2016 State of the Industry: Almond milk trail blazes the dairy alternatives segment

Category continues to increase market share

As consumers look to fuel their bodies with healthy products, the consumer packaged goods (CPG) market is seeing dairy alternatives as a market that could fulfill that trend. In its April 2015 report titled “Dairy and Dairy Alternative Beverage Trends,” Packaged Facts estimates that U.S. retail for the category was $24 billion in 2014, representing a 4 percent increase from 2013.

Although the dairy segment dominates the dairy and dairy alternatives category with 80 percent market share, dairy alternatives steadily are gaining ground. The segment increased its market share from 14.5 percent in 2010 to 20 percent in 2014, Packaged Facts reports. This growth is projected to continue as the Rockville, Md.-based market research firm forecasts the category to reach $31.5 billion in 2019.

“The next several years will see intensified competition between dairy and dairy alternative beverages as both consumer comfort with the alternatives and criticism of dairy foods continue to grow,” said David Sprinkle, research director for Packaged Facts, in the November 2015 issue of Beverage Industry. “Sales of plant-based dairy alternatives, especially almond milk, show no signs of slowing and new alternative sources are expected to drive the alternative segment even faster and higher over the next several years.”

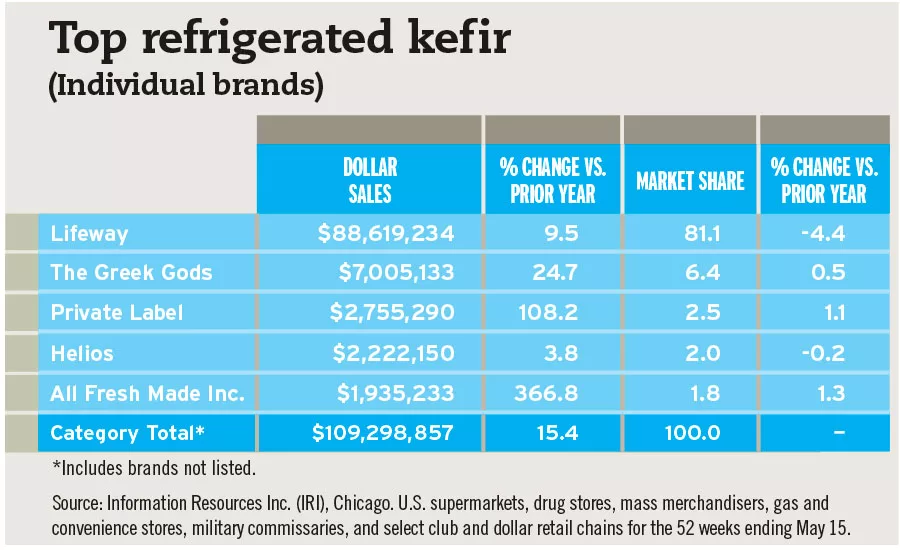

Refrigerated almond milk continues to lead the non-dairy segment, generating $938 million in sales year-to-date for the 52 weeks ending May 15 in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains, according to Chicago-based Information Resources Inc. (IRI). Refrigerated kefir beverages amassed sales of $109 million and refrigerated coconut milk generated $63.7 million in sales, respectively, for the same timeframe, based on IRI data.

Industry analysts note a number of different factors are contributing to the growth of dairy alternatives including demographic changes throughout the United States. “The Hispanic and Asian-American populations, which have a higher incidence of lactose intolerance, are growing faster than the total U.S. population,” Virginia Lee, senior beverage analyst for Chicago-based Euromonitor International, said in the November 2015 issue of Beverage Industry.

According to IBISWorld's January 2015 report titled “Soy & Almond Milk Production in the US,” soy milk now accounts for 25 percent of the segment, while almond milk represents 65.5 percent. Rice milk accounts for 5 percent, while coconut milk maintains 3 percent of the market share, the Los Angeles-based market research firm reports. Other represents the remaining 1.5 percent.

In addition to demographic shifts, dairy alternatives are hitting on health-and-wellness and animal-protection trends. “There has also been growing interest in a vegan diet to support animal rights and to protect the environment,” Euromonitor’s Lee said in Beverage Industry’s November 2015 issue. “Raising cows to produce milk requires the use of feed, which produces a lot of waste and emits methane. The fact that non-dairy milk alternatives are lower in fat than cow’s milk gave sales another boost as older consumers seek to reduce fat consumption to prevent and/or manage heart disease.”

Segment leaders continue to broaden their portfolios in order to appeal to these consumer trends. Last year, Broomfield, Colo.-based White Wave Foods’ Silk added Cashewmilk to its lineup of plant-based dairy alternative offerings. Silk’s Cashewmilk is available in four varieties: Silk Original Cashewmilk, Silk Unsweetened Cashewmilk, Silk Chocolate Cashewmilk and Silk Vanilla Cashewmilk. The cashew-based beverages are free of cholesterol, lactose, dairy, soy and gluten. They also are verified by The Non-GMO Project.

Beyond almond milk, other plant-based dairy alternatives are gaining steam. Earlier this year, Rebel Kitchen, Dover, Del., added a new flavor to its line of premium dairy-free coconut milks: Chai.

Cashew, hemp and hazelnut milks also are growing, but account for a small portion of the market, the Packaged Facts’ report adds. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!