.

Expanding consumer base

Sports and protein drinks continue to see an opportunity in the market, particularly as health-and-wellness trends proliferate. With the mainstream desire to lead healthy lifestyles, the sports and protein drink market has expanded its reach from a targeted base to a more mainstream group of consumers, Dwyer says. She notes that the U.S. sports nutrition market experienced current value growth of 12 percent in 2016.

“Much of this growth was driven by the continued expansion of the sports nutrition demographic base. While sports nutrition products previously targeted core athletes and body builders, greater numbers of casual users have begun using these products as they have become more aware of the health benefits of protein and the importance of active lifestyles,” she explains. “So-called weekend warriors looking to protein products to supplement active lifestyles comprise this new base of casual users. Brands targeting these users often craft their positioning very explicitly toward a particular sport and demographic.”

Although the market continues to see an increase in consumption by a more diverse consumer base, Dwyer highlights that various consumer demographics still can be further tapped, including women and seniors.

“Women comprise another rapidly growing consumer group,” she says. “… As sports nutrition companies are targeting a wider audience, including non-core users, female consumers represent an increasingly lucrative opportunity. As evolving fitness and nutrition trends attract more women to the category, manufacturers are taking note and crafting brand extensions and stand-alone lines to cater to this long-ignored demographic. Moreover, many female consumers are crossing over from weight management to sports nutrition as high-protein diets grow in popularity.”

Dwyer adds that packaging design is important for reaching female consumers, with approachable, health-focused packaging preferred by these users. Female consumers are interested in the weight-management and wellness benefits that sports and protein drinks offer, and packaging that conveys these messages can be more appealing to them, she says.

BMC’s Dilworth echoes similar sentiments, noting that protein drinks increasingly are marketed to women, highlighting the functions of protein as well as offering on-the-go solutions and various types of protein.

Seniors, on the other hand, are looking to sports and protein drinks for a separate set of benefits, Dwyer explains. “Senior consumers continue to show greater interest in taking sports nutrition products, which help to maintain muscle mass and sustain optimal levels of protein intake,” she says. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!