Market Insights

Local cideries, flavor combinations support competitive mindset

Read More

Market Insights

Mixing up a profitable canned cocktail: Test for success – but not the old way

Proliferation of canned cocktails highlights importance of new testing models

September 21, 2022

Ready-to-drink, low/no alcohol categories on the rise

Market research vital for future innovations success

August 23, 2022

Market Insights

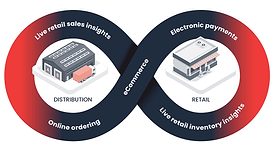

The supercharged distributor sales rep of the future is here

Technology advancements streamline beverage distribution

August 1, 2022

Market Insights

Patent-pending gas-trap cap prevents CSDs from going flat

Technology delivers better experience for consumers

May 17, 2022

2022 Beer Report | Non-alcohol beer goes mainstream

Moderation, health and wellness fuel consumer interest in alcohol-free beer

March 23, 2022

2022 Beer Report | Demand for craft beer rebounds

RTD cocktails, hard seltzers could stall craft beer’s return

March 21, 2022

2022 Beer Report | Hard cider market takes on competition

Lighter options, mashups drive innovation in hard cider new products

March 21, 2022

2022 Beer Report | Imported beer market prep for potential challenges

High end, low-calorie attributes bolster imported beer segment

February 16, 2022

2022 Beer Report | Health and wellness, bold flavors lift FMBs, hard seltzers

Analysts predict unique flavor profiles in store for FMBs, hard seltzers

February 16, 2022

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing