Private-label beverages focus on healthy living

Milk, water and coffee pods drive store brand categories

Price often plays a role for consumers when choosing a beverage brand, and many budget-conscious consumers seek out private-label brands for their value based on cost and quality. Although the private-label market has remained flat, retail sales for food and beverages topped $115.3 billion in 2014, a 2.6 percent increase versus 2013, according to New York based-Beverage Marketing Corporation’s (BMC) October report “Private Label Beverages & Contract Packaging in the U.S.”

The report notes that private label accounts for a major part of the milk, bottled water and single-cup coffee categories, with private label carbonated soft drinks (CSDs) and ready-to-drink (RTD) tea experiencing low single-digit growth.

Shelf-stable fruit beverages saw double-digit growth, the report notes. “In 2014, 12.3 percent of shelf-stable fruit beverage sales in supermarkets were accounted for by private label, generating nearly $530 million in sales,” the report states.

Private label accounted for 31.1 percent of the total U.S. bottled water volume, it adds. The category also has seen strong single-digit growth. “Bottled water volume approached 10.9 billion gallons in 2014, an increase of 7.3 percent over 2013, with retail dollars exceeding $25 billion in 2014, but grew at a lesser rate than volume,” the report states.

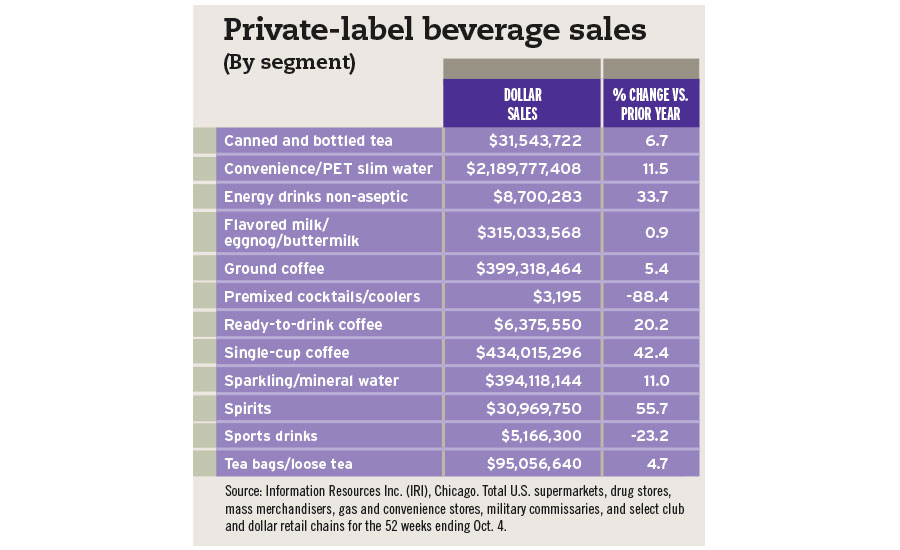

Chicago-based Information Resources Inc. (IRI) notes that private-label sparkling/mineral water totaled more than $394 million, an 11 percent increase, in multi-outlets for the 52 weeks ending Oct. 4. Other notable private label increases were in single-cup coffee and spirits. With $434 million in sales, private-label single-cup coffee grew 42.4 percent compared with the prior-year period, while private-label spirits sales were up 55.7 percent totaling $30.9 million.

Private-label beverage sales in were relatively flat — up less than 1 percent — compared with 2012, totaling $22 billion, according to a September 2014 report from Rockville, Md.-based Packaged Facts titled “Private Label Foods & Beverages in the U.S., 8th Edition.” Units sold were estimated at 43 billion and were flat compared with 2012, the report adds.

With the exception of milk, the September 2014 report notes that non-alcohol beverages have low private-label penetration due to the presence of strong national brands and competitive pricing in many categories. For example, private-label juices accounted for 13 percent of total beverage sales in dollars and units, according to Packaged Facts. Coffee and tea private-label products were approximately 9 percent of sales. The market research firm also reported that private-label carbonated beverages were less than 10 percent of sales, and private-label sports and energy drinks accounted for less than

2 percent of total beverage sales.

Brewing savings

A November report from Rockville, Md.-based Packaged Facts titled “Single-Cup Brew Beverage Products in the U.S.,” highlights that single-cup sales are growing more robustly than sales of branded single-cup coffee, which have declined. “Sales momentum is clearly in favor of private label. …Innovation and expansion of private label has made single-serve brew beverages more easily accessible and affordable,” says David Morris, analyst and author of the Packaged Facts report.

Many major supermarkets, including Giant Eagle, Meijer and Target, are adding single-cup to their private-label coffee lines, Morris says. For example, in 2015, Giant Eagle added K-Cup compatible to its Market District brand, with five variants and two flavored coffees: Hazelnut and French Vanilla. Target’s Archer Farms brand includes flavored coffee, limited-edition products, such as Pumpkin Spice, and other single-cup brew beverages including Spiced Cider, Ginger Green Tea and Strawberry Lemonade Fruit Brew.

Although the coffee pod segment is experiencing growth, consumers are not seeking out private-label premixed cocktails and coolers or private-label sports drinks, according to IRI data. These categories experienced declines of 88 percent and 23 percent, respectively, in U.S. multi-outlets for the 52 weeks ending Oct. 4.

Most of the smaller beverage categories, including RTD tea and coffee, have limited private-label sales, according to BMC’s report. Although the same is true for private-label wine and beer, “wine may have the best potential for growth in private label of all the alcohol segments,” the report says.

“America’s three largest supermarket operators — Wal-Mart, Kroger and Albertsons — all offer exclusive brands for the most popular wine varietals. …One Trader Joe’s house brand, Charles Shaw, is most famously known as ‘Two-buck Chuck’ in honor of its $1.99 price tag, which has since increased,” notes the report.

Retail dollar sales in the private-label beverage market are projected to grow by a compound annual growth rate of nearly 2 percent to $24 billion in 2018, according to Packaged Facts September 2014 report. “Growth will be driven by inflation and rising prices as unit growth will likely continue to decline,” the report states. “The private-label beverage market is expected to underperform the total beverage market in unit sales growth.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!