Whether they’re used by fitness enthusiasts or as on-the-go meal replacements, protein-fortified beverages are carving out their place in the beverage market. According to Chicago-based market research firm Mintel’s Global New Products Database, 74 beverages containing protein were released from January to June in 2013. In comparison, 49 drinks containing protein launched during that same time period in 2012.

“Overall, the protein market in ready-to-drink (RTD) beverages, powdered beverages and meal replacements is up significantly versus last year, and we believe that trend will continue,” says Barry Spors, director of research and development for Wisconsin Specialty Protein, a subsidiary of Omega Protein Corp., Houston. “As we move to an ‘on-the-go’ society, demand has increased for healthy products that are quick and easy to consume and prepare. In addition, consumers are searching for wholesome and natural methods to ingest a well-balanced diet, which is contributing to the upward trend of the protein market in beverages.”

Echoing similar thoughts, Gwen Bargetzi, director of marketing for Hilmar, Calif.-based Hilmar Ingredients, explains that consumers are using beverages in different ways than in the past.

“No longer on the table to ‘wash down the food,’ beverages, in some cases, have become the food as consumers use them for snacks, meal alternatives and nutrient boosts,” she says. “The availability of drink-friendly proteins and greater consumer appreciation for protein health benefits has spurred its use in beverages.”

To help meet these growing consumer demands for convenient, healthy products, beverage-makers are turning to proteins to fulfill a variety of functions.

“Those within the sports nutrition area are still utilizing protein for its muscle-building capacity, though more specialized blends are being developed to target pre- and post-workout occasions and maximizing the effectiveness of protein on muscle development and speed of damage repair,” says Russ Hazen, raw materials and innovations specialist for Schenectady, N.Y.-based Fortitech, a part of DSM. “Many products outside of this realm are employing protein’s satiety-inducing ability in products being developed for the weight-loss and -control market. This is perhaps where the greatest opportunity lies for manufacturers.”

And as more consumers look for protein content to fulfill their health and wellness needs, suppliers and manufacturers are finding more opportunities to meet those demands.

“Overall, we’re seeing a greater interest in incorporating some extent of protein in a number of different consumption periods throughout the day and different types of beverages,” says Shana Smidt, business development manager for Glanbia Nutritionals, Evanston, Ill. “From that aspect as well, we’ve been challenged to develop proteins that work in different types of beverages and at different concentrations. A thing that has always been looked at are protein shots or concentrating protein into smaller amounts for kids, for example.”

In addition to its consumer packaged goods characteristics, proteins also play a functional role in formulation.

“Formulators are using protein to provide fortification, mouthfeel (viscosity), stability (emulsification), heat stability, acid and heat stability, and clarity,” says Grace Harris, director of applications and new business for Hilmar. “Whey proteins are unique in that they can be used in both acidic and neutral-pH beverage formulations. No other protein can do what whey protein can do in a formulation.”

Among its variety of whey proteins for beverage formulation, Hilmar’s WPC 80 line of proteins has been enhanced for heat stability, viscosity control, acid stability and an excellent amino acid profile, Harris explains.

The company’s whey protein hydrolysates also offer heat stability, even under retort conditions, as well as amino acids and pre-digested protein, Harris adds.

Also recognizing the benefits of whey protein, Glanbia offers its Bev-Wise line of protein systems for desired beverage systems. For example, its Bev-Wise A-100W is a pre-acidified whey protein isolate that can be used in high-acid beverages, Smidt explains. It can create a less astringent and clearer beverage that processes well, she adds. However, for intermediate pH levels, Glanbia’s Bev-Wise A-300W, which also is pre-acidified, is a whey protein isolate that could be suitable for categories like smoothies.

But milk proteins like whey and casein are not the only mainstream avenue that ingredient suppliers are turning to for protein.

“Over the last few years, the market for soy proteins has shifted,” says Tim Burrows, director of strategic marketing with Decatur, Ill.-based ADM’s foods and wellness division. “Ten years ago, soy protein was primarily viewed as an extender in meat products. Now, consumers are aware of the benefits of soy as a high-quality, nutritional food choice. Isolated soy proteins are the only vegetable-based proteins with a protein digestibility corrected amino acids score (PDCAAS), a measure of protein quality that is comparable with animal proteins.”

Burrows notes that as weight management products continue to expand, soy protein can assist that trend. “Studies are finding that low-fat proteins like soy proteins have a positive impact on satiety and glycemic response,” he says.

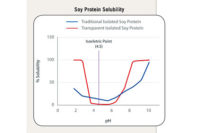

To meet this demand, ADM offers Clarisoy, a soybean-sourced protein that can be added to finished beverages without compromising quality or taste, he explains.

The company also offers CardioAid, a brand of plant sterols, which was recently expanded to include a water-dispersible version.

New crop of proteins

Fortitech’s Hazen notes that although the protein beverage market is growing, it also is segmenting into specialized areas, which are growing dramatically.

“There is still a lot of ‘traditional’ soy- and whey-fortified protein beverages being developed and launched into the market, but there is an increase in momentum being gained in the ‘novel’ vegetable protein arena,” he says. “Protein from a number of vegetables and grains are making their way into mainstream beverage launches. These include everything from pea and rice protein to quinoa and chia. This is allowing protein beverages to move beyond their traditional place within the sports performance nutrition market and into more mainstream consumer products targeting weight loss.”

Neelesh Varde, senior product manager with Geneva, Ill.-based Roquette America, adds that proteins such as pea and algal also are emerging.

“More recently, pea protein has addressed the need for a non-allergenic, high-quality, non-[genetically modified organism] (GMO) protein source with good nutritionals and functionality,” he says. “One of the emerging proteins is algal protein, [which is] derived from microalgae.”

As part of its protein line, Roquette offers Nutralys, its line of proteins sourced from yellow peas. The beverage-suitable proteins are concentrated at 85 percent, non-GMO and free of allergen concerns, Varde says. The company’s algal protein also offers a respectable amino acids profile and does not affect the texture, he explains.

Offering an alfalfa protein concentrate, Wisconsin Specialty Protein’s Alfapro contains more than 50 percent protein, essential amino acids, 13 minerals, eight vitamins, chlorophyll, xanthophylls and omega fatty acids. Its sister company Cyvex Nutrition developed SolaThin, a protein isolate made solely from potatoes.

Overcoming challenges in protein fortification

Whether it’s choosing milk- or plant-based proteins, beverage formulators have a number of things to consider when developing products to satisfy consumers’ health and wellness demands as well as taste preferences.

“The primary challenge with these protein ingredients [is they] are organoleptic in nature,” says Russ Hazen, raw materials and innovations specialist for Schenectady, N.Y.-based Fortitech, a part of DSM. “While the protein products have come a long way, there are still some flavor and texture challenges that need to be overcome. Many protein products can provide an undesirable flavor ranging from astringent or bitter to beany or oaty. [Although] some of this can be addressed through the finished product flavor profile, many products rely on flavor masking technology to help. Texture is also important, and some products can give a gritty or chalky mouthfeel that may require the addition of gum or stabilizers to help smooth out the product.”

Barry Spors, director of research and development for Wisconsin Specialty Protein, a subsidiary of Omega Protein Corp., Houston, notes that each type of protein faces its own set of challenges based on the individual formulation, such as pH, fat content, ingredients utilized, as well as a number of other factors.

“In order to successfully utilize protein in beverages, it is important to understand the various functional properties of each individual protein and how they interact with other ingredients being used,” he says. “These properties will directly impact how the protein functions as well as the solubility, mouthfeel, flavor, clarity and stability of the finished product.”