Organic and natural holding strong

Natural claims show higher growth potential

Sales of organic refrigerated non-dairy beverages outpaced their natural counterparts from 2009 to 2011, according to Mintel.

Adding to the organic refrigerated juice segment, Bossa Nova Superfruit Co. LLC, a subsidiary of The Sunny Delight Beverages Co., recently launched a lower-calorie version of its organic superfruit beverage line.

Using all-natural ingredients, Utmost Brands launched Dry Root Beer variety under its GuS – Grown-up Soda brand this year.

Through the Pepsi Lipton Tea partnership, PepsiCo offers Lipton 100 Percent Natural Iced Teas in popular natural flavors such as its Pomegranate Blueberry variety.

Consumer awareness about healthy food and beverage choices continues to grow and benefit the natural and organic beverage market. The market showed resilience during tough economic times with natural and organic food and beverage sales growing 9.4 percent in 2010 in mass merchandise, food, drug and convenience channels, as well as natural and specialty markets, according to a Mintel report titled “Natural and Organic Food and Beverage: The Market.” From 2009 to 2011, the natural and organic food and beverage market grew 20 percent, the October 2011 report adds.

According to the Chicago-based market research firm’s report, standout segments for natural and organic included functional beverages, which grew 69 percent from 2009 to 2011, as well as the coffee, coffee substitute and cocoa segment, which grew 78 percent in the same time frame.

In the overall natural and organic food and beverage market, natural products outpaced organic products by 7 percent, with natural seeing 23 percent growth from 2009 to 2011 and organic product launches growing

16 percent during that time period, Mintel reports. The refrigerated juice and functional beverage segments experienced moderate growth during that time period with declines in organic sales being offset by strong natural growth, according to the report. Natural accounts for 83 percent of the market share for refrigerated juices and functional beverages in the natural and organic market, Mintel reports.

“Organic is certainly an expanding and growing area, but if you look at the sales of products that are deemed natural, I think it’s a much wider breadth of products,” says Anton Angelich, group vice president of marketing for Virginia Dare, Brooklyn, N.Y.

Not all categories have seen natural overtake organic, though. According to Mintel’s report, sales of natural and organic refrigerated non-dairy beverages, such as soy and rice milk, increased nearly 21 percent from 2009 to 2011 with organic sales outpacing natural.

Meeting the demands

Although the natural and organic food and beverage market has seen recent success, consumer purchase behaviors have led product launches.

“Health-conscious consumers are driving the demand for healthier products and healthier ingredients as consumers are more apt to see foods as useful in preventing [and] in treating health problems,” says Stephanie Weil, product manager and beverage scientist with Wild Flavors Inc., Erlanger, Ky. “Consumers are demonstrating greater awareness of health issues, with many checking ingredient lists and comparing product claims.

“Front-of-pack claims also have a significant impact on their purchasing decisions,” she continues. “The desire for simplicity and naturality — meaning naturally functional — inspires consumers to look toward natural and organic claims, both having a sense of purity without overt education.”

St. Louis-based Sensient Colors Inc.’s Emina Goodman, technical support manager of the company’s beverage and dairy group, also emphasizes the importance of easy-to-read labels.

“The market is pushing for clean labels and easily understood ingredient lists,” she says. “Consumers are demanding products with cleaner ingredient labels and beverage companies employ natural colors to differentiate their brands in a very competitive market.”

Mintel predicts that generational changes could benefit the natural and organic food and beverage market from 2011 to 2016 with growth coming from avid natural and organic consumers, the millennial generation, which is increasing its spending power, and the aging baby boomer generation that is becoming more interested in healthy eating. With that, Mintel expects the natural and organic food and beverage market to see annual growth of 11.5 percent for the next two years with sales reaching $23.5 billion through 2013, at current prices.

New lifestyle choices from consumers also are driving the segment’s growth.

“Natural and organic products are perceived as being healthier and of higher quality,” says John Crandall, vice president of sales and marketing for Amelia Bay, Alpharetta, Ga. “As consumers move away from soft drinks and other sugary mass-produced beverages, they tend to make choices that are natural and organic, with labels they can identify with and understand.”

