Can filling, seaming equipment need grows as packaging trends move toward cans

Craft beer industry, varying can styles drive innovation

Thirty-eight percent of consumers prefer aluminum cans when tailgating versus 26 percent who prefer plastic bottles. Thirty-six percent of consumers prefer cans at barbecues or picnics, compared with 30 percent who prefer plastic bottles. This data from the Washington, D.C.-based Can Manufacturers Institute (CMI) white paper titled “Open up to Cans” highlights one of the reasons why many beverage-makers are looking to cans as a packaging option. Several beverage-makers that have added cans to their portfolio note that they provide expanded drinking occasions.

However, CMI’s white paper, containing data from a study conducted by Chicago-based FoodMinds, notes that cans also have potential to build consumer loyalty. “Research also showed that cans facilitate daily consumption,” the white paper states. “In categories where cans dominate, and even in categories where cans are not the most frequently consumed container, cans tend to be consumed more often by frequent daily users.”

Additionally, consumers are looking to cans for their sustainability halo. CMI’s white paper notes that 47 percent of consumers see cans as easy to recycle and 30 percent believe that cans have the lowest environmental impact.

Further supporting the growth of the can industry, The Freedonia Group Inc., a Cleveland-based market research firm, released a study titled “Beverage Containers,” which highlights an increase in demand for beverage containers through 2017. According to the study, demand for beverage containers in the United States is expected to reach 265 billion units by 2017, a value of $29.1 billion. The company notes that these gains partially will be driven by consumer preference for single-serving containers in many markets.

Metal beverage cans, which are the second largest beverage container type in unit terms, according to the market research firm, offer single-serve options, among many other benefits that have made them a growing packaging option for various beverage categories.

As can packaging options continue to expand to new categories and occasions, the shift in demand has been felt throughout the canning industry. “By far, the greatest impact [on the filling and seaming equipment industry] has been the resurgence of the can as a viable packaging solution,” says Parrish Stapleton, co-owner of Dixie Canner Co., Athens, Ga. “The craft beer industry has exploded as well, every brewer wants to package their products in containers that will give them the longest shelf-life, [are] easy to store and to carry with you, as well as be environmentally friendly; cans are the answer.”

Small brewers, big impact

Craft brewers increasingly have been turning to cans as a packaging solution allowing consumers to bring their craft brew to new occasions and appealing to sustainability concerns, experts note. The more cans produced by craft brewers ultimately results in an increased demand for the quality assurance (QA) measures that the package requires.

However, Albany, N.Y.-based CMC-Kuhnke Inc.’s Marketing Manager Maura Marcks notes that craft brewers face their own challenges. “Craft brewers are typically on a tighter budget and have less output than mainstream beverage companies,” she says. “Therefore, they seek out customized solutions that fit their small-production needs and budgets. Small, more inexpensive options become more available as the demand has increased from growing beverage companies. Craft brewers are also often new to seaming, and seek out websites like doubleseam.com or look to technical support packages from their suppliers.”

Doubleseam.com is an online trouble-shooting guide provided by CMC-Kuhnke. It offers a glossary of terms and topics relating to the seaming industry as well as abbreviation, dimension and evaluation guidelines.

Roberto Baroni, sales manager at Imeta srl, Italy, echos similar sentiments: “The new, [incredibly] growing market for canned craft beer requires filling/seaming equipment for unusual low capacity. The machine manufacturers have to design new, simple and cheap mono-blocks for them.”

Marcks adds that craft brewers also have increased the demand for mobile canning services, noting The Can Van as one example. Based in the San Francisco Bay area, The Can Van brings canning equipment and services to craft brewers throughout California.

Sourcing of packaging and cost of machinery are additional problems for small manufacturers, like craft brewers, according to Stapleton. “Small manufacturers may not have the volume of business to warrant high-speed production, or space to store all the equipment and packaging supplies that packaging manufacturers may require you to buy as a minimal order,” she says. “Cost is another factor; it can be expensive to start a new filling/seaming line.”

However, she notes the number of options available, as well as new innovations, to help overcome some of these challenges. “There are contract-packaging options, purchase of new equipment, there are many used-equipment options available as well,” she says. “Dixie Canner specializes in the manufacturing of low-volume can seamers. With models available from $5,100 with the capacity of 900 cans an hour, up to 1,800 cans per hour, our inexpensive, dependable machinery can provide low-volume canning solutions at a minimal capital investment.”

Mike Mangone, vice president of sales with Havre de Grace, Md.-based ShoreLine Packaging and Processing Machinery, the U.S. representative of Swiss-based Ferrum’s Fill range of can seamers, notes that filling and seaming equipment are accommodating the unique demands of the craft market.

“[Filler] suppliers now offer fillers that are compatible with the, typically, much slower requirements of craft brewers. At the same time, the seamer suppliers ... now offer seamers that also fit the slower speed requirements, where as prior to this, it was difficult to get a filler and seamer combo rated for speeds less than 300 cpm,” he says.

CMC-Kuhnke’s Marcks notes that as the more brewers are looking to cans, opportunity for these small brewers, and other small-beverage companies, might grow. “Can-makers offering smaller minimum order quantities may provide smaller beverage companies the opportunity to purchase their own seaming equipment, and can more varieties and smaller seasonal batches,” she says.

Fulfilling quality

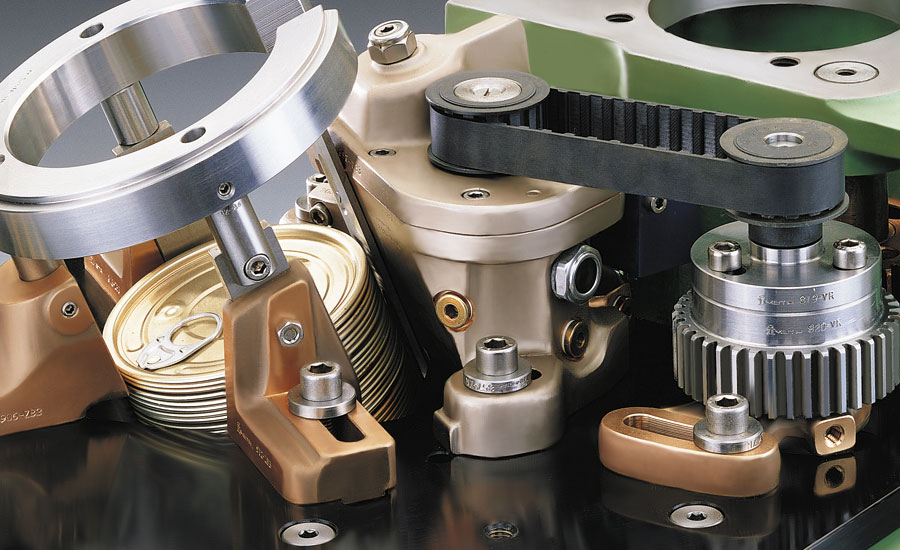

As more beverage-makers incorporate aluminum cans into their packaging portfolios, can filling and seaming is an essential step in the QA process. “[It is important] to ensure a safe, secure and properly formed double-seam on cans and to monitor any maintenance or adjustments needed over time on the seaming equipment,” CMC-Kuhnke’s Marcks says.

Although it is essential, it does not come without its own challenges. Filling and seaming experts note that these challenges show through in a variety of ways.

Dixie Canner’s Stapleton emphasizes the importance of knowledge and maintenance to ensure filling and seaming equipment is providing quality products. “With regards to can seaming, everyone should completely understand the double-seam as well as the machinery performing the double-seam,” she says. “Everyone needs a top-notch [quality control] (QC) plan in place. The machinery should be maintained daily. …Machines, like cars, have metal-on-metal wear parts that need to be cleaned, greased and oiled to work properly.

“As machines wear they will require adjustments to maintain and seam cans within the can manufacturers seam specifications,” she continues. “Bottom line, the end-users are responsible for QC, and if they do not have a good QC program from the start they will have costly and possibly company-closing results.”

As beverage-makers look to innovate and stand out on the shelf, new types of closure options have become available including more sustainable, lighter weight aluminum for making the cans. ShoreLine’s Mangone notes these changes are not without challenges. “As always, the can makers continue to try to make cans and ends lighter-weight and this makes it increasingly difficult to produce a quality seamed can that doesn’t wrinkle or crush at top production speeds,” he says.

