2016 State of the Industry: Natural, organic vital to tea market

Tea lattes, sparkling teas offer more options

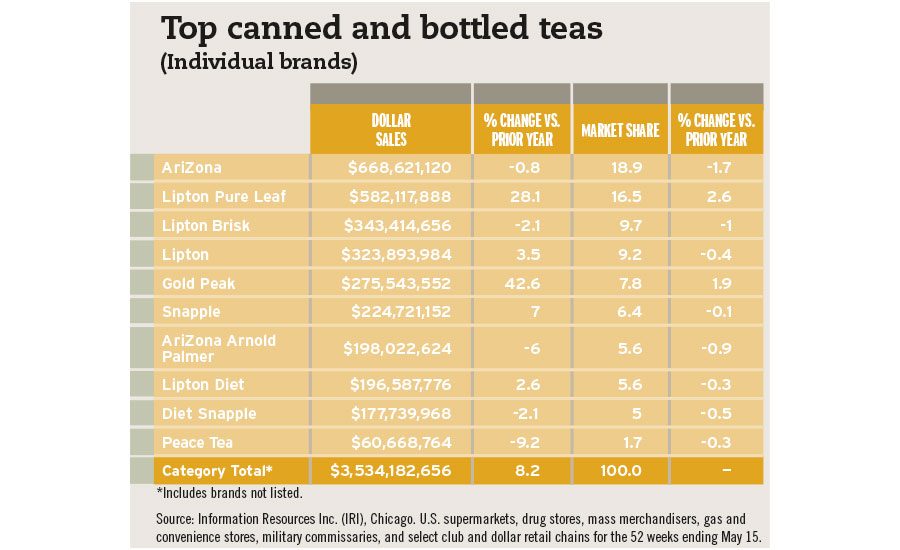

The U.S. tea market has seen an evolution over the years as consumers’ on-the-go lifestyles put an emphasis on convenience and ready-to-drink (RTD) teas. However, natural and organic trends seem to be the next big push within the tea market.

“Natural and organic are very important to tea consumers; however, all-natural is significantly more preferred than organic is,” said Elizabeth Sisel, beverage analyst at Mintel, Chicago, in Beverage Industry’s June issue. “GMO-free and Fair Trade claims are also gaining traction, but do not have the same impact on consumer purchasing decision as does all-natural.”

Eric Penicka, research analyst for Chicago-based Euromonitor International, also noted that natural is having a greater impact than organic when it comes to hot tea because of its inherent natural properties. RTD tea also is seeing a greater influence when it comes to natural attribute claims.

“Within RTD teas, there has been a very clear movement toward the creation of naturally brewed teas and this continues to bring consumers into the category,” he explained in Beverage Industry’s June issue.

For example, Pure Leaf, a product of The Pepsi Lipton Tea Partnership, Purchase, N.Y., released its Pure Leaf Tea House Collection, a super-premium line of the organic tea leaves brewed with fruits and herbs. In addition to its Pure Leaf Tea House Collection, the brand added to its Unsweetened Iced Tea with the launch of two new flavors — Unsweetened Black Tea with Lemon and Unsweetened Green Tea.

Varietal trends also are impacting the U.S. tea market. According to the Tea Association of the U.S.A. Inc.’s 2015 Tea Fact Sheet, about 85 percent of American consumers drank black tea followed by 14 percent who chose green tea. Oolong, white and dark made up the remaining amounts, states the association’s fact sheet.

However, opportunities could abound for these minority variants. Noting that hot tea sales are forecasted to have a compound annual growth rate of 4.3 percent from 2015 to 2020, Euromonitor’s Penicka said premium trends within tea retailers could start to impact the consumer packaged goods market.

“Fueled by premium tea retailers, growing interest in teas more complex than standard black or green teas has already begun to permeate its way through traditional retail channels like supermarkets with oolong and rooibos teas making their way onto shelves,” he said. “We expect to see more of this development in specialty teas and herbal teas over the forecast period.”

The U.S. tea market also has seen impacts from hybrid beverage trends. “Tea lattes have continued to be a trend (tea and milk), while sparkling tea is on the forefront of the hybrid market — e.g., Sparkling Ice’s Sparkling Tea and Lipton’s Sparkling Tea,” said Lauren Masotti, client manager of U.S. beverages at New York-based Kantar Worldpanel, in Beverage Industry’s June issue. “There are some players offering coffee and tea blends — giving consumers the health benefits of tea and the energy boost most often sought [from] the coffee segment.”

Contributing to the tea and dairy beverage segment, Boulder, Colo.-based Celestial Seasonings, a division within The Hain Celestial Group, developed its own coffeehouse-style teas. The barista-style Celestial Lattes are available in in four flavors: Dirty Chai, The Godfather, Mountain Chai and Matcha Green.

Sparkling teas also continue to pop up in the U.S. tea market. Earlier this year, Bhakti, Boulder, Colo., announced its line of natural sparkling teas, which are available in Lemon Ginger Black, Mango Lime Matcha, Tart Cherry Rooibos and Mint Maté. Bhakti Sparkling Teas are a combination of carbonated teas, organic fresh-pressed juices and the company’s signature fresh-pressed ginger, it says.

Yet, one format of tea has remained challenged to find a core consumer base. “While tea has certainly grown within the single-cup brewer segment, the impact Keurig and similar machines have had hasn’t been nearly as profound as what we’ve seen in the U.S. coffee market,” Euromonitor’s Penicka said.

Kantar’s Massoti also noted the challenges for the single-cup tea segment, but adds tea lattes and iced variants could offer potential. “Tea lattes and iced tea occasions may continue to do well in this format as it offers consumers a ‘fool-proof’ occasion they can enjoy in a single cup,” she said. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!