2016 State of the Industry: Sports and protein drinks see steady growth

Category remains solid performer due to health-and-wellness trends

At $11.2 billion and nearly $187 million, respectively, the sports drinks and ready-to-drink (RTD) protein drinks markets are expected to remain solid performers as a result of continued interest in health, convenience and function, according to market research analysts.

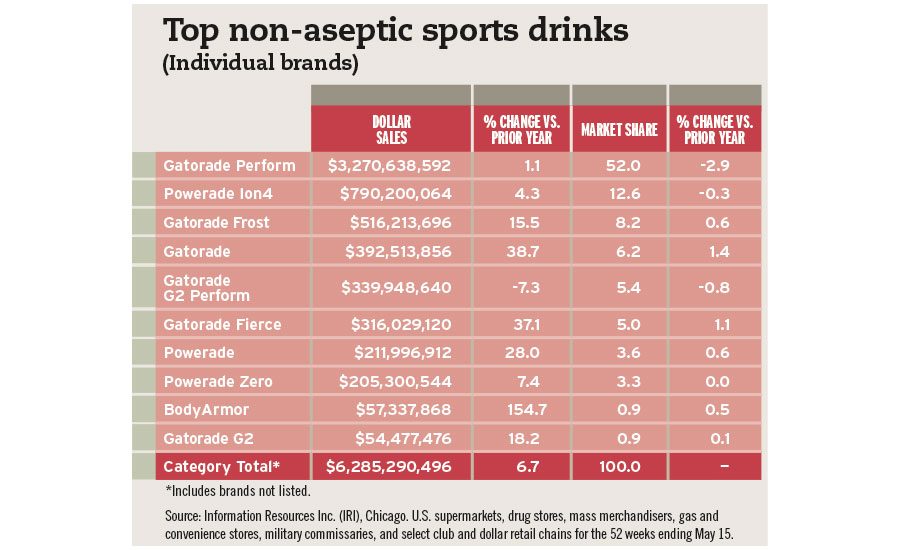

Sports beverages, like Purchase, N.Y.-based PepsiCo Inc.’s Gatorade and Atlanta-based The Coca-Cola Co.’s Powerade, are the fifth largest new age category by dollars and third by volume, according to New York-based Beverage Marketing Corporation’s (BMC) October 2015 report titled “U.S. Sports Beverages through 2019.” Gatorade and Powerade comprise 90 percent of the volume in the sports drink industry, it adds.

“The global wholesale sales of sports beverages was $11.2 billion in 2014, which is 5.1 percent more than 2013’s $10.7 billion and up from $4.7 billion in 2002,” the report states. “Sales are expected to advance at a compound annual growth rate (CAGR) of 3.5 percent in the next five years. Wholesale dollars in 2019 are projected at $13.3 billion.”

Plano, Texas-based Dr Pepper Snapple Group (DPS) entered the sports drink category through investments in Beverly Hills, Calif.-based BA Sports Nutritional LLC, which owns the BodyArmor line of premium sports drinks. DPS initially invested $26 million in BA Sports, but added a $6 million investment in April, increasing its ownership position from

11.7 percent to 15.5 percent, it says.

However, sports drinks have seen increased competition from other categories. In order to exploit an edge over flavored waters, sports beverage purveyors have increased their range of flavors, BMC’s report notes. Earlier this year, The Coca-Cola Co. released Powerade Twisted Blackberry and Powerade Ion4 Watermelon Strawberry Wave.

Entrepreneurial brand owners also are attempting to capitalize on the flavor wave. In 2015, Huntington, N.Y.-based ROAR Beverages and football player Odell Beckham Jr. launched the first product in ROAR’s Odell Beckham Jr. Series. ROAR’s OBJXIII is an all-natural strawberry-and-watermelon-flavored, coconut water-based sports drink, the company says.

RTD protein drinks also are experiencing growth. In 2014, the RTD protein drinks segment grew to nearly $187 million, with wholesale dollars increasing by 5 percent; however, this is a deceleration from the category’s 7.9 percent growth in 2013, BMC’s report notes. Only one brand, Benicia, Calif-based Cytosport's Muscle Milk, is demonstrating signs of breakout success to date, it adds.

In Beverage Industry’s May issue, New York-based Kantar Worldpanel USA’s Client Analyst Kevin Weissheir noted that protein drinks steadily are increasing in usage occasions. “Consumers … are using protein-rich beverages to both nourish their bodies after activity and as a meal or snack replacement,” he said.

Sports and protein drinks are not just for the hard-core athlete, notes Chicago-based Mintel in its January 2015 report titled “Nutritional and Performance Drinks,” adding that the category’s growth and wide appeal of products beyond athletes has resulted in significant sales increases.

“Some 61 percent of U.S. adults use sports drinks … [and] 34 percent of sports drinks users drink them even when they are not working out,” said Beth Bloom, food and drink anlyst at Mintel, in Beverage Industry’s May issue. “This rises to nearly half of respondents age 18-24. Such usage indicates the value of product positioning that moves beyond a sports focus, and highlights attributes such as hydration and flavor.”

Experts also noted that the category is expected to remain a solid performer because of continued interest in health, convenience and function, but the weight-loss drink segment will continue to struggle through 2019.

When it comes to wholesale dollars, BMC’s report predicts that sales of sports drinks will rise to $13.3 billion by 2019, with a steady CAGR of 3.5 percent. It adds that the protein drinks market will grow from an estimated $196 million in 2015 to $230 million in 2019.

Mintel’s Bloom said: “Opportunity exists to grow sales in the category by increasing usage occasions and establishing relevance in the lives of consumers. Promoting products for their proven efficacy in meeting a range of specific consumer needs, e.g., hydration, weight management, skin health, sustained energy, will [help] encourage consumption.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!