Colorful choices

With a growing consumer base, beverage-makers are tasked with developing products to meet their expanding needs.

“Manufacturers speak to these trends by transitioning existing brands to natural flavors and colors, thus an opportunity to bring more interest to products by addressing consumer demands,” Wild’s Weil says.

Weil adds that the scrutiny that artificial colors have received in the last couple of years has helped natural colors experience a rapid rise in both food and drink categories.

Mintel’s report highlights that major beverage manufacturers responded to interest in healthier foods and beverages by introducing better-for-you snacks and drinks. They also began highlighting the natural ingredients in products and reformulating more often with natural ingredients. However, some ingredient suppliers expect more customers to turn to natural or organic ingredients when developing new products instead of during product reformulation.

“I think we’re going to see more and more beverage producers with new products coming out that are going to have the naturally derived colors in them and more natural, more toward the organic side and less formulations starting out with the synthetic colors,” says Glen Dreher, application scientist for beverages for D.D. Williamson, Louisville, Ky. “There’s less in the U.S. of companies trying to replace synthetic colors in existing products. It’s really hard to do that because once the consumer knows your product in and out, they can detect really small changes, whereas when you’re formulating from the get-go with a new product it’s something new, it’s better, you can get more consumer acceptance that way.”

However, working with naturally derived colors can still present a challenge for beverage developers. Dreher notes that because of the lack of a U.S. Food and Drug Administration (FDA) definition of “natural,” adding a naturally derived color to a product developed with other natural ingredients limits the manufacturer from using the claim of “100 percent natural” on the bottle if that source is not naturally found in that product.

The label claim limitation, though, does not hinder naturally derived colors’ appeal to consumers. Using naturally derived colors, such as those offered by D.D. Williamson, can present a clean label with words and phrases that consumers recognize, such as beta-carotene, Dreher says.

“Consumers are looking for a cleaner label; they want to see words they understand, recognize and can pronounce, and that’s where naturally derived colors have a good role,” he says. “Consumers are used to seeing beta-carotene or beta-carotene for color. They understand that; it’s not foreign to them. In their perception, it’s more natural.”

Beta-carotene as well as other ingredients from the carotenoid family can be used to answer increased requests for naturally derived yellow and orange hues. Dreher says emulsion technology advancements have allowed companies to offer clean color options versus the hazier appearance in the past. These advancements have been of interest for manufacturers, especially those developing enhanced waters.

The market also has seen requests for naturally derived pink and red hues delivered from anthocyanins, which are usually sourced from fruit and vegetables such as elderberries, purple carrots and purple sweet potatoes.

Although the ability to match synthetic colors is not an easy task depending on the color request, Dreher says more beverage developers are embracing that change.

“There is less of a concern from the producers to want to match an FD&C color exactly and more ‘Let me see a range of color that you can deliver,’ and they adjust their hues,” he says.

Not all color options offer a natural solution comparable to the synthetic color range. “The challenge with natural colors is finding a blue that can replicate the rich shade of certified colors,” Sensient’s Goodman says. “Since blue is a primary color, which is also used to develop green and purple, this affects the development of vibrant shades in this color range.”

Goodman also highlights that the elimination of preservatives from natural color systems will reduce the color’s shelf life. Sensient’s aseptic packaging system provides a solution by offering beverage developers a preservative-free natural color with a shelf life comparable to a preserved color, she says.

“Natural colors react differently with changing environments in pH, light and heat stability,” she says. “For example, anthocyanins are stable at a low pH. Shade shift is observed at higher pH values, which also results in decreased stability. Beet is the only water-soluble red that is not significantly impacted by pH changes, but it is thermally unstable especially in high water activity applications. Beet normally does not survive pasteurization conditions so it is rarely used in ready-to-drink (RTD) beverage applications.”

Sensient is developing solutions to address these challenges. Currently, it is in the process of testing an encapsulated beet color in RTD dairy beverages.

Ingredient suppliers also are seeing many requests for natural and organic caramel colors.

“People are always calling us up asking if our products are natural. As a supplier of an ingredient, we don’t want to take that responsibility of saying ‘This is natural,’ but what we do is ask people: ‘What are your requirements? How do you define natural?’ And we respond very honestly to those questions,” says David Tuescher, technical director for Sethness Products Co., Lincolnwood, Ill.

Of the four classes of caramel color that Sethness offers, Tuescher says Class 1 typically is the ingredient that companies turn to for natural products. Class 1 caramel color does not have anything added to it; it is merely a carbohydrate with a possible pH or heat adjustment, he says. Sethness also offers an organic-certified Class 1 caramel color. Class 2 adds sulfite, Class 3 adds ammonia and Class 4 has sulfite and ammonia added, he says.

Tuescher acknowledges that Class 1 caramel color has some limitations because it does not work in all applications.

“When you go to a cola you can’t use phosphoric acid; none of the Class 1s will stand up to the phosphoric acid, so you have to go to the organic acids to make those work like citric acid,” he says.

‘Flavorable’ solutions

Keeping up with clean label demands, natural and organic food and beverage manufacturers also sought natural sweeteners. According to Mintel’s report “Natural and Organic Food and Beverage: The Market,” the natural sweetener segment grew 33.5 percent from 2009 to 2011. That growth was attributed to the success of products sweetened with stevia, the research firm notes. In 2008, the U.S. FDA approved the use of rebaudioside-A, a steviol glycoside of the stevia plant, in food and beverages.

Because of the associated bitter aftertaste with stevia, suppliers are developing solutions to offer beverage-makers a low-calorie natural sweetener that can be blended with stevia.

“The non-caloric sweetener market is currently seeing new natural sweeteners such as stevia, talin and lo han guo beginning to make an impact,” says Michael Britten-Kelly, natural products manager for TreattUSA, Lakeland, Fla.

TreattUSA offers its TreattSweet ingredient, which improves the sweetness and transforms the flavor of products sweetened with stevia and other sweeteners.

Beyond sweeteners, suppliers are receiving requests to deliver natural and organic flavors.

“We see a very strong interest in all-natural flavors,” Virginia Dare’s Angelich says. “For a company like ours, almost every flavor that we send out to a beverage company today is natural … so they’re incorporating natural materials into products.”

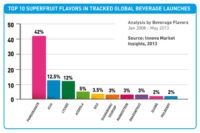

Angelich notes that organic is a little more difficult because it depends on supply and registration, but Virginia Dare still receives and supplies many organic flavor requests. He adds that since the emergence of superfruits, the company has seen requests for flavors associated with fruits that have high oxygen radical absorbance capacity (ORAC) levels. Previously, flavor systems like pomegranate and acai were requested, but more recently it has received requests for fruits indigenous to America such as tart cherry, blueberry and raspberry.

One of the largest markets to which Virginia Dare supplies flavor in the natural and organic beverage market is tea, Angelich says.

“Tea is a wonderful palette for natural beverages, so we’re active with Fair Trade with tea [and] organic compliant,” he says.

Amelia Bay’s Crandall also emphasizes the importance of premium brewed tea to the natural beverage market.

“[Beverage-makers] are coming to us for brewed quality tea extracts including, organic teas, 100 percent natural teas, and premium quality conventional teas,” he says. “Being able to use the word brewed on your label is critical for differentiation in a crowded marketplace. There are only a couple of ways to take advantage of brewed tea labeling; either kettle brew your product in small batches, which is expensive, lacks consistency and is time consuming, or use an all-natural brewed quality liquid extract from Amelia Bay.

“Production times and finished product stability include two hidden costs when it comes to producing an RTD tea beverage,” he continues. “Our extracts reduce production times and result in a product with greater stability that allows for the longest code date possible.”

In addition to tea, Crandall says the company receives requests for coffee flavor systems, but he sees greater opportunity for this in the future.

“Speaking strictly to RTD beverages, you don’t see a lot of organic RTD coffee beverages out there [and] that’s something that we can offer,” he says. “Coffee is so expensive already, the coffee market just for conventional coffee is very expensive, so as the price of coffee comes down you may see a lot more people springing for that premium, organic coffee ingredient.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!