2016 Craft Beer Report: Craft beer market becoming increasingly competitive

Canned beer, flavored beer gaining in importance

For about a decade, the craft beer segment has grown at immense rates, influencing the food and beverage industries in many ways. Yet, experts note that the segment is beginning to experience some growing pains as a result of its rapid growth.

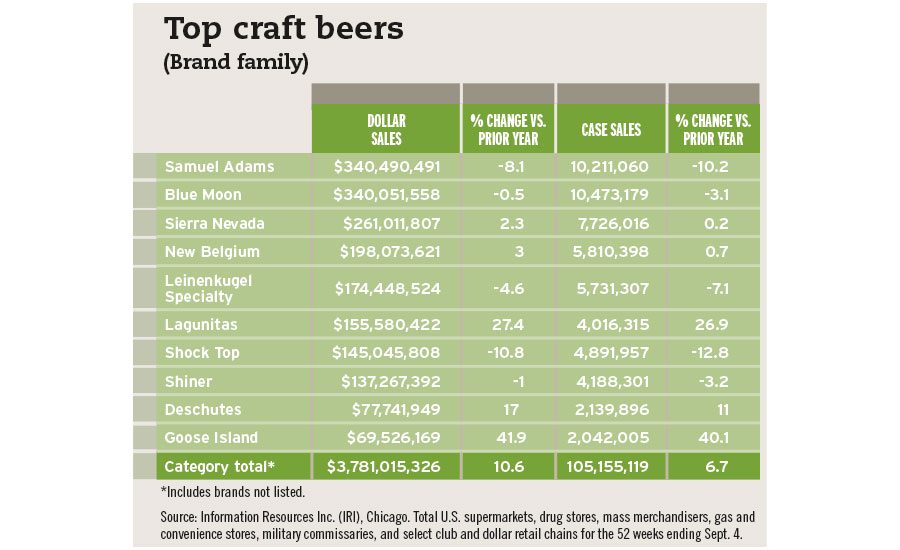

“Craft continues to gain share within total beer and now makes up 21.7 percent dollar share within total U.S. supermarkets, based on the 52 weeks ending Sept. 4, 2016,” explains Dan Wandel, principal of beverage alcohol client insights at Information Resources Inc. (IRI), Chicago. “However, craft’s growth has slowed significantly with regards to dollar sales percent change versus [a] year ago. After 10 straight years of double-digit dollar sales percent increases dating back to 2005, craft is experiencing its lowest dollar sales percent increase versus [a] year ago at 9.7 percent in the latest 52-week period. The current four- and 13-week periods are reporting lower increases.”

The Boulder, Colo.-based Brewers Association (BA) also found this trend in its 2016 mid-year analysis, says Julia Herz, craft beer program director for the BA. “The mid-year statistics showed definitely a slowdown in growth, but [it’s] great growth just the same. We’ve had double-digit growth in the craft brewing segment for the small and independent craft brewery eight out of the last 10 years, and 2015 overall was 13 percent by volume growth. The first half of 2016 was shown to be 8 percent by volume,” she says.

Danelle Kosmal, vice president of beverage alcohol for New York-based Nielsen, highlights that the segment is seeing stunted growth in both on- and off-premise channels. “Growth has slowed even more in the on-premise channels, with craft up 1.3 percent in volume and 3.1 percent in dollar sales for the 52 weeks through mid-August,” she says. “Similar to off-premise, most of the growth that is happening in on-premise is driven by mid- and small-tier brewers.”

Despite this deceleration of growth, IRI’s mid-year 2016 sales data, ending July 3, still shows craft as the top beverage alcohol growth segment based on dollar sales change versus the previous year, Wandel says.

“It was inevitable that craft sales would begin to slow as the segment continues to mature,” he explains. “One of the key challenges that craft [brewers] must learn to overcome now, in a crowded marketplace, is to figure out a way to maintain brand equity and help restore sales growth around [their] flagship, primary brands.”

Going forward, Los Angeles-based IBISWorld’s August 2016 “Craft Beer Production in the US” report predicts that the craft beer segment will

see annual revenue grow at a rate of 4.4 percent from 2016 to 2021, a significant decline from the 20.6 percent annual growth during the 2011-2016 period. The report estimates that the segment will reach $7.2 billion by the end of 2021.

Chicago-based Mintel’s September 2015 “Craft Beer – US” report also predicts a slowdown during the 2016-2020 timeframe. “The slowdown will come from consumers turning to an expanding range of alcohol options; market saturation confronting a finite number of drinking occasions; craft-style launches from larger brewers; and craft brewery acquisitions by larger beverage companies, which effectively forfeit craft categorization due to industry definitions,” it states.

