Premium coffee continues to post strong gains

Ready-to-drink, single-cup coffee adding to growth

Americans continue to show their affinity for coffee; but when they opt for this beverage, they are taking a more premium stance. “The coffee production industry exhibited growth over the past five years, propelled by an increasing number of consumers purchasing high-cost gourmet coffee,” IBISWorld states in its report “Coffee Production in the US,” which was released in January. “Although per capita coffee consumption is expected to grow only moderately, at an annualized rate of 0.7 percent during the five years to 2016, more consumers are buying premium, sustainable coffee.”

The Los Angeles-based market research firm highlights that consumers now are opting for gourmet options like espressos, which typically are packaged in smaller size offerings.

The National Coffee Association USA (NCA), New York, also points to this trend in its 2016 NCA National Coffee Drinking Trends (NCDT) report. The report states that daily consumption of espresso-based beverages has nearly tripled since 2008.

But, espresso-based beverages are not the only segment within the coffee market that is offering a premium attribute.

“As with most consumer product categories today, premiumization is on the rise,” says Gary Hemphill, managing director of research for New York-based Beverage Marketing Corporation (BMC). “Driven by a steadily improving economy, consumers are trading up to higher quality products that offer value. In coffee, cold brew is a prime example of this, as is the ascent of higher priced specialty coffee.”

Virginia Lee, senior beverages analyst for Chicago-based Euromonitor International, says that cold-brew coffee not only is appealing to premium beverage trends, but also health and wellness ones.

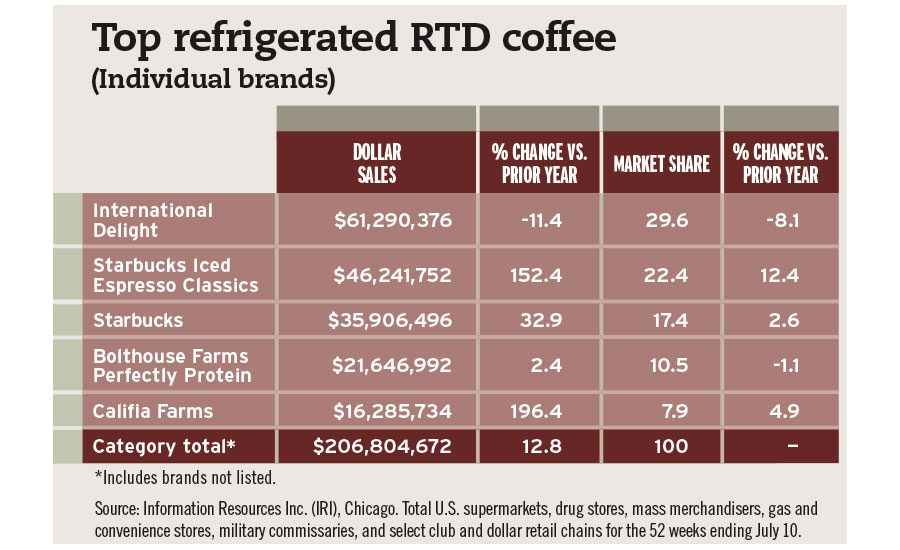

“These premium cold-brew coffees have resonated with millennial consumers who not only appreciate the coffee’s smoother taste but its higher caffeine content,” she explains. “The addition of cold-brew formulas is also expanding the consumer base for U.S. [ready-to-drink] RTD coffee beyond fans of the Starbucks Frappuccino. As cold-brewed coffee contains less acid and bitterness than traditional iced coffee, producers of cold-brew coffee can create a lower-calorie beverage by using less sweetener and creamer.”

Elizabeth Sisel, beverage analyst at Chicago-based Mintel, also notes the positive impact that cold brew is having on the coffee category, but highlights that its growth still comes from a small base. “[C]old brew is still way too small for its sales to have a large impact on the category — it makes up less than 1 percent of the total RTD coffee segment sales,” she says. “Cold brew’s impact on the coffee category likely includes increasing awareness of different coffee preparation methods, educating consumers and introducing them to premiumized versions of RTD coffees outside of what they already know on store shelves.”

Although the cold-brew coffee segment remains small, it is creating headlines in both the consumer packaged goods (CPG) market and foodservice outlets.

For example, Austin, Texas-based High Brew Coffee received a Series A-2 investment of $4 million from CAVU Venture Partners, which also is based in Austin, Texas, earlier this year. Additionally, the company announced a new distribution partnership with Plano, Texas-based Dr Pepper Snapple Group. The distribution partnership was announced this spring and includes expanded distribution in key markets, it says.

Within foodservice, Starbucks Coffee Co., Seattle, and Dunkin’ Donuts, Canton, Mass., each added cold-brew coffee to their menus. Starbucks new “cold bar” of coffee and espresso products affirms the company’s ongoing investment in the iced beverages’ segment following its nationwide launch of Cold Brew last year in all U.S. company-owned stores, it says. In addition to bringing a handcrafted vanilla flavor to its Cold Brew coffee line, Starbucks also debuted a handcrafted Starbucks Doubleshot on Ice espresso beverage and introduced Nitro Cold Brew in select cities, it adds.

Dunkin’ Donuts initially tested its Cold Brew coffee in Metro New York and California markets. On Aug. 1, the customizable beverage became available nationwide.

Although foodservice and CPG brand owners have embraced the cold-brew coffee trend, Mintel’s Sisel anticipates that at-home consumption will have the greatest impact on the category’s future.

“Cold brew has created an opportunity to bridge the RTD coffee and roast/bean segments together with at-home cold-brew preparation, as there is now an interest in roasts specially made for making cold-brew coffee at home,” she says.

However, consumption rates could challenge this sub-segment as well as its parent segment — RTD coffee, according to experts.

