Home » packaging trends

Articles Tagged with ''packaging trends''

Product positioning vital for packaging design

Read More

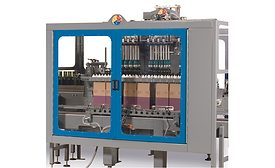

Packaging trends drive flexibility in case packers and wrappers

Beverage equipment suppliers offer flexible, fast case packers and wrappers

March 15, 2016

U.S. demand for pouches to exceed $10 billion, The Freedonia Group states

Food and beverage markets comprise majority of demand

March 8, 2016

Can filling, seaming equipment need grows as packaging trends move toward cans

Craft beer industry, varying can styles drive innovation

January 15, 2016

Personalized packaging grows in beverage industry

Customization, innovation grows due to demand

June 15, 2015

Talking Rain Beverage Co. adds cans to package offerings

Company offers slim cans in fridge packs

May 15, 2015

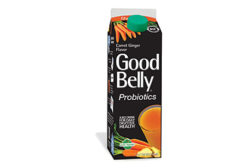

Convenience, portability affect packaging selection

Cartons, pouches and aseptic containers appeal to different consumer need states

October 16, 2013

Elevate your expertise in the beverage marketplace with unparalleled insights and connections.

Join thousands of beverage professionals today. Shouldn’t you know what they know?

JOIN NOW!Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing