Mission is flexibility for filler technology

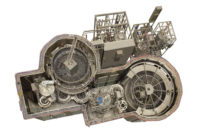

Filler manufacturers have been tasked to develop new machinery that can run the gamut of products required in demanding beverage plants. This means fillers that, for example, are able to run carbonated soft drinks in 20-ounce PET bottles and switch to 1-liter PET bottles of water a few hours later. New fillers also need to limit the amount of time between product runs, amount of product lost during filling and the amount of energy used by the machine.

Efficiency, quick changeovers, sustainability and flexibility each have made their impact on the development of new filler technology. Filler manufacturers are responding in varied ways to keep up with the industry’s evolution and what remains constant is the limitless level of service requested by beverage-makers.

“Everything should be possible, and it should be done to be able to cope with anything marketing might come up with in the next 15 years,” says Sebastian Delgado, director for filling technology for Krones Inc., Franklin, Wis.

Everyday requests

Filler manufacturers are developing machines that can adapt to the varied day-to-day needs of beverage manufacturers.

“When I talk to customers most of the time, when they look at a new filler, independently of the industry – beer, water, milk, juices – they are always looking, of course, for efficiency, which would be either in the maintenance or reduced downtime of the machines,” Delgado says.

To help reduce downtime, Krones offers fillers with quick-change parts, increased run-time capability and pre-emptive maintenance schedules.

“We also try to create fillers that are more flexible in the sense that they can run multiple products on them,” Delgado says. “By adding features on the fillers, if the company wants to run a hot-fill juice and then they want to run a carbonated drink, we will create a special type of filler that can do both.”

Automatic changeover is a focus of development for Sidel, says Andrea Lupi, Italy-based product manager for regular fillers and Combi systems. Sidel has developed fillers with fully automatic changeover that will adjust with a touch from the operator from one product to another without any other intervention needed, Lupi says.

With the range of products produced in a beverage plant today, cleaning the filler also is an important step in the changeover process. Sidel’s latest fillers can perform an automatic changeover and clean the machine in less than 10 minutes from bottle to bottle, Lupi says. In addition to product flexibility, the fillers also are able to change from one bottle shape to another in close to 10 minutes, he says.

Lupi says the main driver of Sidel’s developments is hygiene. The company has been dedicated to progressively improving the hygiene available on its fillers to keep up with the variety of products filled on its machines, Lupi says.

This year, the company introduced a new configuration of filler for low-carbonated products and juices with sensitive pH that is based on light sterilization of the container itself, he says. Sidel’s system, which has been installed in some applications in Europe and China, uses a vapor of water peroxide to sterilize the bottle preforms and caps.

“We are able to have very low or almost negligible consumption of chemicals and have a very high performance in terms of microbiological [sanitation],” Lupi says.

Sidel also has seen increased requests for evaluations of the total cost of ownership of its fillers, which take into account the machine’s price as well as estimations on the costs of its energy consumption and product waste.

Weight control

The quest for improved filling accuracy has led to increased popularity for volumetric and weight-based filling machines. Krones has developed filling machines based on weight cell technology, which measures the weight of a bottle before filling and during filling then automatically stops when the specified product weight has been reached, Delgado says.

“Before you would just flood-fill a bottle and you wouldn’t really care, but more and more we see our customers looking at it and saying, ‘I don’t want to fill more into this bottle than what I have because if I save all of those little portions at the end, I’ll be able to produce more with the same batch of product,’” he says.

Weight cell technology is more accurate than flow meter filling, Delgado says, but previously was an expensive technology. However, its increase in popularity has caused a reduction in the price of weight cell-enabled fillers, Delgado says. In addition, customers are able to save money by being able to produce more with the same amount of product, he says.

Fillers available from KHS USA Inc. operate on volumetric filling, which has the benefit of accuracy and a high yield, says Bob Pease, commercial director for the Waukesha, Wis.-based company. KHS’s product line includes the Innofill line; DRV-PET for carbonated soft drinks; NV-PET for still drinks, such as water; and NV-H-PET for thermofilling.

KHS’s fillers are designed with neck handling for plastic bottles, computer-controlled filling valves and facilitate maximum package and product flexibility, Pease says. The machines are built to have fewer moving parts and surfaces for simplicity and ease of cleaning, he says.

Simple maintenance, ease of operation, and rapid container and product changeover are benefits of KHS’s product line, Pease explains. In addition, the fillers have a highly automated sanitary procedure and clean-in-place system as an available feature, he says. KHS also has domestic machine manufacture capabilities in Waukesha, Pease says, and has peripheral and complimentary product lines, including blow molders and process equipment.

Dealer of replacement Ultra-Speed filling valves and related parts, Universal Packaging Machinery Corp., Orange City, Fla., had some customers indicate they are looking toward volumetric filling provided that the cost is within reason, says Milton Gove, the company’s president.

Currently, Universal Packaging Machinery Corp. offers valves that align with the industry’s trends, he says.

“Our experience shows that companies are looking for faster fill quality meaning consistent fill heights and less foaming, less maintenance, parts that are in stock, ease of changeover and quality service,” Gove says.

Future-focused outlook

Not only are filler manufacturers paying attention to the marketplace today, the companies also are monitoring the landscape to anticipate the next wave of trends. In Asia, Sidel has experienced requests for fillers that can accommodate multi-mix products, Lupi says. These innovative products include juices with large pieces of fruit, such as an aloe vera juice with large pieces of aloe vera plant, and juices mixed with milk or chocolate, he says. These products require fillers to manage product with particles and often need to be filled with aseptic processing, he says.

Krones’ Delgado thinks the aseptic market in the United States might grow in the next couple of years. In addition, Krones is working to adapt its filling technology to fit in with the burgeoning craft beer market, he says. The company counts many large brewers as customers and is adapting its technology to accommodate smaller brewers, Delgado says.

For craft brewers, Krones offers smaller scale fillers that can run at speeds below 250 bottles per minute. The company also has implemented touch-screen technology on the fillers to enable brewers to save recipes for particular beer styles and packaging sizes, Delgado says. BI

Related Links:

Operations: Bottling conveyor solutions respond to industry demands

Operations: In-house manufacturing fits in with prevalence of packaging

Packaging: Sustainability prevails as the top trend for beverage packaging

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!