Bottled water nearing No. 1 spot for U.S. consumption

Sparkling waters continue to outpace category

As health and wellness gains more attention from consumers, some food and beverage categories have faced new challenges. However, the bottled water market is one beverage category that has benefited from the increased prevalence of better-for-you products as more consumers strive to lead healthier lives.

“Consumers’ interest in leading a more healthful lifestyle is definitely impacting the growth of the bottled water category, particularly as consumers look for alternatives to sugary beverages,” says Elizabeth Sisel, beverage analyst for Chicago-based Mintel. “Nearly half of total bottled water drinkers say they are drinking more flavored waters, in particular, to replace high-sugar drinks. And nearly as many say they drink bottled water in general because it is good for their overall health.”

Gary Hemphill, managing director of research at New York-based Beverage Marketing Corporation (BMC), notes that bottled water has benefited from numerous consumer trends, but health and wellness is at the top of list.

“There [are] a lot of drivers but the No. 1 is health and wellness,” he says. “If you consider the product category of bottled water, it’s virtually perfect when it comes to bottled water, so that’s been the greatest driver of bottled water performance this year and historically.”

In its March report “Bottled Water in the US,” Chicago-based Euromonitor states that bottled water reached new highs in 2015 with total volume consumption at 39.3 billion liters. Among the reasons it credits this performance is health and wellness. “This product has had success leveraging its naturally healthy attributes when compared with other types of soft drinks, such as carbonates and sports drinks, which both contain high levels of natural and/or artificial sweeteners,” the report states.

Additionally, experts note bottled water’s thirst-quenching capabilities for its success.

“[H]ydration also plays a heavy role in why consumers drink water,” Mintel’s Sisel says. “While health may seem like a good reason for repeat usage, the fact that it is used as a hydrating, thirst-quenching beverage allows it to fit in with any drinking occasion and be relevant to consumer’s needs throughout the day.”

Michael C. Bellas, chairman and chief executive of BMC, echoes similar sentiments. “It’s very hydrating … it’s not complicated,” he says. “It’s simply healthy; you know what it’s going to be.”

In addition to hydration, Bellas credits convenience, price points and concerns about municipal water supplies as growth drivers for the category. From an industry standpoint, he notes that commitments from large companies, including Atlanta-based The Coca-Cola Co., Purchase, N.Y-based PepsiCo Inc. and Stamford, Conn.-based Nestlé Waters North America (NWNA), have benefited the category.

All of these factors are contributing to BMC’s expectation that, on a consumption basis, bottled water will surpass carbonated soft drinks (CSDs) as the No.1 beverage in the United States very soon.

“[T]he biggest thing on the horizon is that [bottled water] is going to surpass carbonated soft drinks either likely toward the end of this year or at the very latest the first quarter of 2017,” Hemphill says. “Because carbonated soft drinks continue to underperform in the overall refreshment beverage market, declining slightly year-to-year, and water, of course, has continued on this healthy trend.

“At some point, in the coming months, they’re going to intersect and water will become the No. 1 beverage on a consumption basis in the U.S. surpassing carbonated soft drinks, which have had an extraordinarily long and successful run in that position, but the marketplace is changing and evolving, which is bringing about this change, and that’s one of the biggest changes occurring,” he continues.

