Home » Keywords: » supercenters

Items Tagged with 'supercenters'

ARTICLES

Walmart reaches milestone in grocery deliver and grocery pickup

Read More

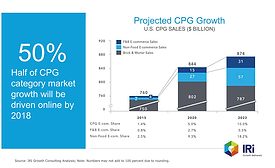

Urbanization, eCommerce impact mass merchandisers

Supercenters increase sales, share

November 9, 2017

Technomic provides coverage for total food industry channel

Will cover all channel in $1.74 trillion US food industry

August 19, 2016

Supercenters, eCommerce give opportunity to mass merchandisers

Wal-Mart offers free pickup for orders made online or through mobile app

November 12, 2015

IRI posts new strategies for national, private-label brand growth

National brands showing momentum in drug stores; private label standing out in mass/supercenter channel

January 20, 2015

Mass merchandisers downsize to meet busy shopper needs

Single-serve beverages appeal to on-the-go shoppers

November 12, 2014

Competitive spirit spurs new formats

Larger retailers get creative to compete for market share

December 13, 2011

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2025. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing