2017 Beer Report: Domestic brewers look to combat volume declines

Despite volume declines, domestic beer still 65 percent of market

Just like the stock market has seen its share of highs and lows, the U.S. beer market also has had its own ebbs and flows. Despite some single-digit declines that were peppered in throughout the past decade, the beer market seems to have leveled out, experts note.

“The beer market has stabilized over the past couple of years after declining between 1 and 2 percent in 2009-2011 and then again in 2013,” says Brian Sudano, managing partner with Beverage Marketing Corporation (BMC), New York. “However, the slowdown of craft and [flavored malt beverages] (FMBs) in the second half of 2016 has put pressure on the category as seen by the 2 percent drop in third quarter depletions and 6 percent drop in beer shipments in October.”

Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen, highlights the stabilization of the U.S. beer market, noting that the total beer category was relatively flat (up 0.2 percent) in terms of volume for the 52 weeks ending Dec. 31, 2016. Dollar sales were up 2.2 percent in 2016, she adds.

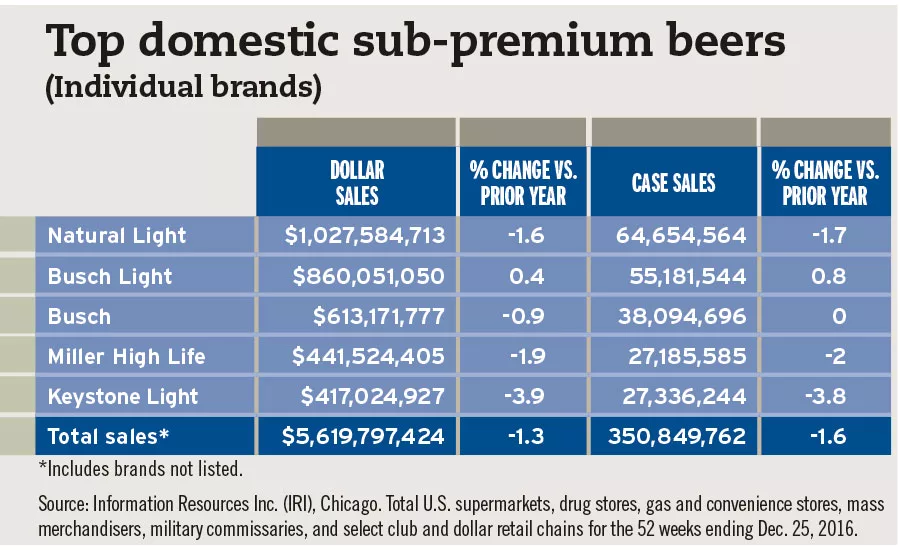

However, performance within the domestic beer market has seen mixed results across the premium, super-premium and sub-premium sectors. “Mainstream domestic premium and below premium segments contributed to some of the largest category declines for beer — domestic premium minus 2.1 percent and below premium down 1.7 percent — although below premium declines have slowed compared to the previous year,”

Kosmal says.