Segmenting success

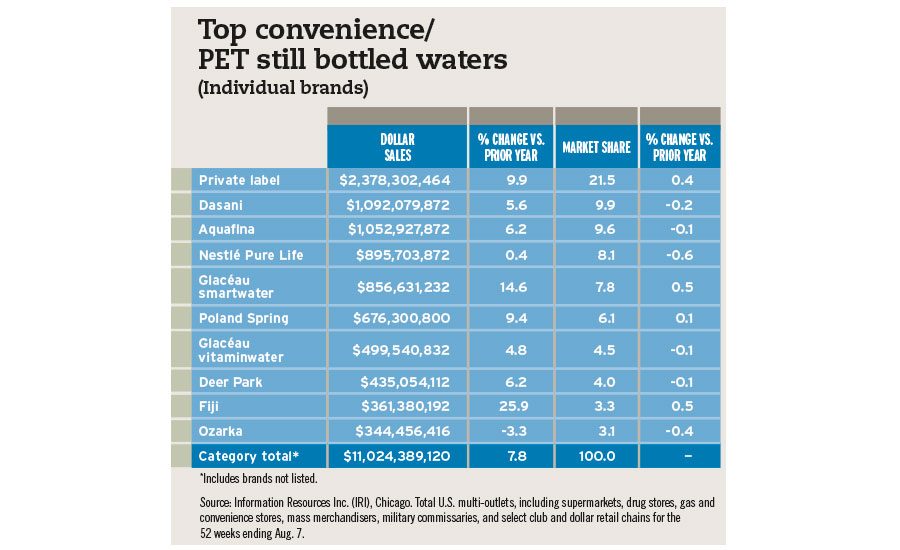

Across the board, experts note that bottled water is making strides. Yet, the category continues to be dominated by convenience, PET still water.

“The 800 pound gorilla is really the single-serve, convenience, PET group and that’s … a little over two-thirds of the category and that’s still growing,” Bellas says. “We’re expecting it to be between 7.5 to 8 percent growth this year.”

In Mintel’s January report “Bottled Water – US,” the market research firm estimates convenience/PET still water is 77.3 percent of the market share. Despite struggles in 2013, the segment was forecast to grow 5.1 percent in 2015 and is expected to continue this growth going forward.

“Future growth is expected to continue upward through 2020 as the category innovates with new flavors and functions, and health remains top-of-mind with consumers,” the report states.

Although its sales had been flat in years past, gallon/bulk bottled water sales have seen a slight uptick.

“[T]he gallon jug, after being relatively flat, is starting to pick up as well,” BMC’s Bellas says. “It isn’t growing as fast, but we think it’s going to up about 3.5 to 4 percent. The reason we think that’s starting to accelerate is because when you have such broad base usage for the single-serve, there are now more occasions for the multiple serve. If you want to serve at a dinner party, you have a 3-liter or a gallon jugyou can take it on camping trips. The enhanced volumetric usage has helped the multi-serve bulk, retail bulk.

“The direct delivery is also enjoying mid to low single-digit growth,” he continues. “Again that [is] driven more by consumers [who are] committed to tap water replacement and concerns with municipal water supply.”

Mintel’s report estimates that the jug/bulk still water segment increased 5.4 percent in 2015 and also will continue a strong growth trajectory. “Bulk water likely benefits from consumers overall increased bottled water consumption,” the report states. “Jug/bulk still water makes up 9.6 percent market share, with growth expected to climb 25.5 percent from 2015-20 to reach $3.4 billion.”

However, the consumption of bulk bottled water has seen its own evolution. Euromonitor’s report highlights how the segment has seen delivery sales lose share to retail bulk sales.

“Bulk sales of bottled water play an important role in bottled water in the U.S., representing a large share of volume sales,” the report states. “Historically, sales of bulk bottled water were relegated to large bottles, typically 3 and 5 gallon bottles, for use in gravity water coolers. Over the last decade, these large bulk water bottle formats, which have traditionally been delivered through direct selling or available for refill in retail outlets, lost share to 24 or larger multipacks of 355-ml PET bottles.”

Yet, the segment experiencing the strongest growth within the past few years is sparkling water. Although stemming from a much smaller base, BMC’s Bellas notes that domestic sparkling water has been up double-digits the past three years.

“The growth there is people still like bubbles,” he says. “This is a really, really healthy alternative to carbonated soft drinks if you like bubbles. We’re seeing everybody entering the category. It’s growing very, very quickly from a small base, but I think it has huge upside because, again, you’re putting essences in those waters, and also you’re seeing some alkaline waters coming in as well. It’s a category that is being positioned in both the soda aisle and the water aisle, so we see that growing strongly.”