“[T]he entire RTD coffee segment, including cold brews, continues to struggle with consumption frequency,” Sisel says. “Consumers are more likely to drink RTD coffees weekly or monthly or less often, than they are daily. The opposite is true with grounds/beans and single-cup coffees, where consumers are much more likely to drink those daily or multiple times a day than they are to drink it weekly or less.”

Hot Options

Although the coffee category is experiencing strong upticks from cold-brew and RTD coffees, the hot coffee market also is appealing to consumers’ premium tastes and desire for convenience.

In addition to RTD coffee, single-cup coffee is posting strong gains, outpacing the ground coffee segment. “Retail sales of coffee pods grew by 22 percent in 2015 to reach $4.6 billion, while standard fresh-ground coffee declined by 1 percent to $6.8 billion,” Euromonitor’s Lee says. “Consumers’ desire for convenience led single-cup coffee pods to achieve the highest sales performance among coffee categories in 2015.”

Beyond single-cup, coffee producers are turning to other product-attribute trends to appeal to consumers’ demand for premium products.

“The premiumization trend is driving demand for higher quality coffees such as organic coffee and single-origin coffee,” Euromonitor’s Lee says. “Organic coffee caters to both consumer interest in premium quality as well as a healthy lifestyle. Single-origin coffee has become a growing segment as consumers are interested in understanding how the coffee they consume is sourced.

“Single-estate coffee, that is coffee not only sourced from a single region but rather from a single farm, is another way producers have been able to support sales of premium coffee and offer a story to consumers that adds value to the product,” she continues. “As consumers increasingly look for more transparency from coffee producers, coffee producers are also emphasizing Fair Trade certification.”

Craft and artisanal trends are influencing the coffee market as well, experts note. “[T]hird-wave coffee roasters’ increasing popularity — particularly with millennials — updates the segment with premiumization,” Mintel’s Sisel says. “And, although niche, consumer interest in third-wave or premium/artisanal coffees is trending at a healthy rate. More than one in 10 consumers say third-wave (aka craft or artisan) coffee house brands are important to their decision-making process when choosing which coffee to drink. This increases to one in four older millennials.”

The NCA’s 2016 NCDT report also highlights the impact that millennials have had on the coffee market. The report found that daily coffee consumption among 18- to 24-year-old consumers jumped from 25 to 48 percent between 2000 and 2016. Additionally, those aged 25-39 saw consumption rise from 42 to 60 percent in that same timeframe.

These consumers also are a key component to the growth of premium coffee, with the NCDT report stating that older millennials, the 25-39 age group, are the most likely group to drink gourmet coffee beverages weekly, with specific options like cappuccino, latte, café mocha, espresso, macchiato, flat white and cold-brew coffee among their selections.

Mintel’s Sisel also highlights this consumer group’s aptness for high-quality, high-variety coffee options.

“Millennials — but, really, older millennials in particular — are still the core consumers of coffee at retail and are also the most likely to describe themselves as a ‘coffee snob,’” she says. “They drink the most variety of coffee types, they drink coffee at the highest frequency and they are the most interested in premiumized offerings, like third-wave coffees and cold brews.”

Traditional competition

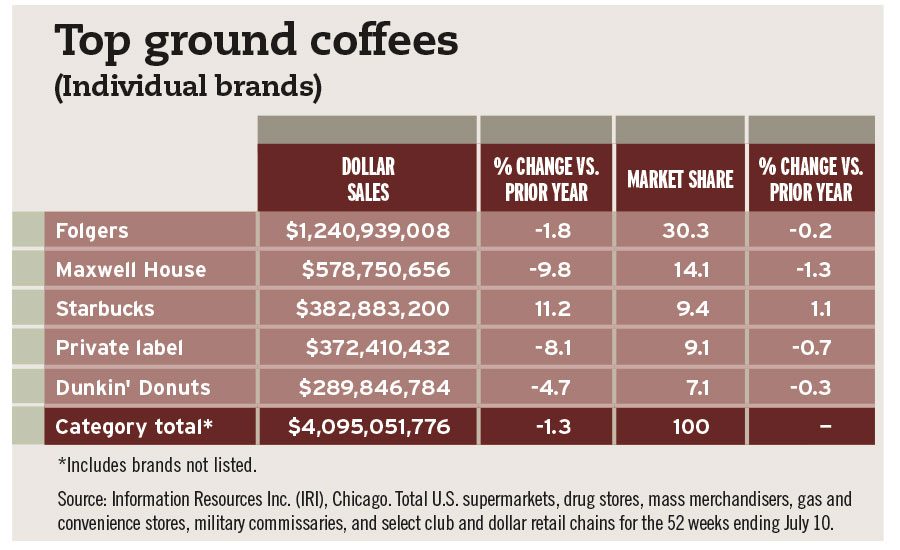

Because of the focus on premium, as well as increasing options, not all coffee segments have seen sales proliferate as of late.

“Ground and whole bean coffee sold through traditional retail outlets have been experiencing flat to down performance as consumers increasingly opt to purchase their coffee through different formats,” BMC’s Hemphill says.

Part of this performance could be attributed to these segments’ established markets. “The ground/bean coffee segment has plateaued, which is not surprising given its long-standing presence in the U.S. and that its market share has likely reached a peak with current consumers,” Mintel’s Sisel says.

Although the ground and whole bean segments have been relatively stagnant in sales, the premiumization trends permeating throughout the category could benefit all coffee segments, she says.

“Consumers are evolving into more sophisticated coffee drinkers and are looking for new ways to experience a favorite drink option, which will continue to fuel interest and participation in the premiumized coffee space across the ground/bean, single-cup and RTD coffee segments,” Sisel says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!