Finding space

Experts say that the onslaught of new players in the segment has resulted in an increasingly competitive market that is affecting established brands while also making entrance into the market more difficult for new players.

“The segment’s definitely slowed over the past year or so,” says Eric Schmidt, director of alcohol research for Beverage Marketing Corporation (BMC), New York. “You’re seeing the larger brands — the Boston Beers of the world, the Sierra Nevadas, the New Belgiums — basically become stagnant because there’s just so much volume and there’s so many people coming online. The influx of competition and so many different offerings [has made it] become such a competitive landscape in the segment that it’s really tough to make your way.”

He notes that the growth drivers have also changed. Previously, the larger volume brands would drive craft beer growth, but as these brands have become stunted, the growth has become more fragmented. “There are so many breweries coming online on a daily basis, so you’re seeing more of the volume come from what I like to call local breweries,” he says.

According to Schmidt, craft beer market volume has nearly reached demand levels, which can make it difficult to compete. “Then the only thing that you can do is lower prices, which doesn’t help with the equity of brands if you have to reduce prices to get more sales,” he explains. “That is definitely, at this point, a concern. There’s just so much; it’s still growing, but like I said, there’s a finite amount of demand in the marketplace. … It’s still doing well enough that you’re still going to have more people coming into the market, but I’m afraid [that] with all this competition, eventually, it’s going to have to, like anything else, shake itself out.”

Schmidt says that a “shaking out” of the marketplace should be expected within the next five years or so. “It’s not eminent; it’s not going to happen this year, but we’re starting to see the slowing of brands,” he says. “… They don’t go away overnight; it’s more of a slow progression. …. A lot of the larger brands … are increasing capacity, opening up new breweries to increase their capacity and how much they’re able to sell, but I don’t know if those levels are sustainable.”

In December 2015, the BA reported that the number of breweries in the United States had reached a record high of 4,144, surpassing the previous record of 4,131 set in 1873.

From his experience in studying the beverage alcohol market, BMC’s Schmidt notes that this type of lifecycle has previously occurred. However, the rapid growth and increasing competition brings into question the quality of newly launched products, he adds.

“The other thing with craft beers is that they’re high-margin beers, for the most part,” he says. “Now, with the influx of brewers coming online, we have to question them. The people who started the [craft beer] industry [had] that kind of labor of love, they really got into it, and they love brewing. Then, you have to question whether some of the ones that are coming online now, who are trying to chase after a segment of the market that’s growing, is the quality there, is the care in it, is it a labor of love or are they just chasing dollars? That’s definitely a part of it.”

However, experts emphasize that these trends are impacting larger craft brewers more so than small, local brewers. “I think growth is definitely something that is going to nip at the heels more of the regional craft brewers, where you’ve got an environment where it’s not guaranteed — it never has been in the first place — to get on the restaurant menu and get on the liquor store shelf, and the regional craft brewer gained a lot of ground. A lot of sales for craft beer is from those regional craft brewers,” the BA’s Herz says. “By regional, I mean above 15,000 barrels of beer a year to up to 6 million, with Yuengling being the most advanced producing craft brewer, then Sam Adams, then Sierra Nevada, then New Belgium.

“Those styles of breweries on volume they are in the recent climate, I think, seeing the most challenges at retail because their distribution and sales depend on more of the supply chain on the regional and national scale,” she continues. “ … So at retail really is where a lot of battleground is, as well as stadiums, concert venues and the like, where the smaller you are the less chance you’re going to have to make that exclusive contract that a lot of those venues allow themselves to make.”

Nielsen’s Kosmal adds: “For several years, a lot of the growth within craft beer was coming from large-scale distribution gains. Most often, this growth was from strong, regional craft brands that expanded distribution and their national footprint. Now, many of those brands have reached the threshold for distribution expansion, and there is little room for growth in that area.”

It’s also important to consider the competition that craft beer faces from the total beer market as well as from the rest of the beverage alcohol industry, experts say.

Achieving success

Gaining and maintaining success in such a competitive market can be difficult for many brands. The brands that are maintaining their success are consistently innovating both what is inside of the package and what is on the outside of the package, experts say.

One way brands have been doing this is through brand refreshes, the BA’s Herz says. “You’ve got a lot of these regional craft breweries doing brand refreshes just to stay relevant [and] top-of-mind,” she explains. “Many of our Top 50 brewers have been around now for more than 20-25 years, and the trends in artistic design and what catches the eye has evolved. For success, I think a lot of the regional craft brewers are going through redesigns and working to continue to stay top-of-mind.”