However, Dixie Canner’s Stapleton also notes that this growing variety of aluminum has its challenges and advises that when purchasing equipment, a beverage-maker should find the right application for the package. “The variety of can types, the materials used and quality of finished package are the biggest challenges today. Cans are highly engineered and use less and less material to produce the finished container. These fragile containers require special handling and very precise machinery to fill and seam,” she says. “There is a lot of technology out there available on the open market.

“Certain applications work best with certain types of packages,” she continues. “The higher the speed, the more this becomes an issue. Understand what type of machinery you are using, what size/type container it works best with, what the cost for tooling/change parts will be, maintenance requirements, etc. Make sure that everything fits into your long-term goals. The worst mistake one can make is to invest in a line that will be obsolete before your [return on investment] (ROI) is complete.”

Imeta srl’s Baroni adds that the varying styles of cans have called for an increased demand for quick change-over. He notes that reduced operator presence, high line-speeds and metal down-gauging are other challenges faced by filling and seaming equipment.

“The machines must be in the perfect conditions and have preventive maintenance and more electronic in-process controls,” he notes. However, he says that utilizing the simplest and smartest design will overcome these challenges.

Filling the warehouse

As the second largest beverage packaging option, cans continue to demand more from the filling and seaming equipment needed for them. Experts note the variety of options available to a beverage-maker looking to offer can packaging.

According to Marcks, CMC-Kuhnke offers double-seam inspection equipment for fillers. “Products like the SEAMscan SPC system provide beverage fillers with a precision optical seam scanner, double-seam measurement software and a powerful SPC database,” she says. “SEAMscan SPC’s user-friendly Windows interface is quickly tailored to easily lead operators through your seam inspection process, and the powerful reporting system provides in-depth analysis for advanced statistical process control (SPC).”

According to the company’s website, the SEAMscan XTS is semi-automated and measures the internal parameters of a double-seam. The X-ray system measures seam height, body hook, cover hook, overlap, seam gap, percent body hook butting and percent wrinkle rating (percent tightness). Options for measuring seam thickness, countersink depth, can height, 360-degree scan for wrinkles, percent tightness and amplitude, also are available with this unit.

Dixie Canner offers seamers that close a variety of sizes, within each model’s range, and work with metal, plastic or paper containers. “We are able to close any type of round can and lid to the can manufacturer’s seam specifications,” Stapleton says.

Dixie Double Seams all feature seam rolls that interlock with a chuck, which ensures a proper alignment. Additionally, turning only occurs during the seaming process, eliminating spills. The company’s floor-model seamers are equipped with an air-lift system that makes operation easier, according to the company.

Dixie Canner also offers its seamers with a vacuum chamber, which is available with vacuum, gas flush, multi-flush and timed delays.

Imeta srl offers rebuilt seamers for mid-high speed lines as well as new seamers for low-speed lines, according to Baroni. Additionally, the company offers chucks and rolls, upgrading kits, and spare parts for seamers. The company also has been working on high-capacity seamers for non-standard applications.

Ferrum offers high-, medium- and low-speed can seamers. According to the company, its high-speed seamer, the F18 can seamer, can accommodate 850 to 2,500 cans a minute with diameters between 50 and 73 millimeters (mm).

Medium-speed can seamers available from Ferrum include the F9, which handles 400 to 1,125 cans a minute with diameters ranging from 50 to 99 mm; the F12-1 performs at a rate of 580-1,600 cans a minute with diameters between 50 and 73 mm; and the F12-2 works with the same size cans, but offers a top performance rate of 1,750 cans a minute.

Ferrum’s low-speed options provide more versatility when it comes to can sizes. Handling cans as large as 106 mm, the F5 model seams 210 to 625 cans a minute. The company offers two other low-speed models, the F6, which accommodates cans up to 100 mm in diameter at a rate of 250-750 cans a minute, and the F8, which seams 330 to 1,000 cans a minute, for cans 50 to 73 mm in diameter.

As more styles of cans become available, more beverage categories will consider expanding their packaging portfolio to include aluminum cans as a packaging option. Innovations from the can filling and seaming industry to accommodate smaller batch sizes as well as varying can sizes will continue to support this proliferation.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!