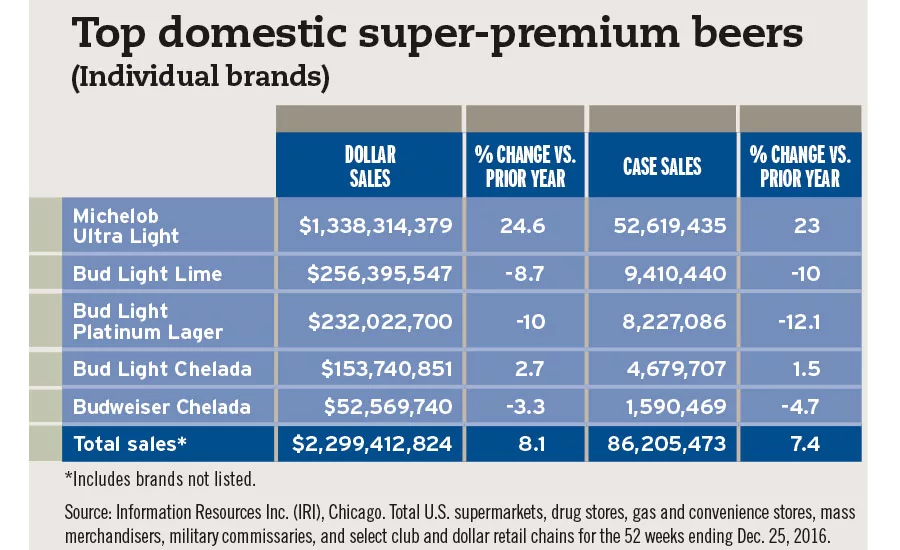

Super-premium domestic beer, however, was a bright spot for the segment as it posted a 7.4 percent increase in volume for the 52 weeks ending Dec. 25, 2016, in total U.S. multi-outlets, such as supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains, according to data from Information Resources Inc. (IRI), Chicago.

This aligns with premiumization trends that are permeating throughout the U.S. beer market. “Premiumization continues to impact the domestic beer segment, with the above-premium segments driving most of the domestic beer growth, part-icularly super premium, flavored malt beverages and some areas of craft beer,” Kosmal says. “Among the different consumer segments and generations, millennial consumers are driving much of this

high-end growth.”

Millennials are enticed by a number of factors when it comes to trying premium products, she adds. “From a consumer survey that Nielsen conducted in November 2016, we found that millennials are more likely to try premium products as a way to try new things, to seek out more flavor options or to drink local products, which tend to be more premium offerings,” Kosmal explains.

Although domestics have experienced mixed results from their sub-segments, they still account for the majority of U.S. consumption. “First, domestic beer brands continue to dominate the U.S. beer market with 65 percent of volume, while craft, FMB and imported beer make up the other 35 percent,” BMC’s Sudano says. “The biggest issue for domestic beer is that trends are working against them, [which is] driving large absolute volume losses.”

However, domestic brewers can combat these losses, he explains. “In order to better compete, domestic brands need to reconnect with consumers and provide a strong message about brand uniqueness to provide a rationale for the consumer to buy, so there is better differentiation,” Sudano says. “This expands beyond distribution and trade execution.”

Last year, Bud Light, a brand of Leuven, Belgium-based Anheuser-Busch InBev (AB InBev), unveiled new packaging that brought back the brewer’s trademark “AB” crest and also emphasized the brand’s premium ingredients; care in brewing; crisp, clean finish; and smooth drinkability, the company says.

Chicago-based Euromonitor International details how domestic brands are reconnecting with consumers in its June 2016 report titled “Beer in the US.”

“In 2015, leading domestic lager brands were largely able to reverse the tides of volume declines,” the report states. “Renewed marketing pushes for pride in what their brands stand for and harking back to their longstanding heritage allowed brands like Miller Lite and Coors Light to resume total volume growth unseen in years, and Budweiser to experience improved declines in 2015.” BI

Top domestic premium beers

(Individual brands)

| Bud Light | $5,972,165,373 | -1.3 | 288,135,550 | -2.5 |

| Coors Light | $2,431,149,370 | 1 | 117,899,228 | -0.1 |

| Budweiser | $2,082,176,714 | -2.2 | 98,761,308 | -3.7 |

| Miller Lite | $2,052,929,647 | 1 | 100,534,617 | -0.3 |

| Yuengling Traditional Lager | $295,564,332 | 7.4 | 12,982,332 | 4.8 |

| Total sales* | $13,674,221,829 | -0.7 | 661,457,396 | -1.9 |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending Dec. 25, 2016.

Top domestic super-premium beers

(Individual brands)

| Michelob Ultra Light | $1,338,314,379 | 24.6 | 52,619,435 | 23 |

| Bud Light Lime | $256,395,547 | -8.7 | 9,410,440 | -10 |

| Bud Light Platinum Lager | $232,022,700 | -10 | 8,227,086 | -12.1 |

| Bud Light Chelada | $153,740,851 | 2.7 | 4,679,707 | 1.5 |

| Budweiser Chelada | $52,569,740 | -3.3 | 1,590,469 | -4.7 |

| Total sales* | $2,299,412,824 | 8.1 | 86,205,473 | 7.4 |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending Dec. 25, 2016.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!