At approximately 13.1 percent market share, the sparkling/mineral water/seltzer segment increased an estimated 15.7 percent in 2015, Mintel notes in its report. “Growth is expected to continue through 2020, climbing a robust 75.1 percent in the period from 2015-20 to reach $3.4 billion,” it states.

In its report, Euromonitor highlights the flavored carbonated water sub-segment in fueling the growth of carbonated waters.

“Flavored carbonated water (tracked in flavored bottled water) has been presented as a healthy alternative to the struggling carbonates category, with such products continuing to be demonized as a contributor to the spread of obesity in the U.S.,” the report states. “Carbonated natural mineral bottled water experienced the fastest growth in bottled water in 2015, growing by 11 percent in retail volume terms, fueled by a growing appetite for haute cuisine in the U.S.

“Whilst long a mainstay of European dining, historically carbonated bottled water struggled to gain acceptance in American homes and restaurants,” the report continues. “Aided by the stronger health and premiumization trends, carbonated water has now burst onto the scene, as affluent Americans have followed in the footsteps of their European counterparts.”

Power of premium

Within the bottled water category, the premium positioning of brands has contributed to the proliferation of functions and flavors.

“Bottled water’s popularity is allowing it to quickly evolve with more premiumized offerings, which include unique water sources and more sophisticated flavors, and a heightened focus on functional waters,” Mintel’s Sisel says. “There might be more opportunity with the added functions bottled waters can offer. A net of 83 percent of consumers want some sort of nutritional or functional benefit when creating their ideal bottled water. Nutritional benefits are important to bottled water consumers, as many drink bottled water for health and hydration.”

BMC’s Bellas notes that across single-serve bottled water, premium is the fastest growing segment.

However, the success does vary by region. “In different regions, premium is growing because of sophistication; there’s more branded products, there’s more on-premise,” Bellas says.

Hemphill adds that the growth of premium bottled waters has benefited from broader premiumization trends. “On the premium side, that’s probably part of a broader trend with refreshment beverages and the alcoholic beverages that we see as well,” he says. “We see them trading up for ones they perceive as higher quality. I think that is part of that overriding trend that we’ve seen across the beverage industry.”

Examples of this include import bottled waters and alkaline bottled waters. The imported water segment is up 12-14 percent Bellas notes, led by NWNA’s San Pelligrino and Perrier as well as The Wonderful Co.’s Fiji Water and Danone’s Evian.

For alkaline waters, Bellas adds that this sub-segment is up triple-digits, but from a small base. He and Hemphill tout the early success of these waters, but remain cautious about what the sub-segment’s long-term contribution will be to the overall category.

“It’s very strong growth from a small base, but, as Michael pointed out, it’s relatively early in the lifecycle of the segment so it’s difficult to tell where it’s headed and how broad, how big, how high it can get,” Hemphill says.

Mintel’s Sisel adds that consumer appeal of alkaline water remains small in comparison to other product attributes. “Consumers are not actively seeking out alkaline waters,” she says. “When asked what functions or attributes they would like to see in their ideal bottled water, only 6 percent said they wanted their water to be alkaline. This is [a] niche attribute right now that is not particularly driving new or more frequent bottled water consumption.”

However, flavor incorporation could bode well for bottled water brands, but careful consideration should be taken about what flavors to introduce, Sisel says.

“Innovation with flavors is much more fragmented: 64 percent of consumers say their ideal bottled water is flavored, but the level of interest in the different flavor types is spread out across the board, particularly regarding niche and more unique flavors, from coconut to super fruit to herbal varieties,” she says. “Only the classic citrus and berry flavors generated any sizable following among consumers.”

Going forward, BMC’s Bellas and Mintel’s Sisel both expect that the plant waters, for example, maple water, could start to see a broader following as distribution increases.

“While unique water sources may only have a niche following, there is a number of these water sources coming to market, such as the different plant waters or even purified rain water,” Sisel says. “However, these will likely stay niche products until greater visibility, awareness and relevance encourage increased consumption among consumers. As the bottled water category continues to innovate and evolve, consumers will likely be more open to more unique water sources.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!