2016 State of the Industry: Flavor innovations, natural ingredients impact energy drinks

Category experiences steady growth

According to Los Angeles-based IBISWorld’s May 2015 report titled “Energy Drink Production in the US,” 67 percent of the U.S. population is concerned about having enough energy to get through the day which, in turn, has fueled double-digit growth in the energy drinks segment during the past five years. Additionally, with $8 billion in revenue, the category outperformed most other beverage categories, it adds.

Although consumers’ fast-paced lifestyles have paved the way for a wide variety of products that cater to their need for energy, energy drinks do not rank at the top. In its May 2016 report titled “Energy Drinks – US,” Chicago-based Mintel states that energy drinks came in third as the category consumers turn to for energy. This was behind meal-replacement drinks and snack/cereal/energy bars based on a survey of 2,000 Internet users ages 18 and older through March 30.

However, the energy drinks category is experiencing steady growth, with an estimated $11 billion in sales in 2015 and a forecasted $16.1 billion by 2020, the report states, citing data from Information Resources Inc., Chicago.

Yet, the report states that consumers are most likely to consume energy drinks/shots as an occasional pick-me-up, demonstrating the category’s standing as an infrequent beverage choice.

Although awareness of energy drinks and shots is increasing, a higher percentage of consumers actually are drinking more or the same amount of energy drinks and shots in 2016 as they did in 2015, the report states. Yet, the energy shots segment is experiencing contraction. “The energy shot segment has struggled since its last point of growth in 2011,” the report states. “Energy drinks’ category dominance has likely challenged the segment and will continue to do so in the future. Energy shots experienced an estimated 4 percent sales decline in 2015, hitting $1.18 billion. Future growth is expected to remain stagnant, if not slightly negative, decreasing an additional 1.8 percent in the period from 2015-2020.”

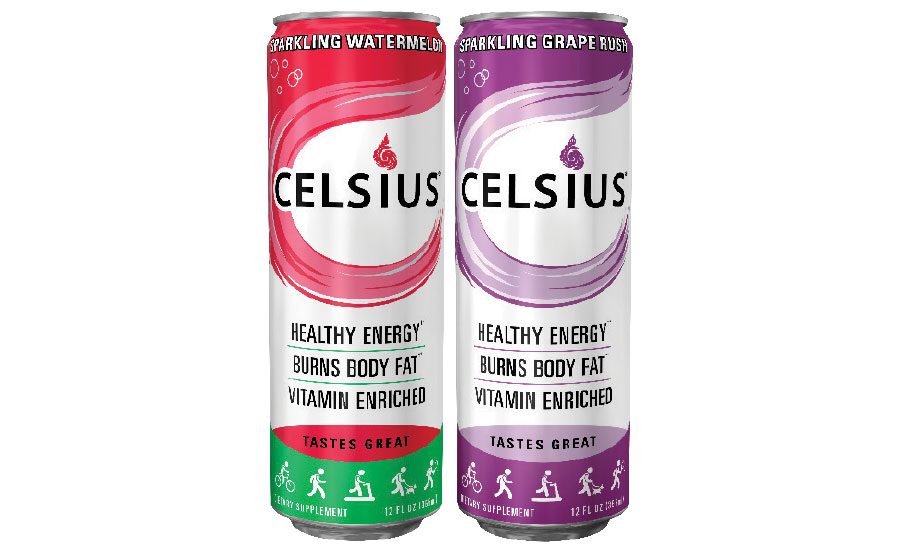

To help drive incremental growth, energy drink producers are introducing new flavor options, according to IBISWorld’s report. “While original-flavored products accounted for the majority of the energy drink volume sold in 2012, new flavors, such as lemon and coffee, have obtained greater share of energy drink sales,” the report states. “Consequently, original-flavored energy drinks’ share of the market has declined substantially over the past decade, according to Canadean.”

IBISWorld notes in its report that the health effects of consuming artificial sweeteners and caffeine is one of the primary concerns hindering consumers from entering the energy market. Because of this, more beverage-makers are introducing all-natural and healthier energy products, it says.

In response to consumer demand, beverage formulators also are using more natural ingredients, like guarana, honey, green tea and coffee bean extracts, in energy drinks. For example, Vacaville, Calif.-based Bee Energy released its Bee Energy Green Tea, which is made with honey and combined with natural caffeine.

However, consumers’ safety concerns with the energy drinks and shots markets has hindered entry, as such, transparency will be key in attracting new consumers, as well as retaining current drinkers, according to Mintel’s report.

“The energy drink and shot category continues to post strong growth, thanks to the successful energy drink segment,” the report states. “… Continued emphasis on taste and flavor will help draw consumers in … while there are a lot innovation opportunities to appeal to niche interest and core consumers’ groups, such as nutritional benefits and premiumization.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!