Constant innovation not only is a staple of the segment, but also remains essential to the success of craft breweries. “In today’s marketplace, [craft brands] have to consistently have a strong innovation platform in place year after year,” IRI’s Wandel says. “A number of craft brewers continue to expand to new markets, new channels or even internationally. Expanding their packaging beyond glass and into cans has also increased the ability for craft to compete for additional drinking occasions.”

Although sales of canned craft beer have continued to rise, craft beer packaged in 12-ounce glass bottles is experiencing a decrease in sales this year, he adds.

Manjunath Reddy, lead analyst at London-based Technavio, notes that the move to aluminum cans by craft brewers is due to a variety of factors. “The popularity of canned craft beer is gradually increasing in the U.S.,” he explains. “… Currently, brewers are using cans for craft beer as aluminum cans have broader openings that keep the taste of the beer intact and consistent by keeping out oxygen and light. Moreover, with the help of these cans, the beer remains cold for longer and also adds to its aesthetic appeal.”

Craft brewers are embracing a plethora of packaging innovations to help them stand out on the shelf, BA’s Herz says. “You are seeing a lot of innovations in packaging, everything from different-style six-pack holders to different-style boxes that you are going to have for transporting your beer,” she says. “You just have a lot of innovations going on for craft brewers to continue to set themselves apart.”

According to Nielsen’s Kosmal, innovative packaging is important in the crowded space. “As the shelf continues to become more crowded with craft

beer items, packaging also continues

to become increasingly more important to capture and keep the consumer’s attention,” she says. “From a Nielsen survey conducted in April 2016,

60 percent of craft beer drinkers or potential drinkers said that design is extremely or very important in convincing them to give that craft beer a try.”

Stylish innovations

BMC’s Schmidt says that brands also are innovating with new varieties to keep consumers’ interests. He highlights Boston-based Boston Beer Co.’s Samuel Adams Nitro Project of nitrogen-infused beers as one example of the ways that brands are innovating within their portfolio.

“One of the attributes of craft beer that helps it is that it has so many different flavors and styles that you can offer, so you’re giving it to consumers, particularly young consumers, they may not be very brand loyal, but they are always looking for something new, and craft beer really offers you a lot of different styles [and flavors],” Schmidt says.

And it’s not only the various styles and flavors available that are attracting consumers to an assortment of craft beer brands. Successful brands are taking a closer look at the products they’re producing and engaging their more artistic, culinary sides when formulating, BA’s Herz explains.

“One way they’re being successful today is [that] they’re really looking at the beverages they make, the beverage of beer, as a chef would look at a food menu. What am I going to create? How am I going to bring flavors here? How am I going to have everything from visual enticement to textural experience and flavor diversity? And so, brewers, if you can ferment it, they’re working with it,” she says.

Mintel’s report highlights that style drives choice for craft beer drinkers. “While brand is the leading factor influencing beer purchase among all beer drinkers, a strong interest in style can be seen among drinkers of craft,” it states. “Craft drinkers are nearly twice as likely as beer drinkers in general to make purchase decisions based on style.”

Currently, the largest sub-segment of the U.S. craft beer market is India Pale Ales, says Technavio’s Reddy. Seasonal beers are the No. 2 craft beer sub-segment, followed by Pale Ales, Amber Ales and Lagers as the Top 5 selling craft beer styles, he says.

However, opportunities abound for non-traditional beer styles. Fruit-, vegetable- and spiced-flavored or based craft beers are gaining in the marketplace, according to Wandel and Herz.

“The top flavors we are seeing in craft include grapefruit, citrus, berry, vanilla, pineapple and mango,” IRI’s Wandel says.

Although driving innovation and staying top-of-mind might be important factors, BMC’s Schmidt says that preserving authenticity and close communication with consumers is essential to maintaining success in the craft beer market.

“It’s just that the overall marketplace is so competitive that to hold on to consumers is a tough thing,” he says. “The breweries are trying to hold onto consumers and keep them involved and have them try different things and have a true story — authenticity to the brand — to try to hold these consumers that are more adventurous than loyal.”

Nielsen’s Kosmal echoes similar sentiments noting the grass roots and local event efforts from local brewers can help them find success within the crowded market. “[Successful brewers] are focusing on the local aspect first,” she says. “They build strong regional brands and develop a loyal base of consumers at a regional level. Once they have that strong regional foundation, then they expand their distribution footprint. They also are engaging with consumers at the local level through festivals and events, and are offering a selection of different styles or flavors to complement their flagship brands.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!